🔎What's next for DeFi?

weekly valuable insights

DeFi Saver is building a better tool for DeFi. Check out its Smart Savings dashboard to find the best yield opportunities!

GM friends.

Here’s what I’ll cover today:

🔎What’s next for DeFi?

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎What’s next for DeFi?

Price action aside, 2025 was a great year for crypto in terms of adoption.

I’ve seen lots of people say that this industry hasn’t progressed much since the last cycle. This isn’t accurate at all in my opinion.

Back in 2021, for example, bridging used to take hours in many cases. Now, you can use a bridge aggregator like Jumper to bridge your funds in a few seconds.

Yes, on-chain UX is still far from perfect. But the point is, DeFi is on the right track.

In this issue, I want to share a few DeFi trends and products that I expect to gain momentum fast in 2026 👇

Retail-friendly consumer dApps

This might sound obvious.

The goal has always been to bring normies on-chain and not just speculators. But the thing is, until now, almost every dApp has been built only with crypto natives in mind, as their UX is way too complicated for the average internet user.

Yet fortunately, this is starting to change, and we’re finally seeing new consumer dApps that bring the benefits of crypto while also offering a true web2-like UX.

A few that I am watching closely:

Aave App - A mobile savings application built on top of AAVE that lets users earn interest while completely hiding the crypto layer

EtherFi Cash - a crypto neobank where you can spend your crypto, book trips, earn on your assets, and complete bank transfers

DeFi App - an on-chain crypto everything app offering a UX pretty similar to CEXs for buying/selling tokens, trading perps, and earning (while fully abstracting bridging and gas fees)

UR - a crypto neobank built by Mantle with an amazing UX where you can also spend your crypto, earn, and execute bank transfers

These are just a few examples.

I think there’s a very good chance that we’ll see several new crypto consumer products going mainstream in 2026.

Non-USD stablecoins

USD stablecoins are absolutely dominating the stablecoin market.

And I expect them to continue to grow, but at the same time, non-USD stablecoins feel like a massive untapped market, especially considering that the US Dollar decreased ~11% against the euro in 2025.

The foreign exchange (FX) market is seeing multi-trillion-dollar daily trading volumes. It would be foolish to think that there’s no demand for non-USD stables.

For now, though, they face two major problems:

lack of liquidity (which leads to a lot of slippage for large swaps)

little to no DeFi utility

But once these things are fixed, I think stablecoins for EUR and CHF (the Swiss franc), among many others, will gain massive traction.

Polygon is one project to watch that is working hard on on-chain FX payments.

Increased experimentation with tokenomics

A lot of projects have launched buyback programs in 2025.

While in some cases (e.g., Hyperliquid) this proved to be a great decision, there are also major projects like Jupiter that are now considering discontinuing buybacks as they had little impact on their token price.

My take is that we will see a lot of projects experimenting with their tokenomics in new ways during 2026 in an attempt to drive more value to their token.

Speaking about buybacks, 100% of the revenue going to buybacks sounds great, but I am not sure this is the perfect solution to token utility and how sustainable this is.

Most projects in this industry are still in a very early stage.

Even Apple, one of the biggest companies in the world, allocates only a relatively small part of its revenue to dividends as it reinvests most of its earnings back into the business for future growth.

I think buybacks are great, but allocating all revenue to buybacks is not a great idea.

Besides token utility, another issue is that 99% of tokens slowly trend toward zero due to the selling pressure from insiders' token unlocks. Paradex proposed performance-based team unlocks to address this and create alignment, which seems very interesting to me, but we’ll probably see more experimentation in this area as well.

Overall, I think many projects will keep trying to launch new, novel token mechanisms in 2026 to figure out what works best.

Besides these things I’ve already mentioned, I also expect perps DEXs, RWAs, and prediction markets to continue to grow exponentially.

But I feel like these are already consensus bets, so I wanted to focus primarily on a few less-discussed trends I am bullish on.

