🔎Tools I use for airdrop farming

Rhea Finance is leveraging NEAR Intents to build the first cross-chain lending protocol that supports native Zcash. Check it out!

I’ve written a lot of posts lately covering the airdrops I’ve been farming.

But in this issue, I thought it would be useful to share a few tools that make my activity as a DeFi airdrop farmer much easier.

Using those, you can track your DeFi positions in real time, find new airdrop opportunities, and check if there are any airdrops you haven’t claimed yet.

Let’s dive in 👇

1. Portfolio Trackers

Portfolio trackers are really a game-changer for DeFi farming, as you can use them to monitor your positions and see your on-chain net worth in just a few seconds.

There are two portfolio trackers I am using:

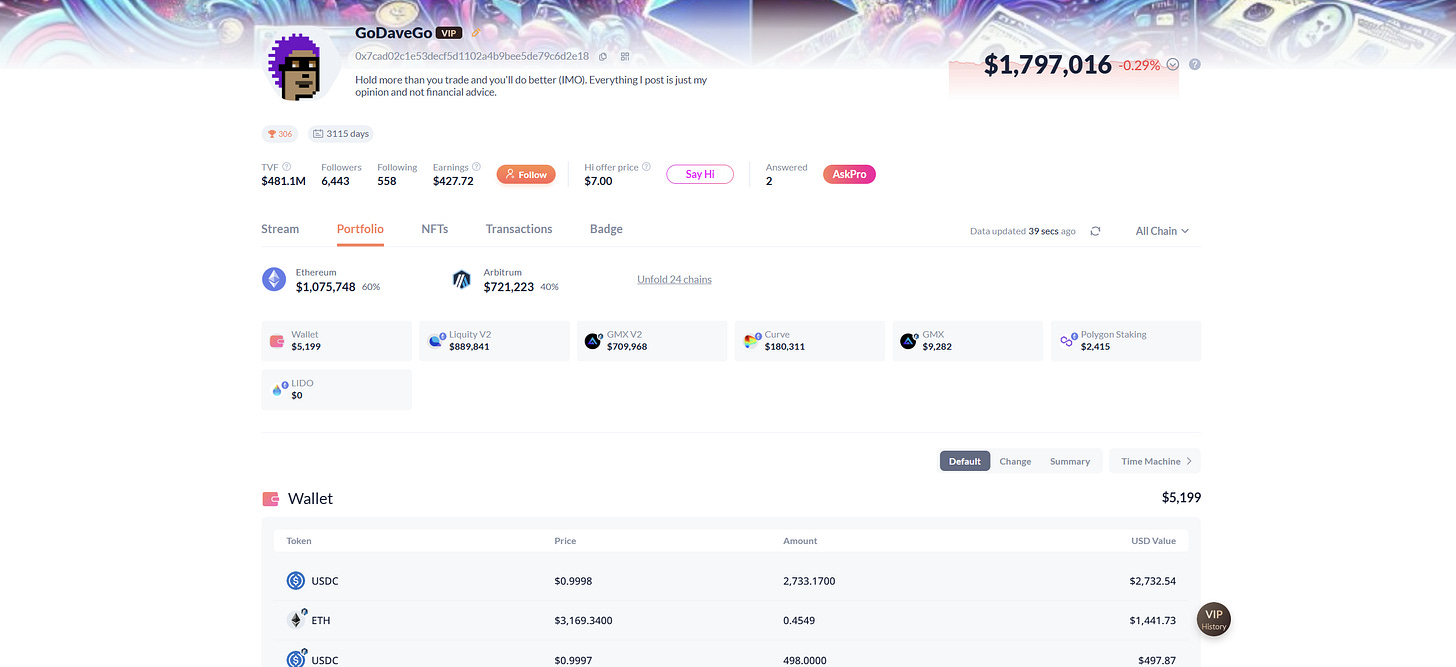

Debank

Debank is by far the most popular EVM portfolio tracker for DeFi.

An underrated feature of Debank that I don’t see many people use is “Bundles”.

How to utilize it:

→ go to https://debank.com/bundles

→ Click on Add Bundle

→ Create a bundle and add all your EVM wallets to it

After that, by clicking on your bundle, you’ll be able to see your total on-chain net worth across EVM chains, all your DeFi positions across major dApps, and the transaction history of each of your wallet addresses in one place.

What’s quite interesting is that Debank is also integrated into the Rabby wallet, which allows you to see your DeFi positions directly in the wallet.

Jupiter Portfolio

Until a few months ago, Solana lacked a good DeFi portfolio tracker.

Fortunately, this changed with the release of Jupiter Portfolio, which is incredibly useful for airdrop farmers and DeFi users in general on Solana.

With Jupiter Portfolio, you can:

→ See your token holdings on Solana

→ Check if your wallets are eligible for any unclaimed airdrops

→ See your past Solana on-chain activity

→ Track your DeFi positions

It’s just like Debank, but for Solana.

