🔎WTF just happened in DeFi?

weekly valuable insights

Play AI is building the Zapier of onchain AI. Explore what makes it stand out!

GM friends. Here’s what I’ll cover today:

🔎An overview of the Stream saga. And my advice

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎WTF just happened in DeFi?

It’s been a terrible week for DeFi.

And not only because the market crashed. This week:

Balancer, a top DeFi protocol, was exploited for $128M

Stream Finance, a protocol generating yield primarily on stablecoins, announced it lost $93M worth of user assets and is gearing up to declare bankruptcy

Moonwell lost $1M in an exploit

Peapods’ Pod LP TVL declined from $32M to $0 due to liquidations

The most devastating one by far is Stream Finance’s loss.

Because it doesn’t affect only its depositors, but also the stablecoin lenders of some of the biggest lending protocols in this space, including Morpho, Silo, and Euler.

In short, here’s what happened:

CBB, a popular figure on CT, started advising people to withdraw their money from Stream due to its lack of transparency

Stream was allegedly running a “DeFi market neutral strategy”, but there was no way to monitor its positions, and its transparency page was “coming soon”.

This caused a bank run, with a lot of ppl trying to withdraw their funds at once

Stream Finance stopped processing withdrawals as it secretly lost a huge chunk of the user funds ($92M) a while ago, and it’s not able to process all withdrawals

This caused the price of its xUSD, Stream’s yield-bearing so-called stablecoin, to collapse

It already sounds bad, but the story doesn’t end here.

A huge issue is that xUSD was listed as collateral on money markets like Euler, Morpho, and Silo.

To make it worse, Stream was using its own so-called stablecoin xUSD as collateral to borrow funds against it using money markets for its yield strategy.

Now that the xUSD price collapsed, many USDC/USDT lenders on Euler, Morpho, and Silo who lent their capital against xUSD can’t withdraw their funds anymore.

According to YAM, a syndicate of DeFi users, there’s at least $284 million in DeFi debt tied to Stream Finance across major money markets!

A significant part of this money is unfortunately unlikely to be recovered.

And this way, many stablecoin lenders got wrecked.

What can be learned from this?

I’ve been personally heavily farming DeFi protocols for the last 2-3 years.

But after what just occurred, I am planning to take a hard look at my DeFi portfolio positions and become more risk-averse.

Yield farming can be highly profitable. I made some great gains from it over the past years, but events like this can cause you to lose a lot of your capital.

A few tips I have:

Always verify where exactly the yield is coming from

Stream is not the only DeFi protocol pretending to generate yield via “market-neutral strategies”. Always look for a transparency dashboard or a Proof of Reserves report where you can clearly see that the team is not gambling with your assets.

Don’t just blindly trust a protocol regardless of how nice its team seems.

Consider whether the risk/reward ratio is good enough

Some stablecoin protocols offer 5-7% APR. Others might offer 10%+ APR. My advice is not to blindly deposit your capital in the protocol offering the highest yield without doing some proper research first.

If its strategies are not transparent, or the yield generation process seems too risky, it’s not worth risking your capital for a double-digit annual yield.

Or if the yield is too low (4-5% APR, for instance), ask yourself if it’s worth it.

No smart contract is risk-free, and we’ve seen even OG apps like Balancer being exploited. Is it worth risking your money for a low APY?

Don’t put all your eggs in one basket

As a general rule, I never deposit more than 10% of my portfolio in a single dApp.

This is regardless of how attractive the yield or its airdrop opportunity seems. In this way, if a certain hack occurs, the impact on my financial situation will be limited.

To sum it up, build your portfolio prioritizing survival over making money.

It’s way better to be safe than sorry.

Together with Play AI

The Zapier of onchain AI

Play AI just released its token PLAI - and staking also went live.

In case you didn’t hear about it, Play AI is developing a first-of-its-kind network where AI agents, apps, and on-chain tools work together seamlessly.

Through its Orchestration Layer, Play AI can connect hundreds of dApps, protocols, and AI agents to automate complex onchain workflows.

