🔎Where are we in the cycle?

weekly valuable insights

DeFi Saver is building a better tool for DeFi. Automate your DeFi transactions with DeFi Saver today.

GM friends. Here’s what I’ll cover today:

🔎Where are we in the cycle?

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎Where are we in the cycle?

It’s always fascinating to watch how quickly the market sentiment changes.

We went from everyone on Crypto Twitter bull posting ETH to suddenly a lot of people flipping bearish overnight.

I wanted to share a few market thoughts as well on what’s next.

Let’s zoom out and look at the data 👇

First of all, let’s start with some historical context. Here’s a chart where you can see the BTC price performance during the previous bull cycles:

If you study the past cycles, you’ll see that the timing of the BTC cycle tops has been consistent:

In 2021, BTC topped in November 2021

In 2017, BTC topped in December 2017

In 2013, BTC topped in December 2013

Every cycle peak so far has happened in Q4 of the post-Halving year. (2013, 2017, 2021, and now 2025)

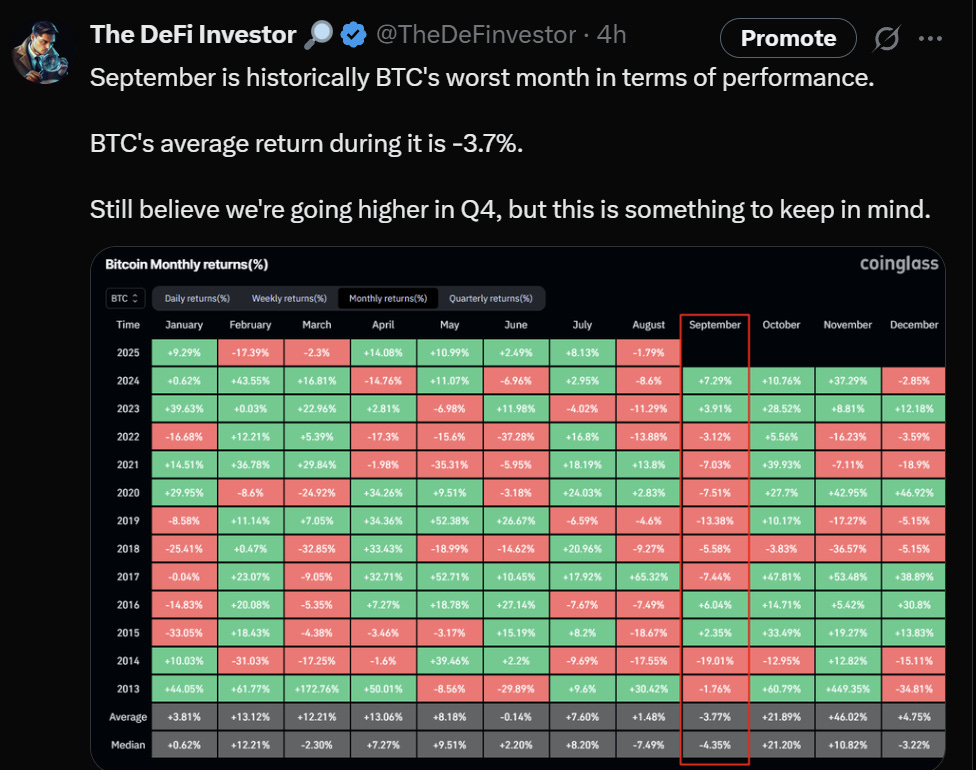

Another interesting observation is that while September is typically one of the weakest months for Bitcoin, October has historically been one of the strongest.

As you can see, while a lot of people are panicking right now because of the recent dip, a market dip around September (late Q3) is not uncommon at all.

If anything, it lines up with what happened in the past.

Does this mean that this cycle will play out the exact same way as the previous ones? Not at all. But while history doesn't repeat itself, it often rhymes.

I have mixed feelings about September, given what happened in the previous cycles, but my belief is that Q4 will be a good quarter for crypto as the final phase of every bull cycle is historically a great one in terms of gains.

Besides seasonality, a few other factors make me think Q4 will be bullish:

Rate cuts are coming (but for real this time)

Now let’s step outside of crypto for a second. Macro matters.

According to Polymarket, there’s a 64% chance that the FED will cut US interest rates in September. Why is this a big deal?

Because when central banks reduce rates, borrowing becomes cheaper. Lower bond yields also push investors toward riskier investments like crypto.

Historically, major rate cuts have been bullish for risk-on assets.

