🔎My crypto strategy for 2026

weekly valuable insights

Avantis just released a 4-week trading competition with a 100K USDC prize pool on Base App. Check it out here.

GM friends.

Here’s what I’ll cover today:

🔎My crypto strategy for 2026

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎My crypto strategy for 2026

It’s been another rough week for crypto.

It feels like every time the stock market dips 1%, crypto dips 10%.

This has been happening for quite a few months. That said, I’m fully convinced that crypto will make a comeback at some point, as it always has.

No one likes bear markets and aggressive downtrends. But I strongly believe that many of the opportunities we’ll get over the next few months will be life-changing.

In this issue, I wanted to share a few thoughts about what I expect to happen next, and at the end, I will also share my strategy for 2026 👇

First of all, I will try to explain my current market stance.

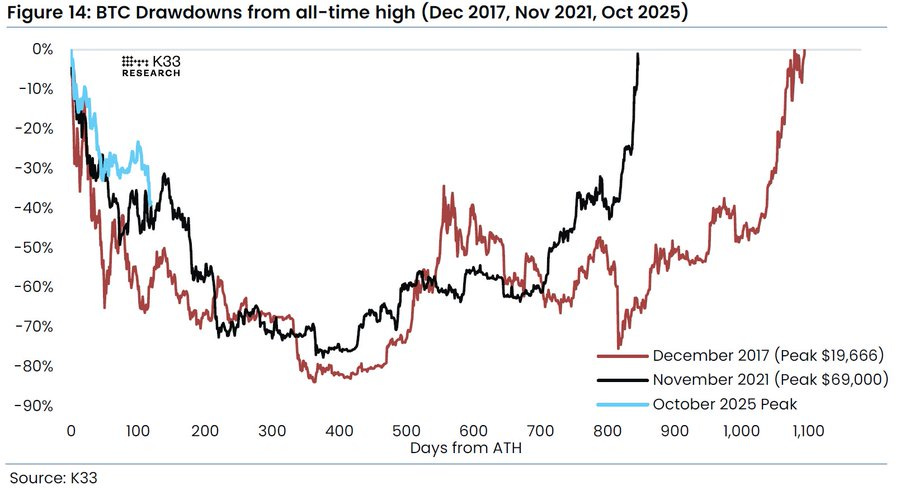

If you take a closer look at what happened in the past cycles, you realize that they’ve been pretty similar to this one so far.

In 2017: BTC hit the cycle top in December

In 2018: BTC entered a bear market and bottomed in Dec. 2018

In 2021: BTC hit the cycle top in November

In 2022: BTC entered a bear market and bottomed in Nov. 2022

In 2025: BTC hit the cycle top in October

In 2026: BTC entered a bear market

The common thing is that BTC hit the cycle top in Q4 of the post-Halving year in both 2017 and 2021, and it bottomed 12 months later.

This is called “the 4-year cycle theory”, which, for a lot of people, doesn’t make sense and may seem dumb, but what happened in the past few months only validates it.

This is one of the reasons I believe BTC could hit the cycle bottom in late Q3 or early Q4 this year, similar to what happened in the past.

But obviously, an entire bullish or bearish thesis can’t be based only on historical performance and historical patterns. On the fundamental side, there are also a few things that make me believe that this downtrend is unfortunately not over:

There’s still a lot of macro uncertainty, which is bad for risk-on assets (Will the US attack Iran? Will the Supreme Court cancel Trump’s tariffs? What happens if the new FED Chair also doesn’t cut rates?)

AI completely stole the spotlight from crypto (the reason I believe retail investors unfortunately never really came back to buy our altcoins this cycle is that AI stocks captured all their attention. This is why tech stocks have been in a bull market of their own over the past months)

There’s no major upcoming crypto catalyst in the near future that could attract new buyers

I expanded on the last point in a newsletter two weeks ago, and I think it explains pretty well why large amounts of money haven’t flown into crypto lately:

Next, I’ll share my short-term market expectations and what my exact plan is for the next few months.

Together with Avantis

The “App-First” Alpha: Why Your Next Base Move Should Be via Avantis

In the fast-moving world of L2s, being “early” is a badge of honor, but being “active” is the real currency. Avantis has just raised the stakes with its Leagues of Leverage campaign, and if you’re looking to establish yourself as a power player in the ecosystem, this is your signal.

Crucially, this campaign is exclusively for Base App users. Powered by Base, the initiative is designed to reward those who leverage the native Base App to navigate the decentralized markets. For the strategic trader, this isn’t just about the immediate leaderboard; it’s about utilizing the primary gateway to the network to curate a rich, verifiable history of engagement.

