Why has this cycle been so hard?

Folks Finance is the leading cross-chain DeFi lending protocol. Explore what makes it stand out.

It’s no exaggeration to say that 2025 has been brutal for most people in crypto.

I myself didn’t expect the market to crash so hard towards the end of the year, but our job as traders and investors is to adapt to whatever happens.

Doing nothing or refusing to accept reality is not a viable strategy.

So in this issue, I wanted to share a few thoughts on why I believe this cycle has been so challenging to navigate and what I expect next.

Let’s dive in👇

1. The number of projects and tokens drastically increased

Back in 2017, there were a few hundred projects.

In 2021, their number increased by 10x to a few thousand.

But by 2025, the number of tokens increased to millions, thanks to platforms like Pump Fun that enabled anyone to easily launch a token.

And when you have so many different teams fighting for attention, there’s obviously a lot of dilution as liquidity is spread across way too many coins.

At the same time, tokenomics got increasingly predatory.

While token utility actually improved in general this cycle, which is great, almost all new tokens launched in the past years followed the low float high FDV meta.

Low float high FDV refers to tokens that launch with a very low circulating supply (typically up to 10%) and a high fully diluted valuation.

A low float creates artificial scarcity to inflate prices at TGE as there are fewer sellers.

But when the token unlocks finally happen and new supply enters circulation, the token price inevitably collapses, leaving early buyers with a massive loss.

This has been happening with almost every new token for years.