Crypto treasury companies keep buying insane amounts of crypto

The numbers here are just staggering.

According to https://www.strategicethreserve.xyz/, over 532k ETH (which is worth over $2 billion atm) has been bought via treasury companies just last week.

And keep in mind that staked Ethereum ETFs haven’t even been approved yet.

$2b in weekly buying pressure is an insane tailwind for ETH and altcoins.

Eventually, crypto treasury companies will run out of money, but I find it hard to believe the top of this bull cycle is already in, given the current inflows.

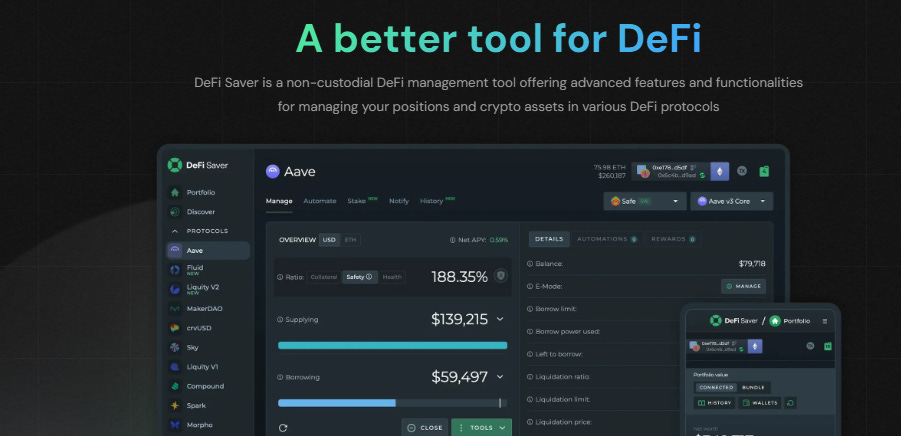

Before we continue, here’s an overview of DeFi Saver - the DeFi tool that can make your life easier:

Together with DeFi Saver

Your All-in-One DeFi Command Center

Managing DeFi positions shouldn’t feel like piloting a rocket without a manual.

DeFi Saver brings everything you need in one app, including DeFi automation, advanced trading orders, leverage management, and lending aggregation.

With over $10.5B in trade volume and 707k user transactions, DeFi Saver is the go-to non-custodial platform for both on-chain power users and DeFi beginners.

Here’s why you should give it a try:

Discover new opportunities fast - You can use DeFi Saver’s “Discover” feature that compares all the opportunities available across top protocols (e.g. using it you can find the best options for borrowing, leveraging, and yield farming)

Access the most popular DeFi strategies from one page - Using the new Trending page, you can find and execute trending yield opportunities, leveraged positions (e.g. long ETH), and other popular on-chain strategies in 1 click

1-Click DeFi interactions – You can create and shift loans between protocols, adjust leverage, or run complex strategies in a single transaction using it

Automated protection – Auto-repay keeps your positions safe, while auto-boost keeps them profitable while you sleep. Stop loss and take profit are also available

Safety First – Its smart contracts have been audited by ConsenSys Audits and Dedaub, and the DeFi Saver team constantly opens bug bounties on Immunefi

Custom Strategies – The platform allows building custom complex transactions combining flash loans and other DeFi protocol interactions using Recipe Creator

From MakerDAO, Aave, Compound, and Morpho, DeFi Saver integrates top-tier protocols and turns complex strategies into simple, single-click actions.

Automate your DeFi transactions with DeFi Saver!

Another reason why I believe the cycle top isn’t in is the following:

Very few of the common top signals have already been reached

Searches for "crypto" hit a new 4-year high recently, and Jim Cramer became bullish, which is why I took a small amount of profits earlier this week.

But besides this, none of the other ‘top signals’ I covered last week was recently hit.

For instance, Coinbase’s App Store rank is currently still over 200. Last cycle, it became the number one app on the App Store.

The fear and green index also looks healthy. Despite the recent rally, we haven’t reached insane levels of market euphoria yet. With that being said, ETH, for instance, is up a lot in the past weeks, so a short term correction is normal.

But unless this is the shittiest cycle ever, I don’t think the fun is over.

So, how am I positioning myself for what’s coming next?

