🔎What's next for Ethereum?

weekly valuable insights

Index Coop launched an incentive program for its crypto leverage tokens. Mint leverage tokens to earn raffle tickets.

GM friends. Here’s what I’ll cover today:

🔎What’s next for Ethereum?

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎What’s next for Ethereum?

As you may know, Fusaka, a major Ethereum upgrade, went live a few days ago.

In short, the significant improvements brought by Fusaka include lower transaction costs on both L2s and the L1, a higher Ethereum network throughput, and support for passkeys in web3 wallets.

For the first time ever, Ethereum underwent two hard fork upgrades in a single calendar year (Pectra Upgrade in May 2025 and Fusaka now).

It’s great to see the Ethereum Foundation finally starting to ship faster.

The question, though, is what’s next?

In this issue, I’ll cover a few major upcoming catalysts for Ethereum.

Let’s dive in 👇

Launch of the Glamsterdam upgrade

This is the next Ethereum hard fork scheduled for 2026.

The exact changes that will be included in Glamsterdam are still being discussed.

But one of the most exciting improvements that hopefully will be part of the upgrade is EIP-2780, which could reduce the cost of ETH transfers on the L1 by 71%.

Ethereum L1’s gas fees have already significantly decreased in recent years, and this upgrade would reduce them even further.

Another important change that is likely to be included in the Glamsterdam upgrade is represented by EIP-2780. This one would make the network more censorship-resistant and ensure guaranteed inclusion for all valid transactions.

Last but not least, the Glamsterdam upgrade is confirmed to include the addition of “Block-level Access Lists”. This is the real game-changer in my opinion.

Block-level Access Lists will significantly reduce gas costs for complex transactions such as swaps, borrowing, and depositing into vaults on Ethereum L1.

This will finally enable more people to afford to use DeFi on the L1.

The approval of BlackRock’s spot staked Ethereum ETF

Just a few days ago, BlackRock filed for a staked Ethereum ETF with the SEC.

This is very bullish for a simple reason: When BlackRock wants something, it almost always gets it.

For context, in 2024, BlackRock had a record of 575 ETF approvals, with only one single ETF rejection since its creation. So now that they have also applied for a staked Ethereum ETF, I think we can consider its future approval inevitable.

BlackRock’s existing spot Ethereum ETF has already seen tremendous success, with holdings surpassing $11B in ETH at the writing.

A staked Ethereum ETF could further increase the institutional demand for ETH.

Make the Ethereum L2 ecosystem feel like a single chain

If you’re a DeFi power user, chances are that bridging isn’t an issue for you.

But if you onboard a normie to crypto and tell him about different L2s and how he needs to bridge funds from one L2 to another just to use a specific dApp, there’s a good chance he’ll get lost.

The point is that the cross-L2 user experience needs to be drastically improved, and bridging should be abstracted in the backend.

Ethereum Foundation has a few improvement proposals aiming to address this, but it looks like we still have to wait a very long time until they are implemented.

Fortunately, there are many ecosystem projects working on solutions that hopefully will fix liquidity fragmentation much sooner.

For example:

zkSync has recently released the Atlas Upgrade, which enables ZK L2 Chains to interact natively with Ethereum DeFi (e.g., a user on AAVE could borrow GHO on Ethereum L1 with collateral from the zkSync Lite chain)

NEAR is developing NEAR Intents, a multichain transaction protocol that is already being used by some teams to build cross-chain dApps

Avail has released the Nexus Upgrade in November, which is a multichain protocol relatively similar to NEAR Intents

My hope is that at least one of these teams will succeed in fully abstracting away bridging and making all blockchains feel like a single one.

A seamless cross-L2 experience is the no. 1 thing that I believe Ethereum needs right now.

Together with Index Coop

Participate in Q4 Leverage RUSH and get rewarded

What if you could get paid for trading BTC, ETH, or other majors?

Recently, Index Coop has launched Q4 Leverage RUSH - a six-epoch raffle campaign with 150,000 $INDEX in total rewards.

All you have to do to participate and join the raffle is to mint leverage tokens.

Leverage tokens are basically leveraged crypto products for assets like BTC or ETH, but with a major advantage: liquidation protection.

There are three ways to earn via Index’s Q4 Leverage RUSH campaign:

Place directional trades based on your market expectations (e.g. buy ETH2x leveraged token for 2x leveraged exposure if you’re bullish on ETH)

Open a delta-neutral position (You can do that by minting the same amount of ETH2xBTC & BTC2xETH on Index Coop on Arbitrum to hedge your exposure)

Refer other users to the platform

All these things will earn you raffle tickets after 24h.

Index Coop has a referral program designed to reward both new traders and referrers:

Referrers get 1 bonus ticket for every new referral, and 50% of all the tickets earned by their referrals

New traders using a referral link get 2x tickets on their first trade

150,000 $INDEX in total rewards is up for grabs.

Not only do leverage tokens provide a highly rewarding method to trade majors with leverage, but they are also offering liquidation protection.

Check out Index Coop’s leverage tokens!