The Ladder to the Grand Finale

The competition runs from February 2 to March 2, 2026, featuring a massive $100,000 USDC total prize pool. The rewards are structured to favor those who stay consistent, with weekly payouts scaling up to a staggering $50,000 finale in the fourth week.

Check out the Leagues of Leverage competition here.

In other words, do I believe we’re going down only from here?

No. I think it’s very likely we will see a market bounce at some point in February or early March. In every bear market, there are also occasional rallies.

That being said, I think the pumps we will see in the next few months will not last for more than a few weeks. So personally, I am not interested in trading them.

BTC has been underperforming the stock market for months, and I unfortunately don’t see any signs that this underperformance period is over yet.

For the reasons I explained above, I think the most likely scenario is that the BTC bottom will be reached in late Q3-early Q4, perhaps in September, as September is historically the worst-performing month for BTC.

So, what’s my strategy for 2026?

Even though I believe the bottom will be reached later this year, I think timing the market with your entire portfolio is generally a bad idea.

For this reason, my plan is the following:

Buy some BTC at every major support level - My first buy was at $81k a few days ago. My plan is to buy next at $69-70k, $59k, $50k, and $43k

I have no idea if BTC will actually hit $43k by the way. It would be insane to see it at this level again. But in case it happens, I have some stablecoins that I am planning to deploy into the market at that point. Hope for the best, but prepare for the worst.

By buying BTC at every major support level, I make sure that even if my thesis is wrong and BTC resumes the uptrend before Q3, I still have some market exposure.

Start dollar-cost averaging daily into BTC sometime in July-August, depending on market conditions, and continue until October-November. This is when I plan to deploy most of my capital into the market

Don’t accumulate altcoins until late Q3. As long as I don’t believe the BTC bottom is in, I don’t think it makes much sense for me to buy altcoins, since they are correlated with BTC's performance and typically underperform it during downtrends. This is why I plan to wait till Q3 and buy only BTC in the meantime

I haven’t decided yet how much of my crypto portfolio to allocate to altcoins and how much to BTC, but at least 60% will be in BTC.

This is because, as you’ve all seen, only a few select altcoins have outperformed BTC in 2025, and we never really got an altseason like in 2021. For this reason, I prefer to allocate most of the portfolio to BTC, as I believe it’s by far the safest long-term crypto bet, given that BTC is seen more like “digital gold”.

Now obviously, your strategy can differ based on your risk tolerance.

Speaking about altcoins, I haven’t decided which ones I will buy yet. There is still a lot of time until late Q3, so I will be closely monitoring a lot of projects and probably share in this newsletter what I am buying in the next few months. But my goal is to invest in high-revenue-generating dApps.

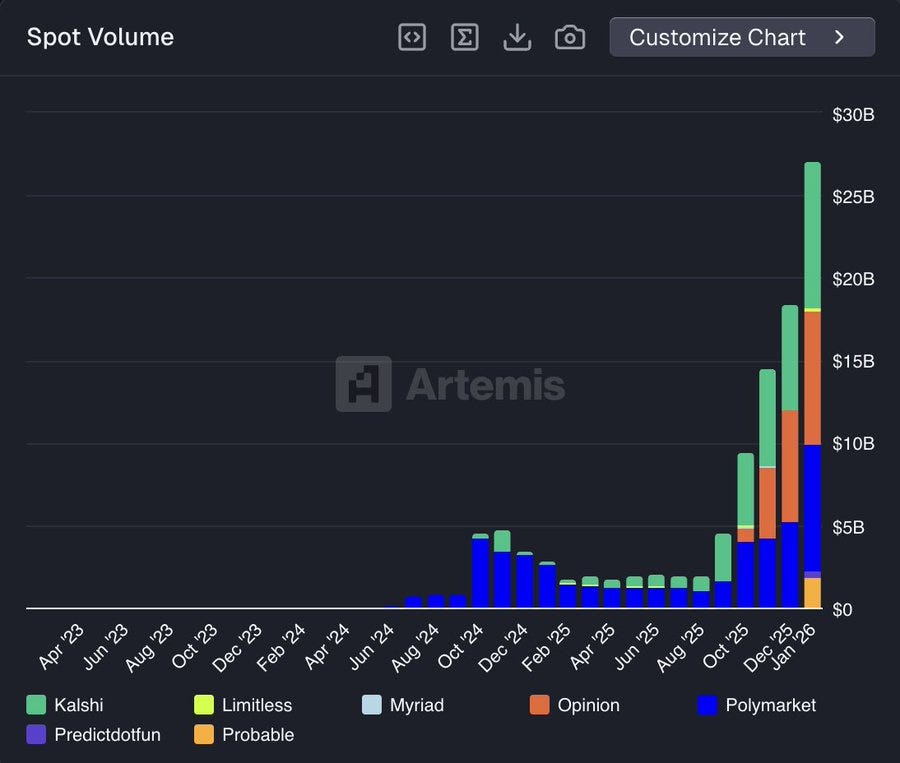

In the meantime, my focus remains airdrop farming. I think that especially prediction markets airdrops have huge potential. (keep an eye on Opinion and Polymarket)

I am also still heavily farming perps DEXs via a funding rate arbitrage strategy. The fact that a perps DEX like Extended gives traders an APR of up to 15-21% on their collateral used for trading makes it a great farming opportunity.

