🔎What's going on with the market?

weekly valuable insights

DeFi Saver is building a better tool for DeFi. Learn more about its recent major partnership with Summer.fi here!

GM friends.

Here’s what I’ll cover today:

🔎What’s going on with the market?

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎What’s going on with the market?

Looks like trade war season is back.

While gold has been surging, altcoins are performing as if WW3 just happened.

The primary reason for the latest dip is the new trade war between Europe and the US, which apparently ended in less than a week.

Trump wanted to purchase Greenland, but as Denmark refused to sell it and its European allies supported its decision to keep it, Trump threatened to impose a new 10% tariff on several major EU countries, which threatened to retaliate.

And obviously, this entire shitshow created a lot of panic in all financial markets.

The good news is that yesterday, Trump announced that after talking with NATO Secretary General Mark Rutte, he decided to no longer impose the tariffs for now.

The question now is, what’s next for markets?

I’ll share a few thoughts on this below.

First of all, I think the current terrible price action is mostly due to the macro and geopolitical situation, and it doesn’t necessarily have anything to do with ‘crypto fundamentals’.

Even if you might find analyzing macro boring, I think it’s crucial to keep an eye on the major macro events if you're trading crypto, as the reality is that BTC and altcoin prices are directly impacted by them.

That being said, besides Trump’s trade war with Europe, that now seems to be behind us (which is a great sign), there is unfortunately also another market headwind:

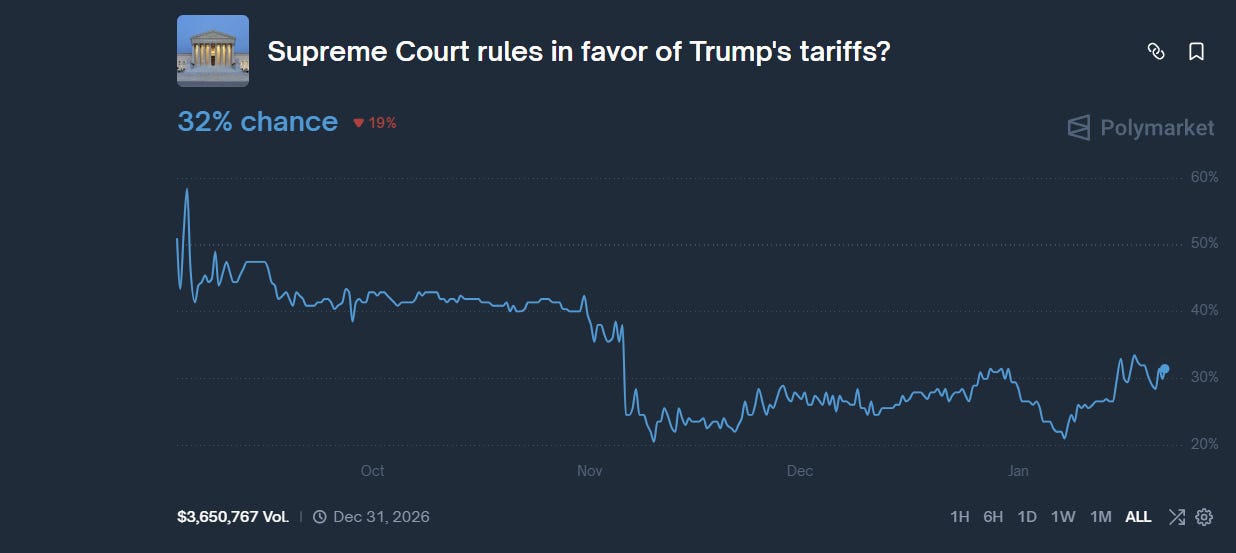

The US Supreme Court’s decision on Trump’s tariffs

There’s only a 32% chance that the U.S. Supreme Court will say that Trump’s tariffs are legal, according to Polymarket.

If Polymarket is right and the tariffs are canceled by the Supreme Court, I think there’s a relatively high chance this will trigger massive liquidations and a major dip in the short-term, as it would create a lot of panic in the markets.

So far, the US collected over $100 billion in tariffs.

Assuming the Supreme Court also orders Trump to pay back all this money after canceling the tariffs (which is unlikely but not impossible), it would cause a total mess and have a massive negative impact on all financial markets.

The only good news is that this would probably also mark a local bottom.

But as we don’t know when the decision on Trump’s tariffs will be announced (most likely in February, but not confirmed), there’s a lot of market uncertainty, and a lot of whales are hesitant to deploy money into crypto because of this.

Is it now a good time to buy altcoins?

Personally, for now, I prefer to stick to accumulating only Bitcoin.

While I think we could see an altcoin rally in the short-term now that the tariff war between the US and Europe seems to be over, I unfortunately believe that other asset classes like stocks and maybe also metals will keep outperforming altcoins for the foreseeable future.

There is still a lot of market uncertainty about the Greenland situation and what Trump will do next to get what he wants, even though tensions are starting to de-escalate there.

This unpredictability is terrible for risk-on assets like crypto.

And as I said above, there’s also a high chance the Supreme Court will soon rule that Trump’s tariffs are illegal, which could cause a lot of panic and affect all markets.

