🔎Best time to buy the dip

Katana is an L2 designed specifically for DeFi. Find the best DeFi opportunities on Katana here.

I’ll be honest:

If you try to catch the absolute bottom, there’s a very high chance you will miss it and end up watching from the sidelines as every coin starts going up.

This is true regardless of the amount of experience you have in this market.

Still, there are things you can do to lower the average cost of your bags and make sure that when you buy a token, you don’t actually buy the top.

In this issue, I wanted to share what I am looking at when deciding whether to buy the dip, and more importantly, at what price levels to buy it.

Let’s dive in 👇

In my opinion, the best time to buy is when one or several of these conditions are met:

1. There’s a major upcoming catalyst that can attract a lot of buyers

This might sound a bit vague, but let me share more details.

This cycle, BTC had three major market rallies.

The first rally started in late 2023 and was primarily driven by the insane hype around the upcoming spot Bitcoin ETFs, which ended up launching in Jan. 2024

The second rally began in Nov. 2024 and was caused by Trump winning the US election, as he promised to be “the first pro-crypto US president” and many people in crypto were looking forward to the beginning of his term in Jan. 2025

The third rally began in late April 2025 due to two main reasons: people gaining confidence to invest again as the tariff war ended up being resolved amicably, and the hype generated by the launch of the new Crypto Digital Asset Treasury companies (DATs), the latter having a major positive impact especially on ETH

As you can see, in at least two of these three cases (the first and second one), BTC pumped mainly due to the significant hype around an upcoming major crypto event.

This ultimately comes down to understanding human psychology.

People are simply wired to stories.

The most important thing that an asset needs to pump is a good story that attracts new buyers and convinces them that the price could go up.

In late 2023, for instance, a lot of people were buying BTC as they were excited about the idea of frontrunning institutions before the spot Bitcoin ETFs went live.

For altcoins, a good story can include a major upcoming tokenomics or protocol upgrade, an exchange listing, or rising metrics.

Unfortunately, right now, I don’t see any major catalyst for BTC that could attract a new wave of buyers. This is why I don’t have a lot of market exposure, although we might see a small pump in the short-term, given that the tariff war just ended.

But things could look different in a few weeks or months.

2. BTC is at a major support level

I’ll use BTC as an example for this entire article, but you can apply the same concepts that I’ll show below to analyzing any token.

But as a rule of thumb, it’s generally a good idea to buy an altcoin only when you believe BTC will pump too, as if BTC goes down, it usually drags down all altcoins.

Here’s, for example, a chart with the BTC price.

In the chart above, I marked the price levels that BTC struggled to break at least 3-4 times on the daily timeframe in the past with a white line on Trading View.

I’m not a huge fan of technical analysis, and I almost never buy or sell a token solely based on it, but knowing some basics, like how to spot support and resistance levels, can be very helpful.

The next step is to simply set a buy order at each support level you identify in this way, and then just wait until it gets hit, and your order gets filled. As I mentioned above, you can do this with both BTC and altcoins.

No one really knows how low the market will go.

But with this strategy, you can gain additional exposure to the market whenever it dips, while avoiding buying the top. It is simple and effective at the same time.

Before we continue, here’s an overview of Katana, the DeFi-focused Ethereum L2:

Together with Katana

The Ethereum L2 built for maximum capital efficiency

If you’re looking for high DeFi yields, you should check out Katana.

Katana, a DeFi L2 blockchain incubated by Polygon and GSR, has been one of the fastest-growing networks over the past few months, with over $961M in TVL.

On Katana, yield generation begins at the bridge level.

Thanks to its Vault Bridge model, when you bridge select assets like ETH, USDC, or USDT to Katana, the network will automatically deposit your original assets into low-risk strategies on Yearn to generate yield.

All the revenue generated then flows to liquidity providers on Sushi or Morpho.

Here are some of the most interesting DeFi opportunities on Katana:

Get paid to borrow - If you bridge assets like ETH and WBTC to Katana, you can borrow stablecoins against them on Morpho while being paid to do so (this is possible as the revenue from Vault Bridge is used to incentivize these markets)

Deposit USDC in Katana’s Earn vault to earn 41.22% APY in USDC + KAT incentives (The APY is assuming that Katana will have a $1b FDV at TGE)

Deposit WETH in Katana’s Earn vault to earn 15.52% APY in ETH + KAT incentives (The APY is assuming that Katana will have a $1b FDV at TGE)

With Katana, you can put your assets to work in low-risk yield strategies while earning double-digit APRs.