You can find my main airdrop farms here:

My final advice is to not blindly copy trade me. Unlike other people on CT, I don’t pretend to have a crystal ball. I am just sharing what I am doing with my own capital.

I have a recommendation, though: listen to market opinions from as many people as possible (both bulls and bears), do your research well, and form your own thesis based on what you believe is most likely to happen next.

Then make sure that you create a plan that you actually stick to.

With this recipe, it’s very likely you will win in the long run as long as you always keep an open mind and learn from your own mistakes.

Chart of the week

The prediction market trading volume continues to hit new ATHs

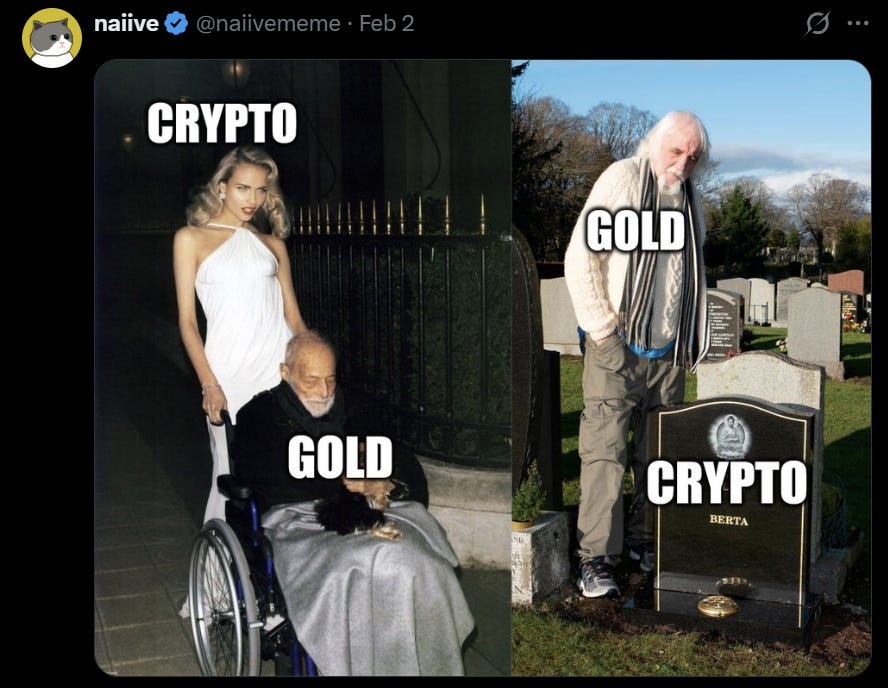

Crypto meme of the week😂

The latest developments in DeFi

Hyperliquid announced plans to add support for prediction markets

AAVE is expanding to MegaETH in exchange for $10M guaranteed revenue

Boros, the funding rates trading product built by Pendle, hit $10 billion in notional trading volume

MetaMask partnered with Ondo Finance to offer tokenized US stocks, ETFs, and commodities in-wallet

Jupiter secured a $35M investment into JUP from ParaFi Capital at the spot price

Resolv announced plans to implement delta-neutral equity and commodity strategies to diversify yield sources for its stablecoin

Lighter introduced Lighter EVM - a ZK rollup Ethereum L2 that is fully composable with the Ethereum ecosystem

Ethena introduced Ethena Exchange Points - a points program that rewards trading activity on Ethena-powered exchanges like Ethereal and Hyena

Avantis launched the Leagues of Leverage trading competition on the Base App

Ondo introduced Ondo Perps - 24/7 perpetual futures for both U.S. stocks and ETFs

Hey Anon released Pandora Parlays - a product built on Polymarket that lets users combine 3-10 prediction markets into a single bet

Lido v3 went live on the Ethereum mainnet

Polymarket expanded to Solana and can now be accessed via Jupiter

Vitalik Buterin said that the original vision of L2 no longer makes sense as Ethereum L1 is finally scaling

Cap announced plans to airdrop $12M in cUSD stablecoins to its users

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.

Solid breakdown of the 4-year cycle theory. The part about AI stealing crypto's spotlight is something most people overlook but explains alot about why retail never really showed up this cycle. DCA'ing from July-August into Q4 seems like a disciplined approach, especially with those support levels mapped out incase we see deeper drawdowns.