For now, my main goal is to survive, accumulate BTC, and earn from other crypto activities, such as airdrop farming, prediction market trading, and shorting high FDV token launches, rather than buying altcoins.

It’s a challenging period for everyone in crypto, but better times will come.

Together with Summer.fi

The new home for Summer.fi pro users

DeFi Saver, the go-to DeFi platform for managing and automating DeFi positions, has just announced a major partnership with Summer.fi.

As Summer․fi Pro interface will wind down in 30 days, all existing Summer.fi Pro positions have transitioned to DeFi Saver.

Here’s what’s changing as part of this partnership:

For Summer.fi Pro users - All your Summer.Fi Pro positions are now accessible via DeFi Saver and available for management

For DeFi Saver’s existing users - You will now get access to Lazy Summer protocol vaults, a new set of attractive yield opportunities, starting in Q1 2026

DeFi Saver launched in 2019 and is the most popular DeFi management tool, offering advanced features that make managing DeFi positions much easier.

Beyond the basics, you’re also gaining access to several DFS-exclusive power tools:

Simulation mode allows you to try things and test transactions in a sandboxed environment, without risking actual funds;

Position Flip lets you reverse your position (collateral ↔ debt) in a single transaction;

Expanded protocol support means that in addition to the protocols you were used to at Summer, you can now create and manage positions on Fluid, Liquity, CurveUSD, LlamaLend, and Euler, too.

And much more.

Learn more about the partnership between DeFi Saver and Summer.fi here!

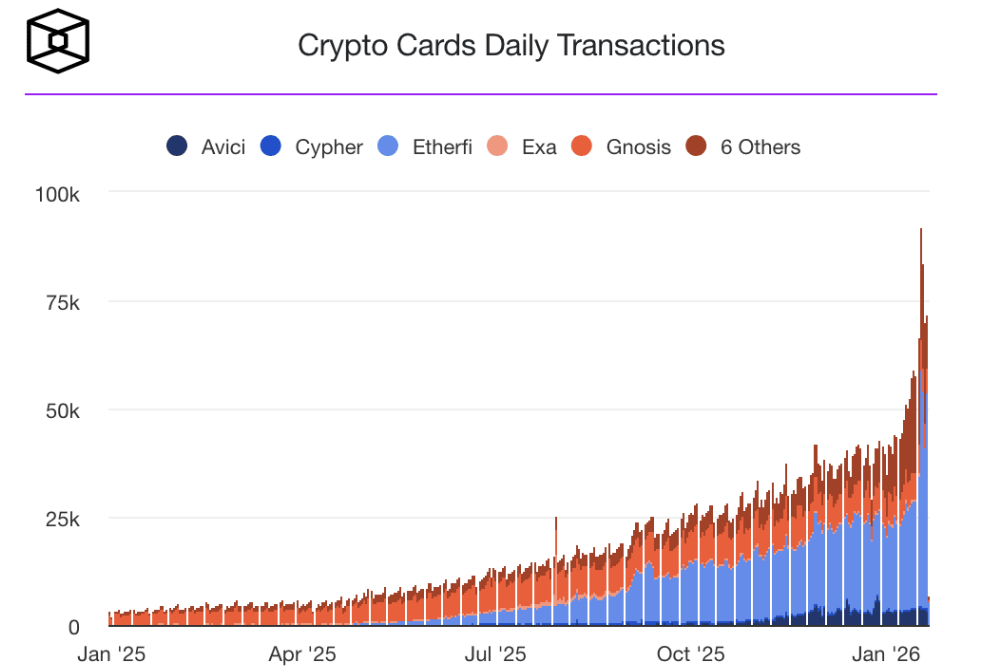

Chart of the week

Crypto cards are surging in popularity

Crypto meme of the week😂

The latest developments in DeFi

Pendle introduced sPENDLE - a liquid staking token with a revenue-sharing mechanism

Hyperliquid’s HIP-3 daily trading volume surpassed $1 billion for the first time ever

Ondo launched hundreds of tokenized stocks and ETFs on Solana

INFINIT, the AI layer for DeFi execution, announced the listing of its token IN on Kraken

Chainlink launched 24/5 U.S. Equities Data Streams, enabling stocks and ETFs to be traded on-chain beyond traditional trading hours

NYSE announced they’re building a blockchain-based platform to support 24/7 trading for U.S. equities and ETFs

GMX announced its expansion to MegaETH

HyENA, the USDe-margined perps DEX built on Hyperliquid, opened access to public. Traders can get a 12% boosted collateral APR when using it

RAAC partnered with Curve to deploy 100M+ pmUSD liquidity into Curve ecosystem

Cap, a popular stablecoin protocol, announced plans to conduct the first airdrop in the form of stablecoins instead of tokens

Optimism’s proposal to use 50% of its sequencer revenue for token buybacks is live

Metamask added support for Tron L1

Noble announced plans to migrate from a Cosmos appchain to an EVM-based L1

Loris Tools announced Trade - a perps DEX aggregator built to make perps DEX farming and funding rate arbitrage easier

Paradex announced a rollback after an issue triggered mass liquidations

HyperLend introduced its token called HPL

Privacy Cash launched Private Swaps on Solana

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.