🔎$HYPE is making a big comeback

weekly valuable insights

The Risk Protocol is building a new DeFi primitive that tokenizes risk. Check it out here.

GM friends.

Here’s what I’ll cover today:

🔎Why is HYPE pumping?

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎Why is HYPE pumping?

In the past 3 days, HYPE has been one of the best performing tokens.

After weeks of going down like most other altcoins, it just skyrocketed from $22 to $32, an almost 50% increase, which is not bad at all for a token with a whopping $7 billion market cap.

Now, to be frank, I was initially surprised by this pump as well.

I’ve done a bit of research, though, to see what potentially caused this and found a few interesting things 👇

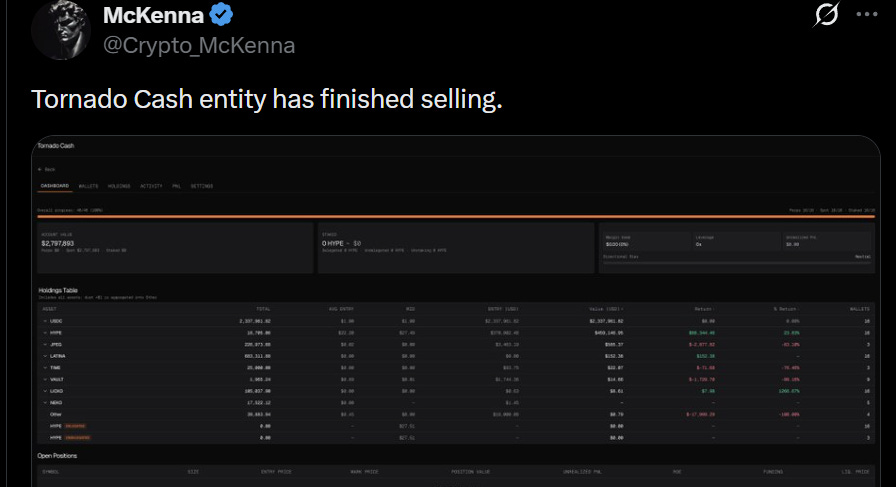

1. A whale who dumped tens of millions of dollars in HYPE finally ran out of tokens

This entity has been heavily selling HYPE for the past few weeks.

The good news, though, is that on Jan. 27, it finally ran out of tokens.

With the sell pressure from this entity finally gone, many Hyperliquid supporters stepped in and started buying HYPE, which is likely the main reason why HYPE pumped over 20% exactly on Jan. 27.