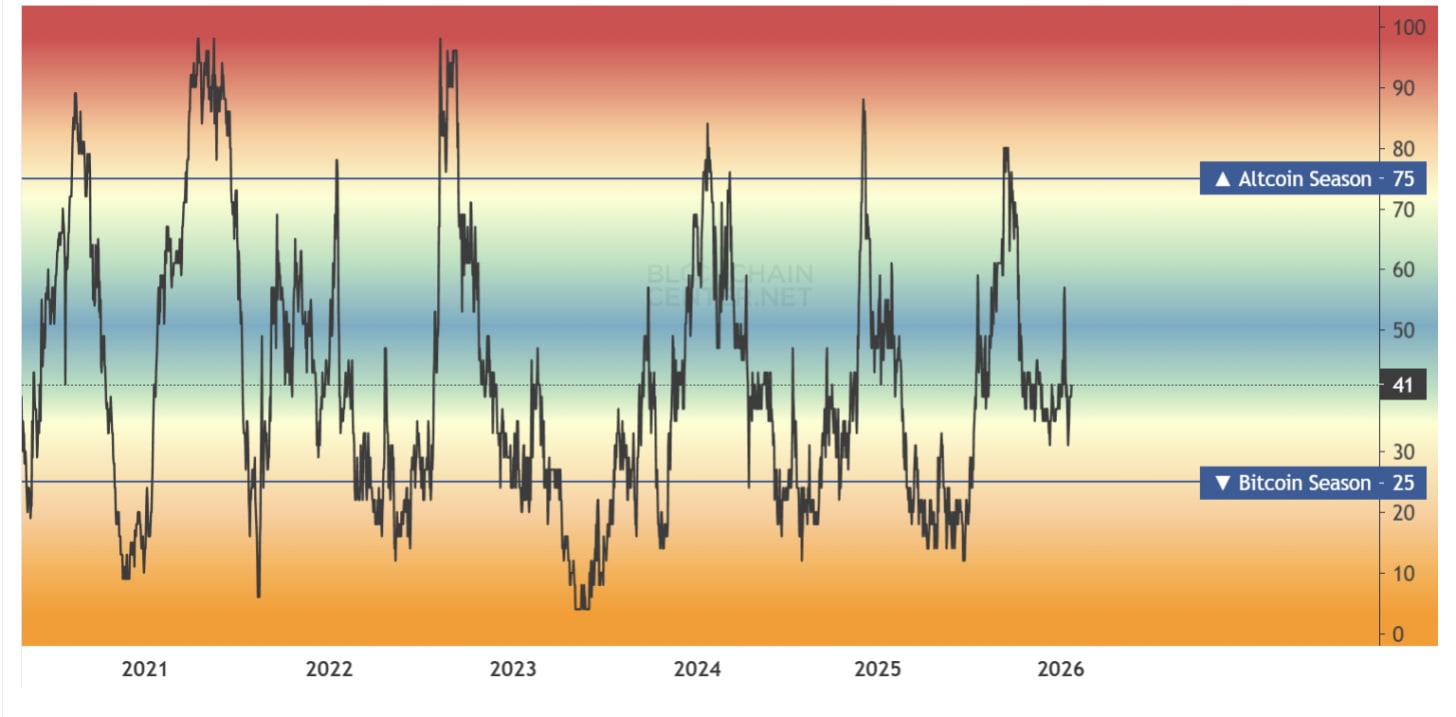

3. The altseason index is below the 25 level

The third thing I look at when deciding whether to buy the dip is the altseason index.

You can track this indicator here.

This one is especially useful if you want to buy altcoins. It basically tracks if the top 50 coins outperformed BTC over the past 90 days.

The worse the altcoins performed, the lower it goes.

Generally, when the index is over 75, you should take profits, and when it’s below 25, it’s a good time to start dollar cost averaging into the tokens from your watchlist as it shows that they are in oversold territory.

As simple as this sounds, this proved to be a pretty effective strategy over the past years.