Good luck trading in 2026🫡

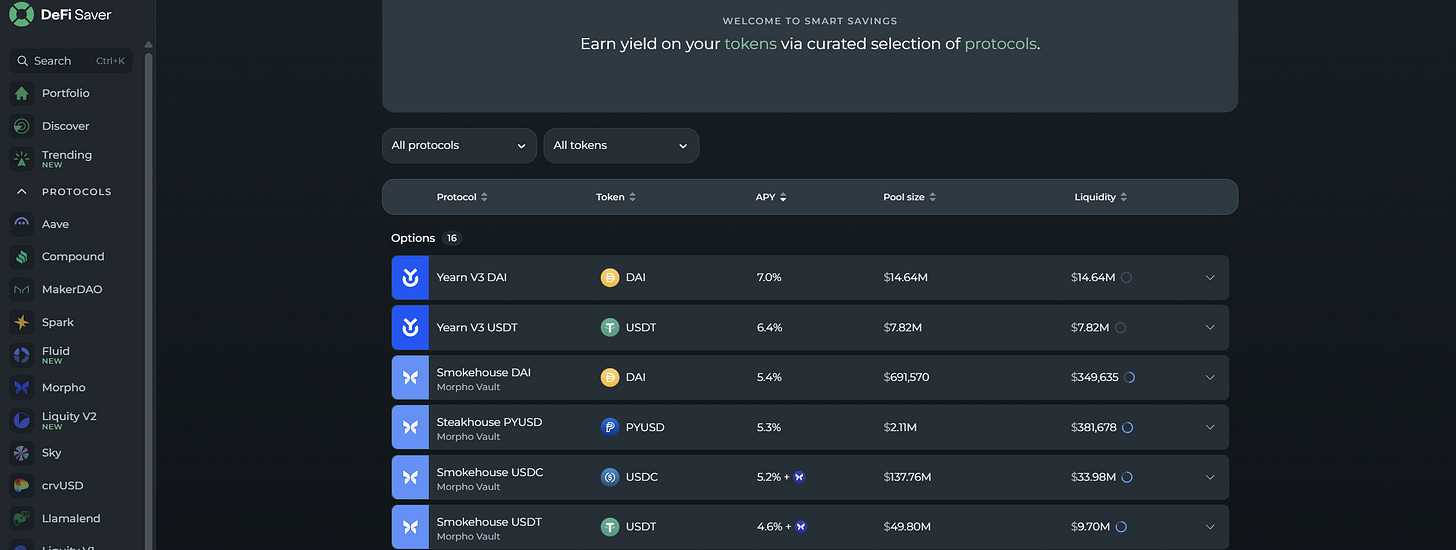

Together with DeFi Saver

Access the best lending strategies in one place

Managing yield across DeFi can be messy.

That’s why DeFi Saver, an OG DeFi team, has built Smart Savings - a lending dashboard that makes it easy to access a curated selection of popular yield strategies.

And recently, the Smart Savings dashboard received a big upgrade, allowing users to see a full breakdown of their DeFi savings in one place and track their projected yield.

Using it, you can easily access savings opportunities such as:

Yearn V3’s automated yield strategies, which constantly route your capital between dApps to access the highest DAI yields

Morpho’s vaults curated by Steakhouse, the largest risk curator on Morpho

Spark Savings, which generates yield via a set of strategies using Spark Liquidity Layer

Sky Savings Rate, which offers a yield on USDS with instant redemption

The new Smart Savings dashboard also lets you get a clear breakdown of where your yield comes from without jumping between apps.

If you’re looking for risk-adjusted stablecoin yields, I highly recommend giving it a try.

Start earning with DeFi Saver’s Smart Savings today!