Jupiter has also recently released Jupiter Wallet, which allows visualizing your Solana DeFi positions directly in the wallet in a similar manner to Rabby.

There are obviously many other DeFi portfolio trackers, but to me, Debank and Jupiter Portfolio seem to be the most useful ones at this moment.

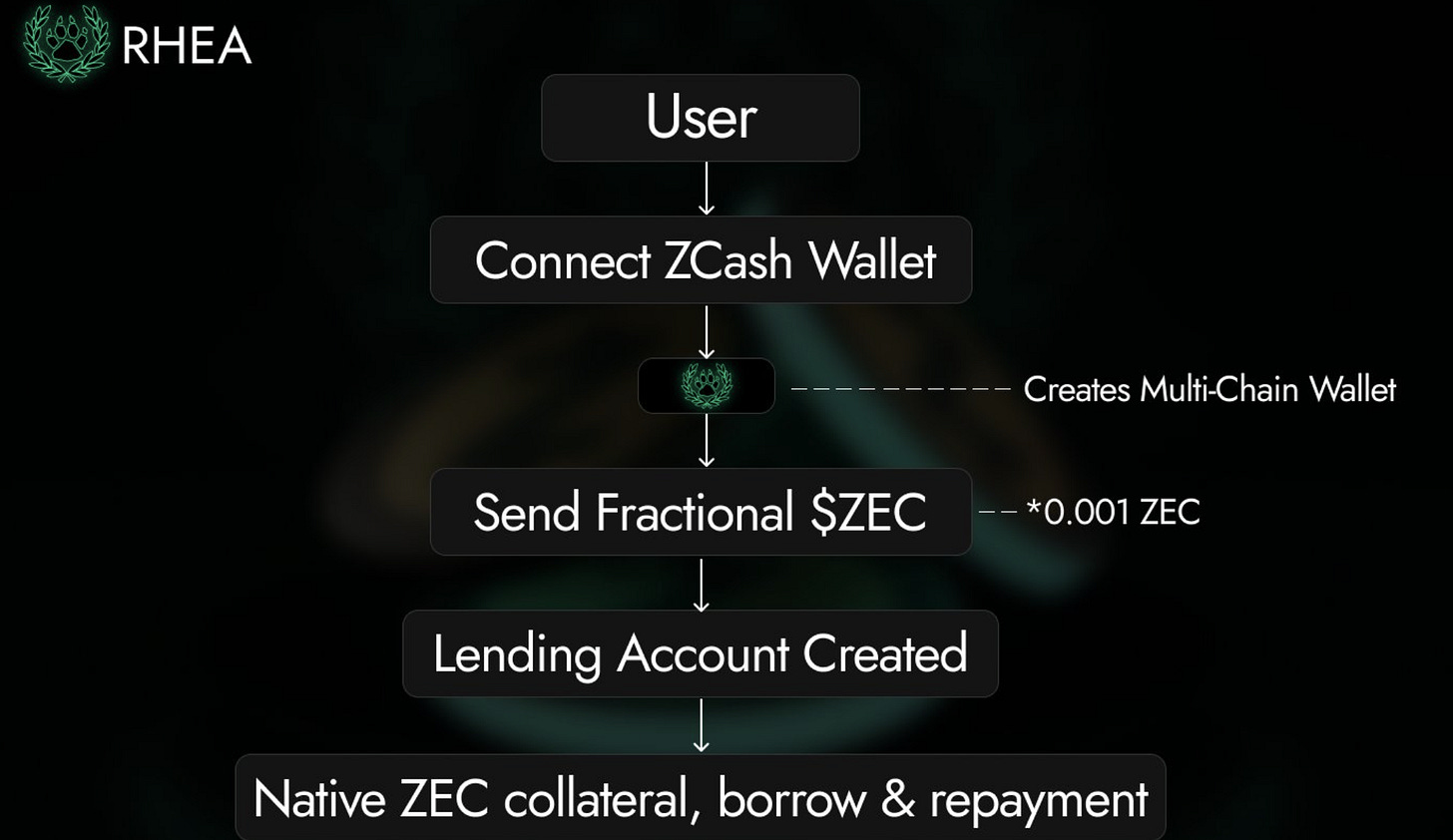

Before I cover a few other tools, here is an overview of Rhea Finance, a first-of-its-kind protocol powered by NEAR Intents:

Together with NEAR Protocol

The first native lending protocol for $ZEC

There’s one altcoin that has been a top performer for months.

I’m talking about ZEC, the token of Zcash, which is up 1600% in the last 3 months, fueled by the renewed interest in the privacy narrative.

Yet if you hold ZEC, there’s not much you can do with it in DeFi right now.

But this is going to change soon.

Rhea Finance is building the first cross-chain lending protocol powered by NEAR Protocol Intents that will support native Zcash as collateral for borrowing.