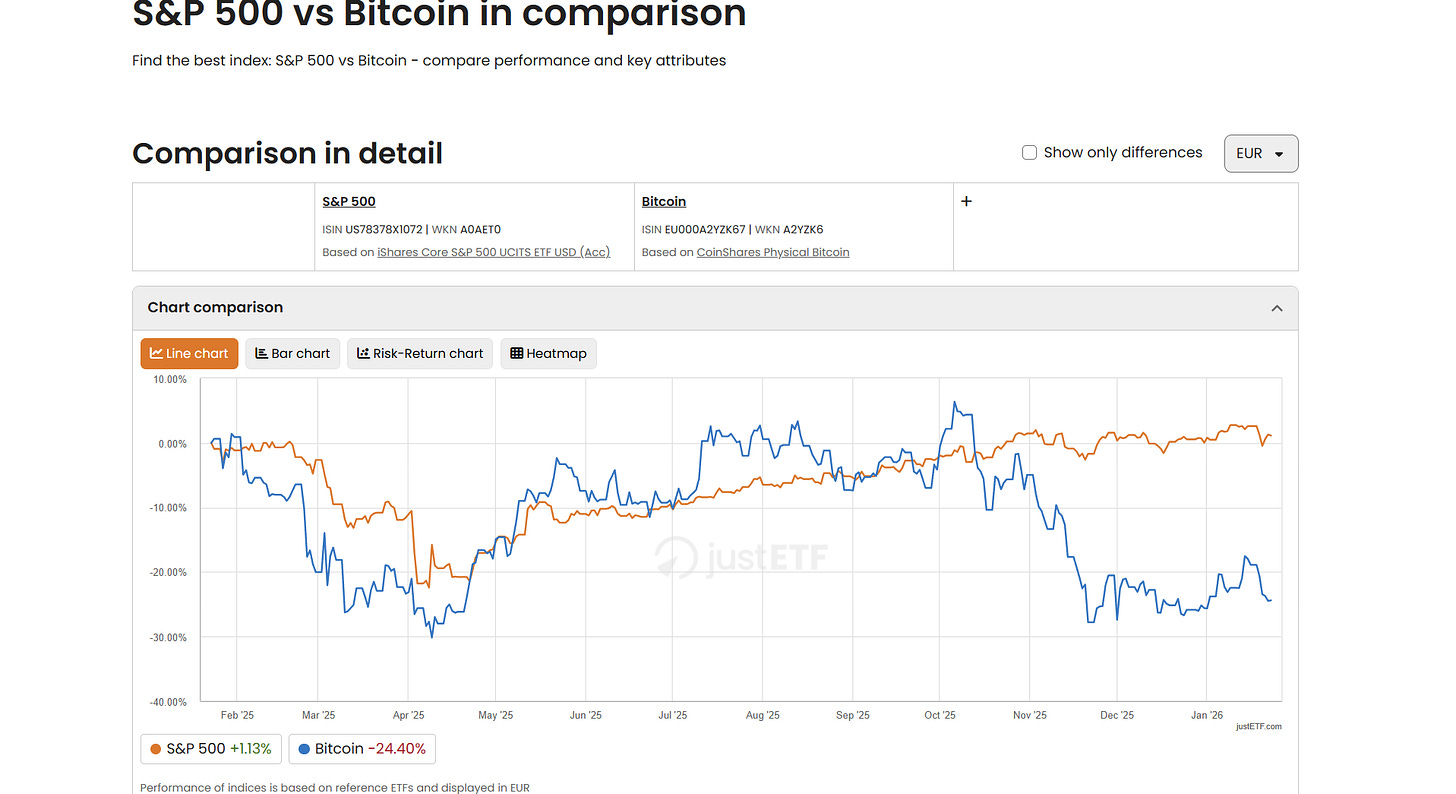

4. Bitcoin is showing relative strength vs S&P 500

Historically, the best time to bet on crypto is when we are in a risk-on environment and retail and institutional investors start looking for higher-risk assets.

You don’t want to be all in into crypto when there’s a lot of panic or uncertainty in financial markets, as in that moment most people will sell risk-on assets like crypto and stocks and search for ‘safe-haven’ investments like gold.

A simple strategy to check if we are in a risk-on or risk-off environment:

Go to justetf.com/en/asset-comparisons/index-comparisons/sp-500-vs-bitcoin or other similar websites comparing S&P 500 performance vs Bitcoin performance

Select a 3M, respectively 6M time frame, and look at the chart comparison

If BTC is consistently above S&P 500 - we’re in a risk-on environment

If BTC is consistently below S&P 500 - we’re in a risk-off environment

If, for instance, S&P 500 sees a 3-5% dip while BTC is barely affected, that is a bullish thing as this can mean that crypto sellers are running out of coins.

Based on my experience, if you want to buy altcoins, you usually want to do so when BTC starts outperforming the S&P 500, as that also suggests market participants are becoming more optimistic and increasing their risk tolerance.

This signals that investors are starting to look for higher-risk investments as we enter a risk-on environment, and it’s likely they will eventually invest in altcoins too.

That’s all for today.

None of these indicators and strategies I presented will help you catch the exact bottom, because that’s not really possible.

However, I strongly believe they can help you accumulate the assets you want at a much better price than a traditional DCA strategy.

My strategy is generally to start buying the dip aggressively only when at least two or three out of the four conditions I covered are met.

For example: If BTC hits a major support level and the altseason index goes below 25, I believe it’s a great time to start accumulating.

Thanks for reading!

Until next time,

The DeFi Investor