2. Points meta artificially inflated metrics, creating a false sense of PMF

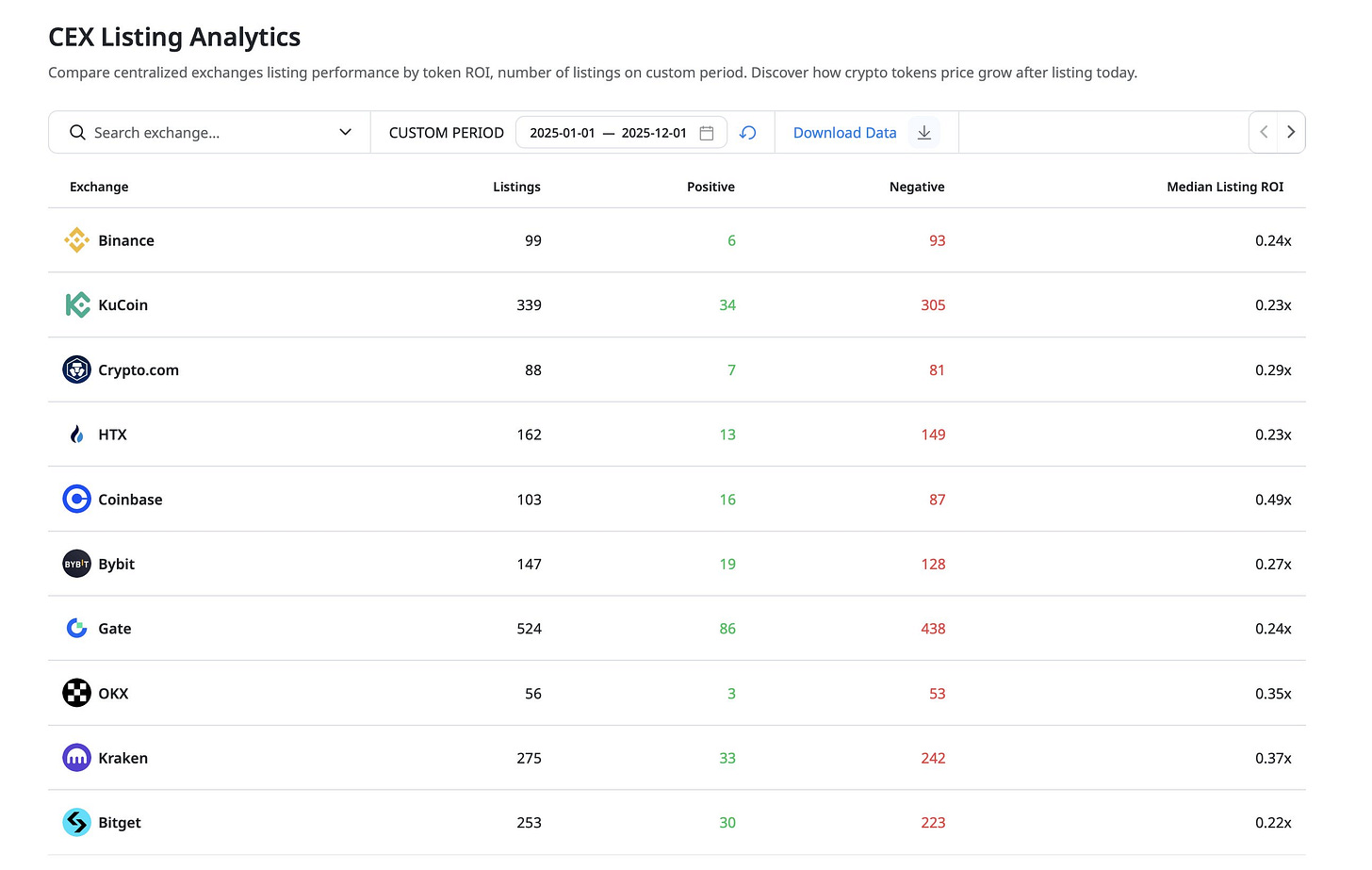

The average ROI of the new tokens listed on Binance this year is 0.25x.

On Bybit, it’s even lower: 0.11x. This means that on average, the new tokens listed on these tier-1 CEXs in the past year are down 75-89%!

Obviously, a reason for this is that it’s normal for most startups to fail.

But I strongly believe that the biggest reason for this terrible performance in the first few months after TGE is the rise in popularity of points programs that have created artificial demand for many tokenless projects that didn’t actually have a good product but wanted to launch their token at a high FDV.

Want to attract a lot of TVL from farmers in a short period of time? Launch a points program.

Want to grow your project CT mindshare temporarily? Launch a Kaito yap campaign.

Don’t get me wrong. Points programs or yap programs are not necessarily bad. They are a great tool for growth if used right. Hyperliquid is an example of a project that successfully built a strong user base via its points program.

But the issue is that using points programs, there are also a lot of projects with no PMF that artificially inflated their TVL/volume just to reach a high valuation at TGE.

Pre-TGE, this made many tokenless projects successful that would never have gotten traction otherwise, despite them not actually solving a real problem.

Post-TGE, farmers left, and as most people stopped using the products of these projects, their token obviously dipped and started slowly going to 0. This exact playbook screwed retail investors so many times that they simply lost interest in buying new tokens. And you can’t really blame them.

Add to this the FTX and Terra Luna saga from 2022, which also led many people to fully lose trust in the industry.

3. Attention shifted from crypto to AI

Every bull market has its bubble.

In 2025, that bubble is AI - similar to how crypto was in 2021.

Funds are rushing to deploy capital into AI companies at absurd valuations, simply to gain exposure to the narrative everyone is bullish on.

In 2017 and 2021, everyone thought crypto would revolutionize the world.

In 2025, everyone thinks that AI will revolutionize the world.

And there’s no doubt in my mind that both of these industries will change the world.

For now, though, what matters to us is that, unfortunately, a lot of big investors have lost their interest in crypto and pivoted to AI.

To put into perspective how big the AI bubble currently is, 57.9% of all the venture funding in Q1 2025 went to AI companies alone. Meanwhile, the venture funding allocated to blockchain companies drastically decreased in recent years.

As capital rotated from crypto to AI, altcoins have started losing the speculative premium that they gained in the 2021 altseason.

I am not sure what the solution is to bring crypto back into the spotlight and make it seem interesting again to both institutional investors and retail investors.