Here are the three major pieces that are part of its stack:

Play Hub - A no-code UI for creating & monetizing workflows across 100+ apps

Play Studio - A platform where developers can create & deploy their own agents

Data Markets - The nexus where all the data is collected and used to improve the agents

The $PLAI token powers this ecosystem.

It can be staked to secure the network, used to reward workflow creators, and unlocks advanced access within PlayHub, among many other things.

Play AI is finally making no-code crypto automation possible.

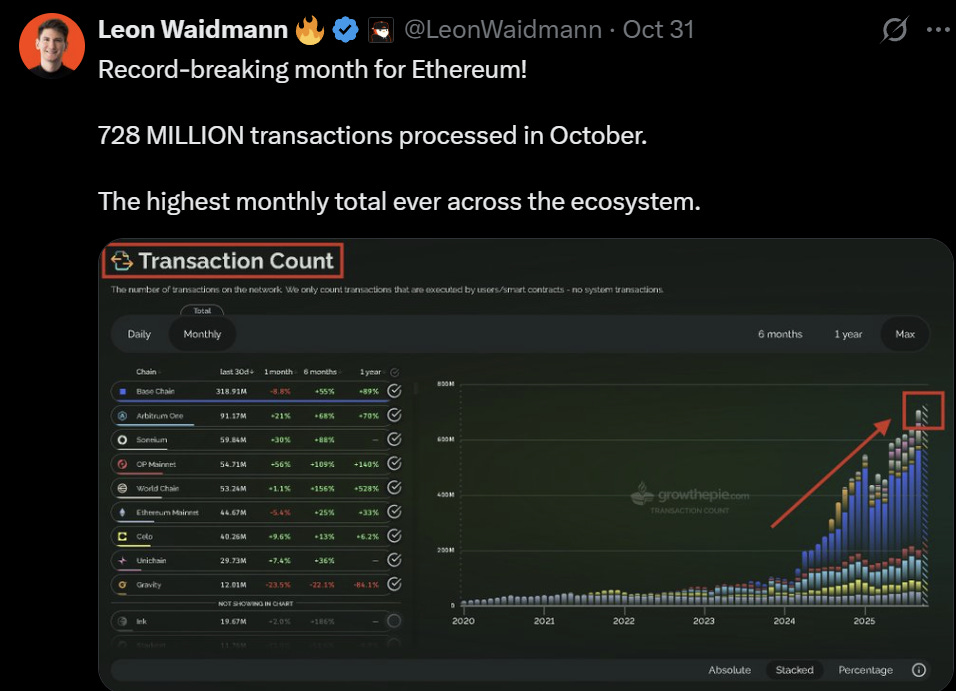

Crypto chart of the week

Ethereum L1 + L2 transactions continue to surge

Crypto Meme😂

The latest developments in DeFi

AAVE approved a $50M annual buyback program

EtherFi DAO passed a $50M ETHFI buyback proposal

INFINIT announced the opening of a waitlist for early access to their upcoming Prompt-to-DeFi feature, with limited spots available

Monad scheduled its mainnet launch for Nov. 24

Arbitrum introduced StylusPort - a framework for Solana dApps to expand to Arbitrum L2

f(x) Protocol introduced fxMINT - allowing to mint fxUSD stablecoin against ETH/WBTC at a 0% annual interest rate

Folks Finance launched its token called FOLKS

Play AI released its token called PLAI

ZKsync underwent the Atlas Upgrade, which unlocks 1-second ZK finality and 15,000 TPS

Lighter launched FX trading and adopted Chainlink as the oracle solution for its RWA markets

Aster announced plans to use 70-80% of its fees for ASTER buybacks

MegaETH released its ICO allocation checker

Jupiter DAO approved the proposal to burn the JUP tokens it bought back

Polymarket launched the Polymarket Builders Program

dYdX announced plans to enter the U.S. market by the end of the year

Orderly Network started using 60% of its fees to buy $ORDER

GAIB released sAID - a yield-bearing token backed by AI infrastructure financings

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.