🔎What's the best perps airdrop to farm?

weekly valuable insights

Today’s email is brought to you by Play AI - The Zapier of onchain AI

Check out Play AI’s Season 2 rewards program!

GM friends. Here’s what I’ll cover today:

🔎What’s the best perps airdrop to farm?

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎What’s the best perps airdrop to farm?

I’ve written a lot of content lately on both X and in the newsletter explaining why and how I am farming tokenless perps DEXs.

In short, I believe perps DEXs are the best airdrops to farm rn because:

They distribute a fixed number of points every week (which makes points scarcer and more valuable, rewarding early adopters when their metrics surge)

Some of them have extremely high token allocations for airdrops (Hyperliquid airdropped 33% of its token supply, and Lighter and Extended have plans to airdrop similar amounts)

They have a relatively small number of users, as a lot of airdrop farmers prefer deposit-and-forget stablecoin farms rather than actively trading

But I thought it would also be interesting to write an issue where I’d cover what could be the best airdrop for you to farm based on a list of criteria.

I’ll cover 3 different perps airdrop opportunities and talk about their pros & cons.

At the end, I’ll also share my conclusion.

Now let’s dive in👇

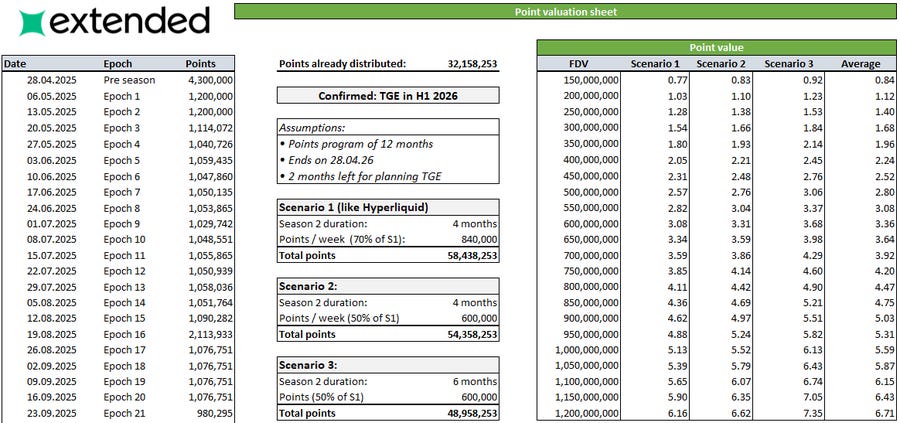

1. Extended

Extended is a perps DEX built by an ex-Revolut team, with its CEO being the former Head of Crypto Operations at Revolut.

It’s the 12th largest perps DEX by volume at the time of writing.

Pros:

Its team confirmed a 30% token supply airdrop at TGE

Points are easy to farm - Unlike other DEXs, Extended gives almost the same number of points for trading BTC or ETH as for trading low-cap altcoins (based on my experience). Trading volume is the most important factor for earning points

It has deep liquidity for majors - If you try to trade low-cap coins, the liquidity is not going to be that great, and the spread will be high in some cases, but for trading popular tokens like BTC, ETH, AVAX, SOL, XRP, the liquidity is pretty good

Cons:

The TGE is scheduled to happen in H1 2026 - Most likely around Q2 next year. On one hand, this means you have more time to farm it, but it also carries a risk: if we’re in a bear market at that time, it could lead to a small valuation for the Extended token at TGE and obviously a smaller airdrop value

If you’re willing to wait to get your airdrop until then and take this risk, then I’d say it’s worth farming Extended.

The current OTC price of Extended points is $2.45.

Paradex

Paradex is another zero-fees perps DEX I’ve been farming recently.

It’s incubated by Paradigm, which is (according to them) the largest institutional liquidity network in crypto.

Pros:

A 20% token supply airdrop at TGE is confirmed

The TGE is expected in early Q1 2026 - Which is ideal IMO as we still have some time to farm it, but without having to wait too long for the token launch

The project’s roadmap includes turning Paradigm into an all-in-one exchange by also launching spot trading, video streaming, borrowing & lending - This matters as it could lead to a higher valuation for its token and a higher airdrop value

You can transfer up to 10% of your XP points - This is a very cool feature, as if you wanna sell your airdrop points, Paradex is the first DEX to directly allow that

Cons:

Points are a bit harder to farm based on my own experience - I haven’t figured out yet what the most important criteria is to get points when trading, but it seems like you get more points when: you trade altcoins that just got listed or are less popular, and when you hold a position open for a longer time (at least a few hours)

Its liquidity is not always deep for altcoins - If you trade large caps like BTC, ETH, SOL, you’ll be fine - but if you choose to trade more volatile altcoins, make sure to always check the spread as it’s sometimes quite high and can affect your profitability

Yet overall, I think it’s a good product in terms of UX.