But it’s clear to me that AI stealing the show had a negative impact on crypto prices.

These three factors mentioned above combined made this market cycle feel significantly more difficult in my opinion.

Next, I want to share a few thoughts on what I expect to happen over the next few years, or at least the direction I hope this industry will take.

But before that, here’s an overview of Folks Finance and its roadmap:

Together with Folks Finance

Building the future of cross-chain DeFi lending

One of DeFi’s biggest barriers to mass adoption is liquidity fragmentation.

DeFi users are forced to bridge assets, wrap tokens, and juggle multiple protocols just to manage their money lending or borrowing positions.

Fortunately, Folks Finance is building a solution to solve exactly this.

Folks is the leading cross-chain DeFi lending protocol, built over more than 5 years of development and backed by some of the biggest funds in the crypto industry.

Just recently, its team announced several major upcoming product launches, including:

xChain V2 - The next big upgrade to Folks, bringing cross-chain curated markets, cross-chain lending between EVM & non-EVM chains, and more

Folks Mobile - A VASP-licensed mobile app designed to bring DeFi to the mainstream by abstracting all complexities

A new EVM Liquid Staking Token - This will come with institutional-grade staking partners and automated strategy vaults

It’s safe to say the project has a stacked roadmap for the next months.

Additionally, Folks Finance has recently launched its Season 2 points program.

By lending, borrowing, swapping, and simply using the protocol in as many ways as possible, you can qualify for a future airdrop.

Explore what makes Folks Finance stand apart today!

The path forward

Unfortunately, almost every single altcoin is down at least 50-70% in 2025.

With that being said, if someone were to ask me today if crypto is dead, my answer would be absolutely not.

Stablecoins and prediction markets are just two examples of crypto use cases that went mainstream. And regulators are now more crypto-friendly than ever before.

The projects in highly successful crypto sectors like stablecoins that reach PMF and actually generate a decent amount of revenue will likely trade at significantly higher valuations in a few years from now.

However, at the same time, I think a market crash like what we’ve been seeing over the past months was inevitable to happen at some point.

There are a few good projects in crypto with solid teams. But the number of projects in this industry trading at multi-billion-dollar valuations despite not generating any revenue and lacking PMF is way higher.

What crypto needs right now is more products that solve real problems for regular people and not just for crypto-natives. And most importantly, products that can generate revenue and have a sustainable tokenomics model that truly benefits their token investors.

This is the only way to make tokens attractive as investments again.

The business model of most dApps in the past years has been selling their own token.

But now that the speculative premium is gone and the capital flowing into this industry is becoming increasingly scarce, I believe we’ll slowly return to fundamentals.

You might think that this sounds too idealistic or too nice to be true. But a market crash, as we’ve just seen, is likely to bankrupt and filter out a lot of projects that don’t have product-market fit as their development funds come solely from selling their own tokens, which have now significantly decreased in value.

Meanwhile, the projects already generating revenue are much more likely to survive, as their revenue should cover a good part (if not all) of their development costs.

A successful project has to also be a profitable business. It’s as simple as that. Otherwise, I wouldn’t touch its token as a long-term investment with a ten-foot pole.

Of course, there will always be exceptions. Privacy coins, for example, have been top performers recently despite not having a good or sustainable economic model at all.

You can make a lot of money by betting on trending narratives early (like privacy is trending right now) even if you ignore fundamentals, but keep in mind that most narratives die in a few months at most. So if you choose to trade these, make sure you don’t end up a bag holder after the hype is gone.

Sadly, 99% of the crypto projects will fail to adapt to the new market conditions and will eventually die.

This is why it’s now more crucial than ever to be selective with what you invest in. Yet I am sure there will be many opportunities in the future for those who didn’t quit now.

Crypto making a comeback is not a question of if, but when.

Until next time,

The DeFi Investor

It was easy for those who trade Weekly Cycles.

Because we know what comes next