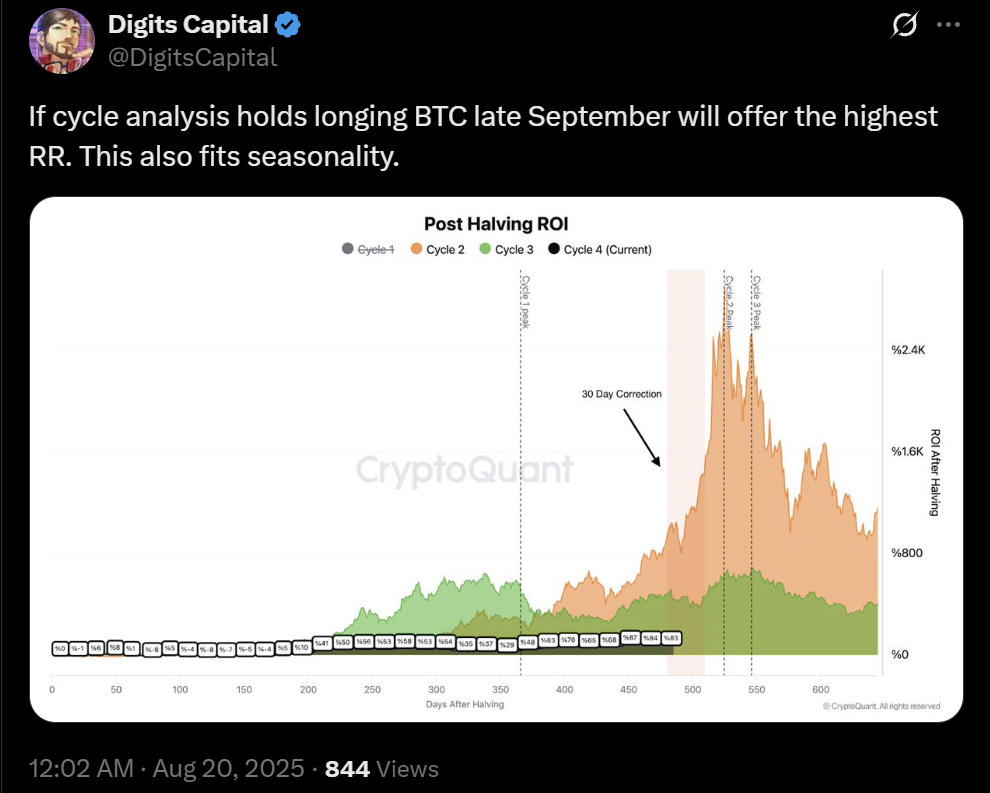

As you can see in the post below, one of the best moments to buy post-Halving is historically in late September of the next year after the BTC Halving (the last BTC Halving happened in 2024), as October is typically a fantastic month for BTC.

That’s exactly what I plan to do.

Depending on what narratives will be trending in late September, I’ll pick a few hot tokens at that point to add ahead of Q4 if we get a bigger dip.

Otherwise, I’ll just stick to my current bags.

I’ll then take profits gradually throughout Q4 and significantly reduce my crypto exposure by the end of the year if everything goes as expected.

And that’s basically my current plan.

However, keep in mind that this is a game of probabilities, and many things can change in a few months. As investors/traders, our job is to adapt as new info arises.

We can all just speculate. My advice for you is to try to create your own thesis based on your expectations.

But regardless of what you think will happen in the next months and what your plan is, make sure that risk management remains one of your top priorities.

I’ve said it many times:

The hardest part is not making it, but keeping the money you earned.