Before I cover one more perps airdrop opportunity and share a conclusion, here’s what you need to know about Play AI - The Zapier of onchain AI:

Together with Play AI

Automate your on-chain activity & get rewarded

Consumer AI has drastically evolved since the ChatGPT launch.

But using it for complex tasks remains very challenging for most people.

Play AI is an orchestration layer for crypto x AI built to fix this. Its Season 2 rewards program is live, with 50M in $PLAI rewards being allocated to users.

Here are a few crypto tasks you can do with Play AI:

Automate delta-neutral strategies to farm funding fees across top exchanges such as Binance, Hyperliquid, and Lighter

Place delta-neutral trades on prediction events on Limitless

Copy insider plays on prediction events on Polymarket or copytrade whales on Hyperliquid with custom configurations

Snipe tokens mentioned by a certain Twitter profile

All of those can be done without writing a single line of code.

You can see Play AI as the Zapier of On-chain AI.

Using it, you can easily create and deploy powerful workflows while also getting paid in $PLAI tokens for doing so.

Check out Play AI’s Season 2 rewards program!

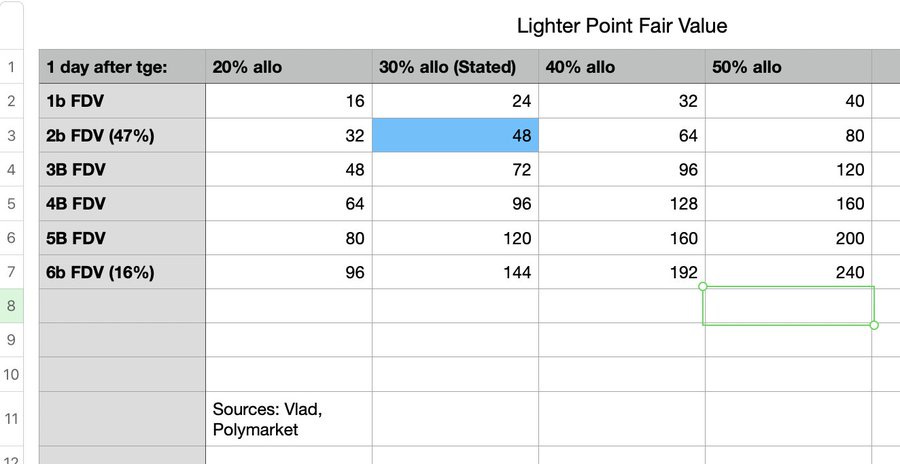

Lighter

Lighter is the first major perps DEX to introduce zero fees.

It’s now the largest perpetual DEX by trading volume, as it has recently surpassed even Hyperliquid in volume.

We’ll see if this will still be the case after its TGE when the farmers are gone, but it has a highly capable team, and its future looks very promising.

Pros:

A 25-30% token supply airdrop at TGE is confirmed

Its TGE is around the corner and scheduled to happen in Q4 (likely in December)

Lighter has a very strong community - This is one of the most bullish things in my opinion, as attention is crucial for a successful token launch

Rumors are spreading that Lighter will also airdrop a memecoin to points holders in November before launching its native token (this isn’t confirmed yet)

Cons:

Its points are extremely hard to farm - As its volume and all stats skyrocketed recently, its points started becoming increasingly scarce and harder to get, and skyrocketed in value, reaching the OTC price of ~$100 per point at this moment

Trade duration seems to matter a lot on Lighter. If you keep your positions open for a few days, you’re gonna earn significantly more points for the same volume than someone who closes their positions after a few minutes. This makes it harder to farm in my view

Low open interest markets also come with significant point boosts.

Final thoughts

The key question is: “What’s the best perps airdrop to farm?”

The answer I’ll give depends a lot on your own situation and preferences.

If you’re a whale (let’s say you have at least high 6 figs) and you’re looking to farm the airdrop that has the highest chance to be successful → choose Lighter

Lighter points are hard to farm, but if you have significant capital, it’s definitely still worth using it in my opinion.