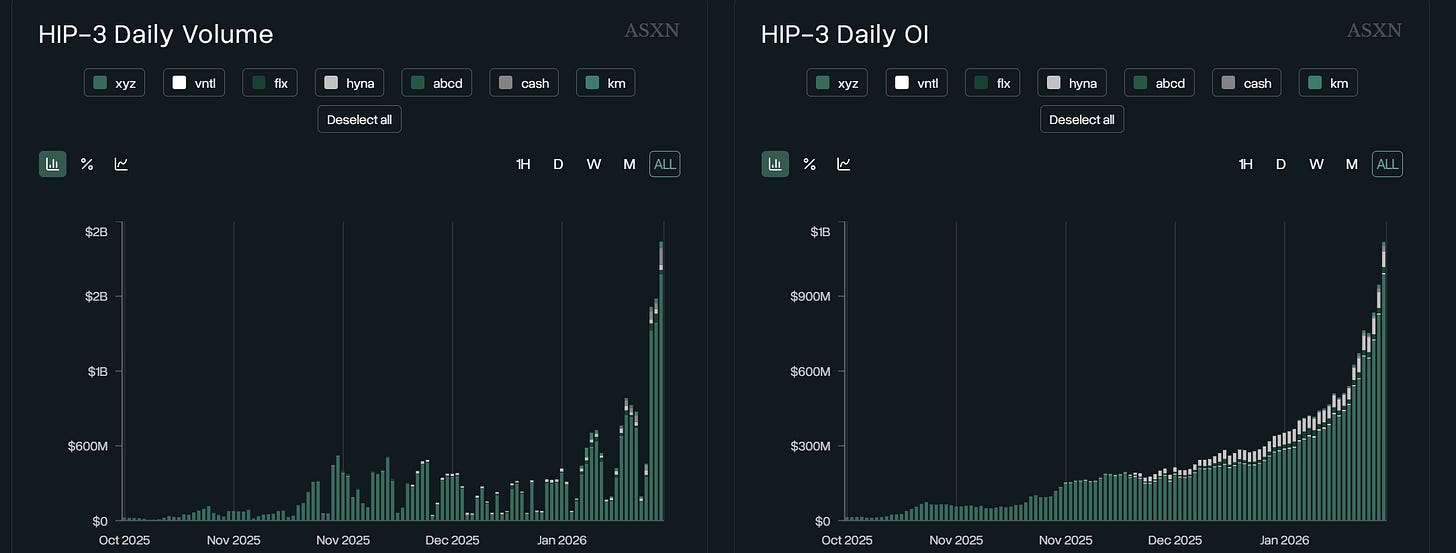

HIP-3 markets’ daily volume is skyrocketing

HIP-3 is a major Hyperliquid upgrade that supports permissionless perps creation.

Using it, anyone building on top of Hyperliquid can launch custom perps for assets that are not yet listed on the Hyperliquid exchange.

And so far, most builders used HIP-3 to launch equity and commodity perps.

And it turns out that the demand for this type of perps is huge. It’s been less than 5 months since HIP-3 went live, and the daily trading volume of the stock, ETF, and commodity trading pairs created using it is now surpassing $2 billion!

Now, you may ask how HYPE holders benefit from this?

In 2 ways:

From trading fees - While the fees for HIP-3 markets are 90% lower than for other markets, Hyperliquid still generates $100k-$200k in daily revenue from them

Ticker auction revenue - Builders who want to launch a HIP-3 market need to purchase a trading ticker, which usually costs $10-$70k worth of HYPE

So, increased HIP-3 adoption has a direct positive impact on HYPE.

Next, I’ll cover another major recent Hyperliquid achievement (perhaps the most interesting one) and what I expect to happen next with the broader market.

Together with The Risk Protocol

Trade Crypto Risk—Not Just Price

Risk is one resource crypto has in abundance—yet it remains largely unharvested.

The Risk Protocol lets users turn that risk to their advantage, transforming it from a problem into an asset.

The Risk Protocol (“TRP”) is building the missing risk layer of crypto and pioneering “RiskFi”—a novel vertical within DeFi that turns risk itself into a programmable, tradable, financial primitive. Crypto has pioneered entirely new forms of market infrastructure, yet remained underdeveloped in one of finance’s most essential pillars—risk. The Risk Protocol was created to close that gap and bring institutional-grade risk expertise to crypto.

The team includes a Head of Risk who ran derivatives at one of the world’s largest quant firms, a Head of Research who has co-authored papers with Nobel Prize-winning economists on volatility, and a CMO who scaled a protocol to 55 million users.

Their innovation, SMART Tokens, lets you split any crypto asset into different “risk flavors” such as RiskON (amplified upside) and RiskOFF (downside protection). But applying the SMART Token innovation to RiskON/RiskOFF is just the beginning. The mission is RiskFi: a full suite of risk primitives—from trading pure volatility to prediction markets on risk itself.

The kind of risk management infrastructure that institutions have gained from over the decades will now be permissionless and on-chain.

Their incentivized testnet launches soon, with early participants rewarded for helping shape the future of on-chain risk.

Follow them on X, and check out their Litepaper in the pinned Tweet.

Hyperliquid became the most liquid venue for BTC price discovery

Hyperliquid founder Jeff shared on X that Hyperliquid now has deeper liquidity for BTC perps than Binance.

This is a big deal for a simple reason:

Whales want to trade on the exchange with the deepest liquidity, as otherwise, they will incur massive losses because of slippage when placing taker orders.

Hyperliquid becoming the most liquid exchange might help it attract more big traders, which would have a positive impact on its revenue in the long run.