Crypto chart of the week

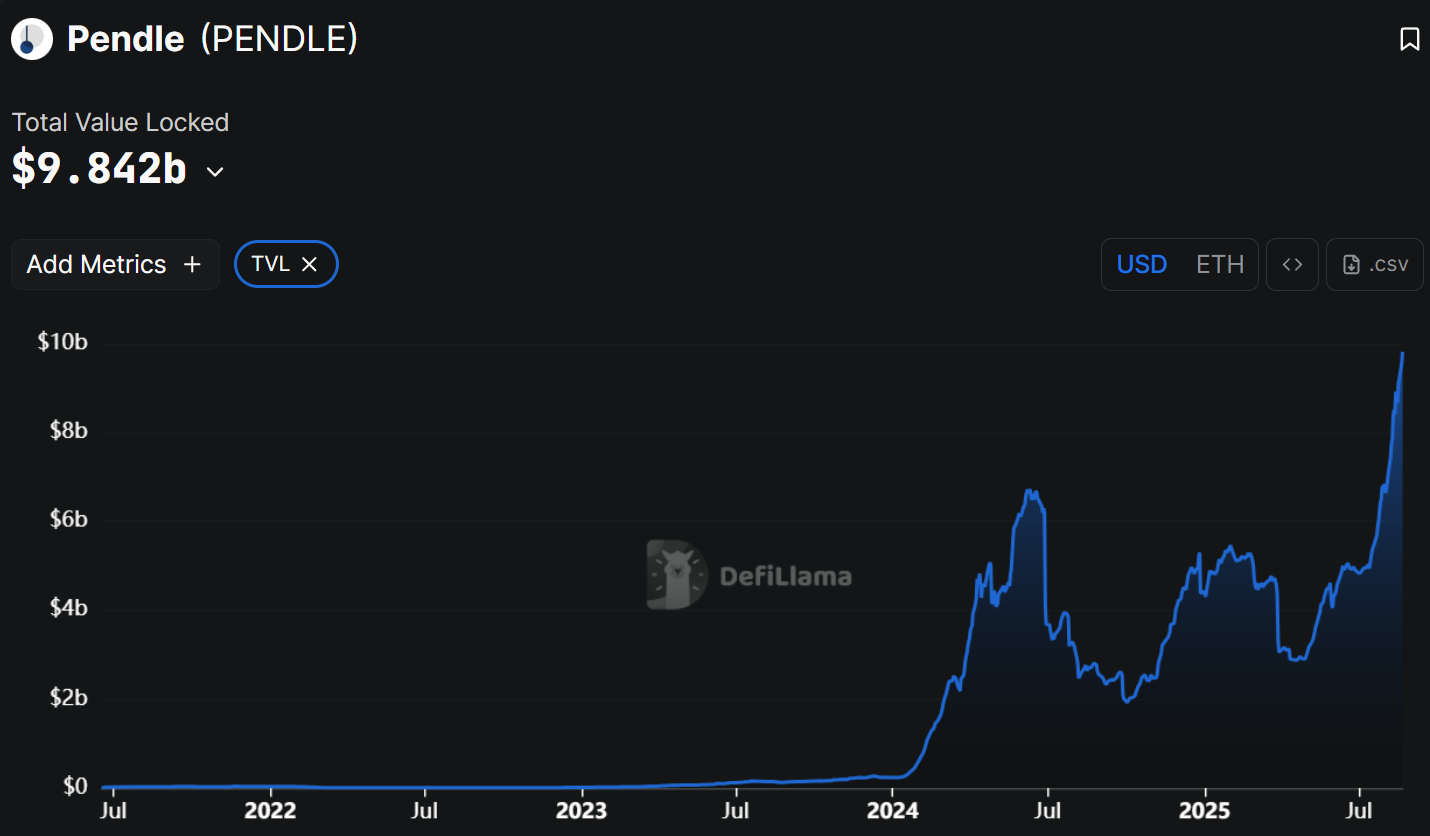

Pendle is getting close to hitting $10 billion in TVL

Crypto Meme😂

The latest developments in DeFi

Fluid’s buyback program proposal went live

Ethereum treasury companies bought $2.2 billion worth of ETH in the past 7 days

INFINIT V2 public beta was launched with the first set of AI-powered multi-step DeFi strategies

Silo Finance received a grant from the Avalanche Foundation that is being used to incentivize users on Silo Avalanche

Wormhole announced plans to acquire Stargate, LayerZero's main product ☠️

Cap, a stablecoin protocol that decentralizes yield generation, was launched

Sonic proposed allocating funds towards launching an S token strategic reserve

Andre Cronje teased an ICO for Flying Tulip, an upcoming all-in-one DEX on Sonic

Almanak, a DeFi AI agent platform, launched its community sale on Legion

Metamask announced its own stablecoin

Lombard Protocol introduced its token called BARD

USD AI, a stablecoin protocol backed by infrastructure credit, went live on Arbitrum

Avalanche is being used by Skybridge Capital to tokenize $300M real-world assets

Circle launched Circle Gateway, enabling to move USDC instantly across top chains. Gateway is available on Ethereum, Arbitrum, Avalanche, Base, and a few other chains

Napier Finance unveiled Napier AMM - a liquidity network optimized for yield trading

DeFi App announced it’s distributing 100M HOME tokens to Nansen Points holders

Huma Finance introduced a settlement solution that delivers same-day payouts for marketplace sellers worldwide

Liminal introduced xTokens - tokenized delta-neutral strategies on HyperEVM

Ronin unveiled plans to become an Ethereum L2

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.