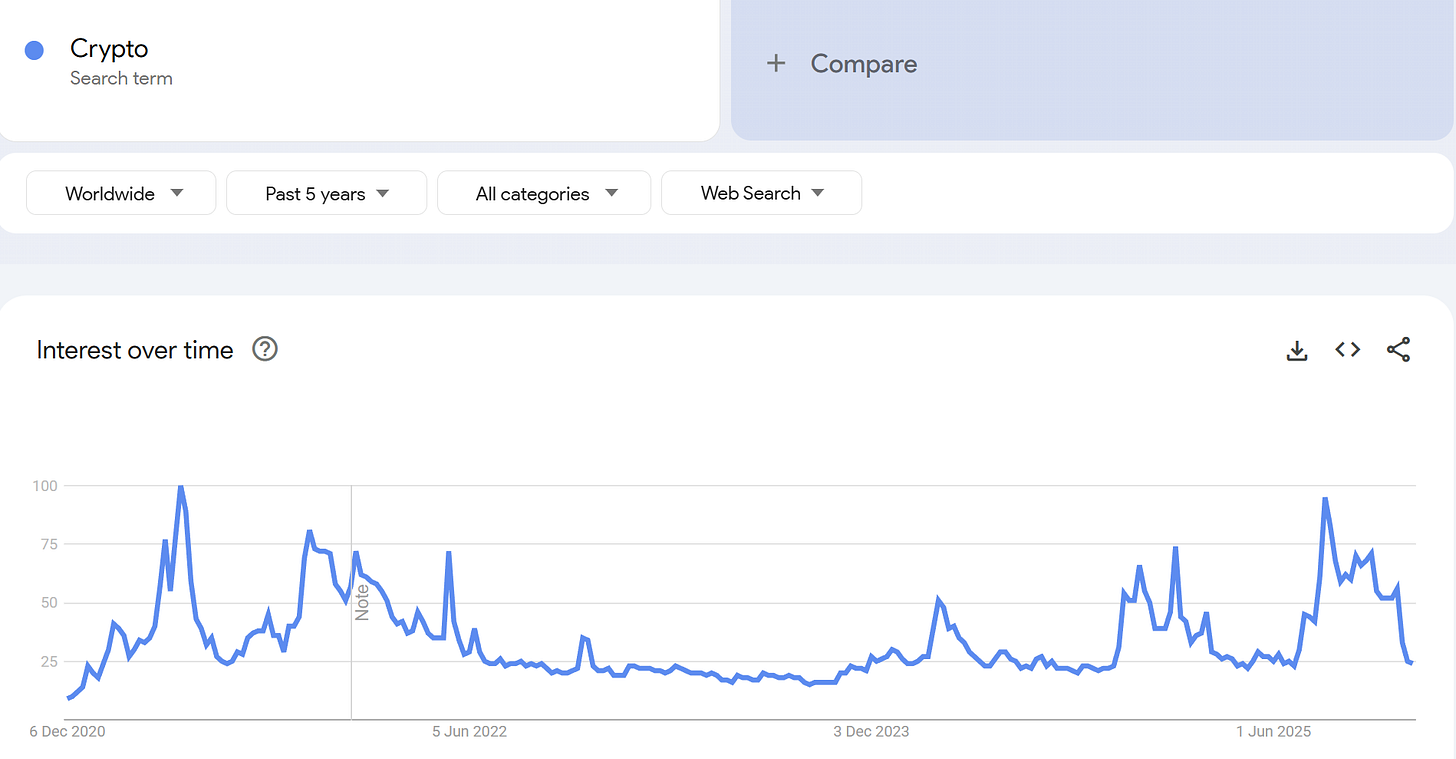

Chart of the week

Crypto searches dropped back to the bear market levels

Crypto Meme😂

The latest developments in DeFi

Lighter launched spot trading for ETH with zero fees

Pendle’s PT tokens are expanding to Solana

HyENA, a USDe-margined perpetuals DEX powered by Ethena and Hyperliquid, went live

Folks Finance launched its Season 2 points program and opened the whitelist for Folks Mobile - its upcoming user-friendly DeFi mobile app. Folks Mobile will go live in 2026

Rango, a popular cross-chain aggregator, has been integrated into MetaMask Swaps for better rates. Rango provides secure swaps across 70+ chains, including Bitcoin, EVM Chains, and Solana

Base has launched a bridge to Solana

Curve Finance started adding support for FX pairs

Aegis announced plans to launch a new yield-bearing stablecoin

MetaMask launched prediction markets powered by Polymarket

Tempo, a payments blockchain built by Stripe, launched its testnet

Aster announced plans to launch Aster L1 Chain and Builder Codes in 2026

Fluid announced Venus X, its upcoming money market and DEX on BNB Chain, built in partnership with Venus

Farcaster pivoted to building a wallet

ETHGas introduced the Open Gas Initiative - a way for dApps to subsidize gas fees for their users

Meteora announced a $10.6M MET token buyback program

Extended enabled using its vault shares as yield-bearing collateral when trading

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.