Chart of the week

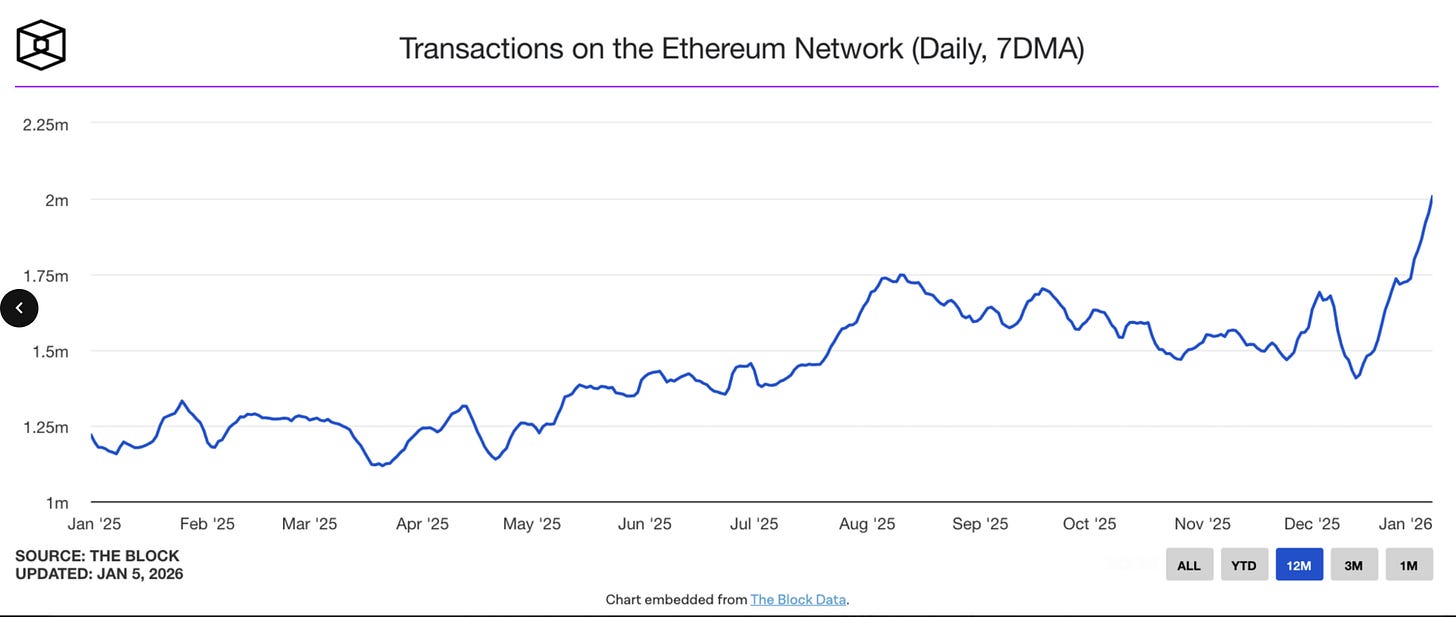

Ethereum activity is at an all-time high

Crypto Meme😂

The latest developments in DeFi

Lighter started doing token buybacks with its revenue

Aave Labs announced plans to share non-protocol revenue with token holders

Polymarket released real estate prediction markets in collaboration with Parcl

Jupiter launched JupUSD - its own stablecoin built in partnership with Ethena and integrated across all Jupiter products

Based wrapped up its points program and released an airdrop registration page

Huma Finance released Huma Prime - a defensive looping strategy vault with up to 30% APY

Jupiter is considering stopping token buybacks

Tria released Earn - a new crypto savings product that runs inside Tria accounts

BNB Chain announced plans to reach 20,000 TPS with sub-second finality

Phantom has launched in-wallet prediction markets

Morgan Stanley filed for spot Bitcoin, Ethereum, and Solana ETFs

Yieldbasis announced plans to launch ETH liquidity pools with no impermanent loss

Superform started allocating the user funds deposited in SuperVaults v2 to Pendle to generate a higher yield

US Supreme Court is rumored to rule on whether Trump’s tariffs are illegal on Friday

Pacifica’s Conquest League Trading Competition started

Ostium launched Season 2 of its points program

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.