Here’s what you have to know about it:

Rhea Finance is the first unified, multi-chain lending protocol built for both non-EVM and EVM ecosystems

With Rhea, you’ll be able to access yield opportunities for both stablecoins (USDC, USDT) and blue-chip assets from non-EVM ecosystems

The protocol is currently providing up to 12% APY on stablecoins

All of this is possible thanks to NEAR Intents - the technology that powers Rhea Finance and enables it to unlock cross-chain liquidity.

NEAR Intents is a multichain transaction protocol that has been surging in popularity lately, with its daily volumes surpassing $100M-$200M.

On Nov. 14, NEAR Intents captured 54% of the cross-chain market share! And almost every day, it hits a new all-time high.

Its goal is to completely abstract bridges and wrapped tokens.

Explore what makes Rhea Finance stand out!

2. DeFiLlama Airdrops dashboard

DeFiLlama has a highly underrated dashboard called Airdrops.

You can access it by going to https://defillama.com/airdrops.

Here you’ll find hundreds of tokenless projects (the list is not instantly updated, so from time to time you might also see here projects that just had their TGEs).

What’s great is that DeFiLlama allows filtering those opportunities by:

→ TVL

→ Total Money Raised

→ 1d/7d/30d TVL growth

→ Chains

→ Category

And many other filters.

I’ve been using this tool for a long time and was able to find many interesting airdrop opportunities using it. Typically, I look for tokenless projects that either:

→ Are growing fast across all metrics including TVL, have a team that has shown that they have a community-first approach (e.g. they promised a high airdrop allocation for their community), and are building something unique

→ Raised a lot of money from VCs (let’s say $20M+) and are not overfarmed (this is why I think projects like Jito from Solana were able to do a big airdrop)

DeFiLama makes it easier to identify these kinds of projects.

3. Airdrop checkers

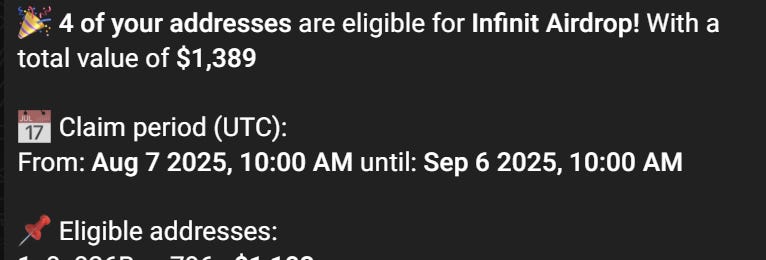

If you’re like me and you’ve farmed points for dozens of protocols, then an airdrop checker that checks your wallet for unclaimed airdrops and alerts you when you need to claim one could probably be very useful.

Unfortunately, based on my research, there aren’t any great free tools for this.

Yet if you are a DeFi power user and you’re open to paying for a service like this, there are two relatively decent options:

Drops

Drops is an airdrop checker that will give you alerts whenever one of your wallet addresses that you share with them is eligible for an airdrop.

Based on my experience, they track and alert you regarding almost all the important airdrops across 8 ecosystems, including Ethereum, Solana, and Cosmos.

How to use it:

→ Go to https://www.drops.bot/

→ Scroll down until you see “Become a Premium user Unlock all Benefits”

→ Choose a subscription plan from there

Then you’ll have to paste your wallet addresses and connect your TG account, and the Drops Telegram Bot will send you a DM when/if you have an airdrop to claim.

What I like is that you can pay with crypto. What I don’t like is that the smallest subscription plan requires paying for 5 different wallet addresses.

I think this airdrop checker can be useful, but it’s worth it only if you’re highly active on-chain and have multiple wallet addresses.

Jupiter Airdrop Checker

Jupiter Airdrop Checker can be used only for Solana airdrops.

If you have only one Solana wallet address where you’re active on-chain, you can use this tool to check if you have unclaimed airdrops for free.

However, if you have multiple wallet addresses, you’ll need to stake 100 JUP to unlock the airdrop checker for up to 10 of your wallets.

100 JUP costs $28, so it’s not a lot, and the JUP still remains yours after you stake it.

But unfortunately, as I said at the beginning, you can use this checker only for Solana airdrop opportunities, which aren’t that many.

That’s it for today.

I hope you find this issue valuable, and hopefully, these tools will save you some time.

Have a fantastic day!

Until next time,

The DeFi Investor

The Debank bundles feature is definately underused. It's been a game changer for tracking positions across muliple wallets without switching between accounts constantly. Your filtering criteria on DeFiLlama for finding projects is solid too, especially looking at the $20M+ VC backing that haven't been overfarmed. That approach worked wonders for early Jito participants. One thing I'd add is watching for projects that integrate innovative tech but fly under the radar becuase they're not hyped on Twitter yet.