If you’re okay with waiting for more than 5-6 months before getting your airdrop, and you’re open to take more risks for a higher potential return → choose Extended

If you’re looking for an airdrop that’s less farmed than Lighter, and at the same time, it is coming relatively soon → choose Paradex

Personally, I am farming all of those, as you never know which one will end up being the biggest airdrop, and I want to be positioned for as many opportunities as possible.

But my highest priority airdrops are now Extended and Paradex.

Previously, it was Lighter, but now that its points have become harder to farm, I decided to focus more on Extended and Paradex.

I farm them using a delta-neutral strategy for funding rate arbitrage. For instance, I short JUP on Extended, and at the same time I long JUP on Extended, so I can’t lose money regardless of how its price moves.

Besides those, one more airdrop I’ve been farming (which I didn’t cover in-depth here, as this newsletter was getting too long) is Variational.

It’s been one of the fastest-growing perps DEXs lately, and it has a few interesting features, such as an RFQ-based design through which it offers very deep liquidity, zero fees, loss refunds, and a very high variety of listings.

It’s invite-only currently. But if you plan to trade there actively, you can use my invite code here. (first-come, first-served, as I don’t have many invites left)

Good luck trading!

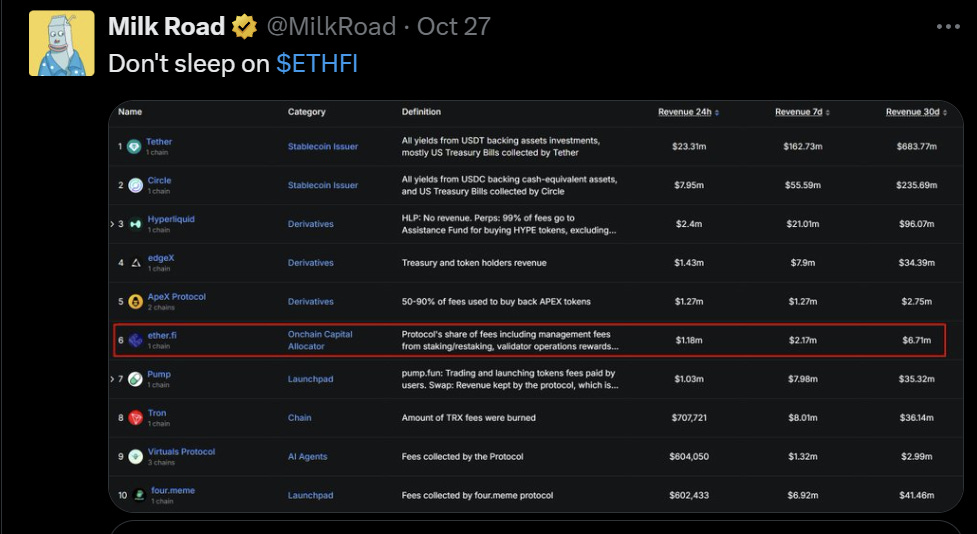

Crypto chart of the week

EtherFi quietly became the #6 DeFi protocol by 30-day revenue

Crypto Meme😂

The latest developments in DeFi

Rabby Wallet announced plans to integrate AAVE

Polymarket confirmed its token and an airdrop are coming

21Shares released the first-ever Exchange-Traded Product (ETP) for Pendle

Mantle announced that Anchorage enabled institutions to seamlessly access MNT. Anchorage is the first federally chartered crypto bank

Beacon, an app for safe autonomous DeFi, released its token BCN on Aerodrome

Jupiter announced plans to launch an ICO platform in November

France introduced a bill to buy 2% of the BTC supply for its own BTC strategic reserve

INFINIT partnered with Google to make agentic finance mainstream

Solstice enabled earning 19% fixed APY on eUSX via its Exponent integration

Solana released Orb, a human-readable blockchain explorer with AI explanations

Huma Finance announced plans to launch a deposit campaign together with Kaito

21Shares filed for a Hyperliquid ETF

Western Union, the world’s largest money transfer business, announced it will launch a stablecoin exclusively on Solana

MYRIAD, a fast-growing prediction market platform, went live on BNB Chain. MYRIAD also introduced Automated Markets

Frax Finance released FraxNet - a multichain on-chain money account for frxUSD

Monad’s airdrop checker page is now live

Paradex launched XP Transfers, enabling users to sell Paradex airdrop points

DeFi App announced the Defi App Trading Contest with $1M in rewards

Aegis launched the Aegis sYUSD Vault in collaboration with Levva

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.