What’s next?

A key date for the entire market is Jan. 31.

What happens then will impact all altcoins and stocks (including HYPE).

On this day, we will finally get to know if the US government will be shut down or not. If this actually happens and it is an extended shutdown, it could have a pretty big negative impact on both the stock and the crypto market.

There’s a 65% chance of this happening at the time of writing, according to Polymarket, but the good news is that it decreased from 75-80% a few days ago.

If somehow the US government doesn’t shut down, that would be great for markets and could lead to a short-term relief rally, which may also have a positive impact on HYPE. However, even in this scenario, I unfortunately still think most altcoins will continue to underperform in the mid-term due to current macro uncertainty.

I shared my view on the market last week in this article:

That being said, the market conditions might not be great right now, but I believe that perps DEXs have tremendous potential in the long run.

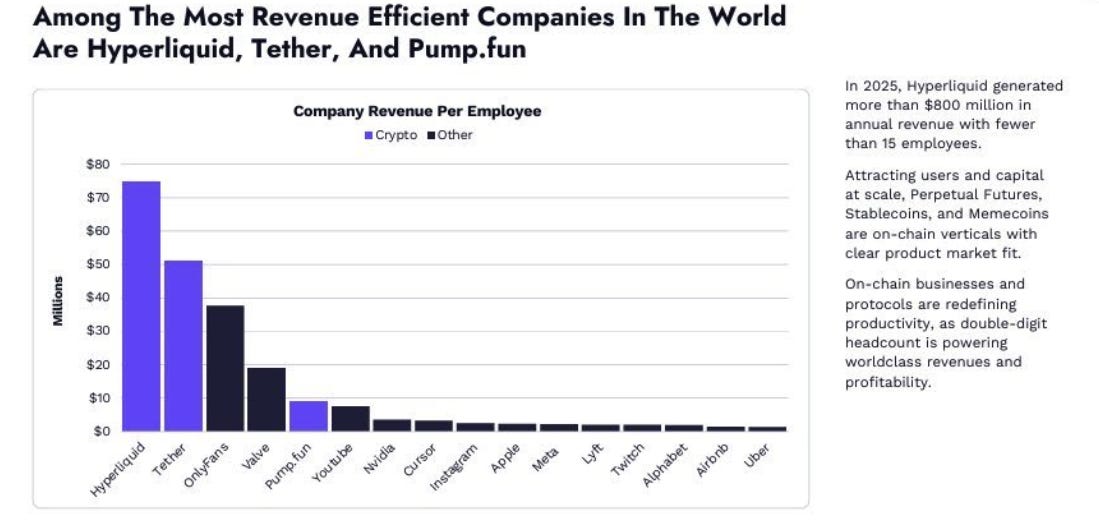

Chart of the week

Hyperliquid, Tether, and Pump Fun are among the most revenue-efficient companies in the world

Crypto meme of the week😂

The latest developments in DeFi

Pendle cut PENDLE token emissions by ~30%

MegaETH announced plans to launch its public mainnet on Feb. 9

Hyperliquid’s HIP-3 open interest and volume surged to new ATHs

Lighter announced plans to enable using its LLP vault shares as trading collateral

AAVE introduced Kraken DeFi Earn, a new savings product powered by AAVE

DeFiLlama released Token Rights - a dashboard that shows what utility a certain token has

Mantle expanded its token MNT to Solana

Ethereum Foundation formed a Post Quantum team to achieve quantum resistance

Robinhood announced it will enable 24/7 trading and self-custody for its tokenized stocks in the next few months

SEC Chair Paul Atkins announced plans to open the $12.5 trillion 401k retirement market to crypto

Tether launched USAT, a federally-regulated USD stablecoin for US users

USDai announced plans to launch its token in Q1

Flying Tulip announced its ICO on CoinList

Maple expanded to Base

Infinex scheduled its token launch for tomorrow

EigenCloud (formerly Eigenlayer) released the whitepaper for EigenAI, a product that will allow verifying how an AI produced its outputs

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.