🔎Should you pay attention to MegaETH?

valuable weekly insights

Aurion is building the liquidity hub of MegaETH. Check it out here.

GM friends.

Here’s what I’ll cover today:

🔎All you need to know about MegaETH

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎All you need to know about MegaETH

MegaETH, one of the most anticipated Ethereum L2 blockchains, is finally here.

I’ve spent a few hours exploring its ecosystem and thought it would be interesting to highlight the most interesting dApps I’ve found.

But first of all, let’s start by addressing the elephant in the room:

Why do we need another L2, and what makes MegaETH unique?

The short answer is that, for most dApps, the chains we have are good enough.

That said, MegaETH is taking blockchain performance to another level.

During its recent stress test that lasted a few days, MegaETH processed 10.7B transactions, more than Ethereum L1 has processed in its entire history!

According to its team, it can process 100k TPS with sub-millisecond latency.

So it’s probably the most scalable chain in crypto right now. This level of scalability is not needed for most dApps, but for certain apps, such as orderbook-based DEXs or web3 games, a high network speed is essential to deliver a good UX.

Besides its high performance, there are some other things that set it apart:

Native stablecoin - MegaETH launched its own native stablecoin USDM, which is backed mainly by assets invested in BlackRock's tokenized U.S. Treasury fund

The interesting thing is that all the revenue generated by USDM will go towards MEGA token buybacks after MegaETH launches a token.

MegaMafia - MegaMafia is an accelerator that supports early-stage founders building new dApps on MegaETH

Now, there are a lot of different accelerators in web3. What’s interesting about this one is that MegaETH managed to attract, through MegaMafia, several teams building truly innovative products. (a few which I’ll cover a bit later in this article)

KPI-based rewards - The MegaETH token will have an unlock schedule that will be based on the ecosystem achievements

Until a certain ecosystem growth, performance, or decentralization goal is hit, most tokens won’t enter circulation. The goal is to address the low float high FDV issue.

I’m not sure how efficient this is, but I like to see more tokenomics experimentation.

And that’s basically it. Overall, it’s safe to say that MegaETH is not just another fork, as it is bringing some new mechanisms to the market.

What can you do on MegaETH right now?

Well… to be frank, less than I expected.

That said, there are a lot of interesting dApps building on MegaETH that will be deployed in the near future.

To get started today, you should visit RabbitHole (here).

This is basically a prompt-based interface for the MegaETH ecosystem.

You can ask any questions related to MegaETH, including where you can earn yield, what unique dApps are built on MegaETH, how to bridge, etc.

It’s an interesting idea to build a chatbot for MegaETH-related questions.

Speaking about dApps, here are a few that are already live and caught my attention:

Avon - A new kind of lending protocol that lets lenders and borrowers set custom borrowing rates and terms - I personally deposited some USDm in Avon MegaVault as early depositors get a 3x points boost this week

Aave - The largest DeFi money market needs no introduction. I like that Aave was deployed on MegaETH, as I think that there might be some juicy MEGA token incentives for the Aave users on MegaETH in the future

Huntertale - a GameFi project native to MegaETH that reminds me of DeFi Kingdoms (I am generally not a big fan of GameFi, but this one seems interesting)

Prism - an AMM native to MegaETH that will soon also offer prediction markets, lending, and perps products

As I said, there are also a lot of interesting dApps yet to go live:

Aurion - An advanced DEX + prediction markets platform with gamified mechanisms built natively on MegaETH

Supernova - A CLOB-based rates exchange for trading or hedging interest rates, FX, and crypto cross-rates that will also offer fixed-rate and term borrowing

Blackhaven - A reserve-backed treasury, the so-called OlympusDAO of MegaETH

Premarket - A platform for trading premarket options for TGEs, IPOs, RWAs, and other assets before they officially launch

If you want to see a full list, I suggest checking out this page.

To sum it up, I think it’s worth keeping an eye on MegaETH.

Rumors are spreading that it will launch an incentive program soon (it’s not confirmed yet, though), which could create great opportunities for DeFi farmers.

But I think MegaETH’s success depends on whether any innovative dApps built on it manage to gain massive traction and attract external capital from other chains.

Together with Aurion

The Liquidity Hub of MegaETH

MegaETH is pushing the limits of on-chain trading with its insanely high speed.

But speed means nothing without deep, efficient liquidity.

This is where Aurion comes in - an upcoming high-performance AMM built natively for MegaETH and powered by Algebra.

A few things you should know about it:

Aurion combines concentrated liquidity with ultra-low-latency execution to offer a great experience for both traders and liquidity providers

It will offer multiple pool types, including CLMM, stableswap, and volatile pools tailored for different needs

Automated liquidity management will be available for liquidity providers to minimize losses and maximize returns

But perhaps the most interesting thing about it is that Aurion will also soon launch a built-in prediction market with gamified mechanisms.

By combining capital-efficient trading with on-chain prediction markets, Aurion aims to become MegaETH’s DeFi hub.

If you are exploring the MegaETH ecosystem, it’s worth checking it out.

Chart of the week

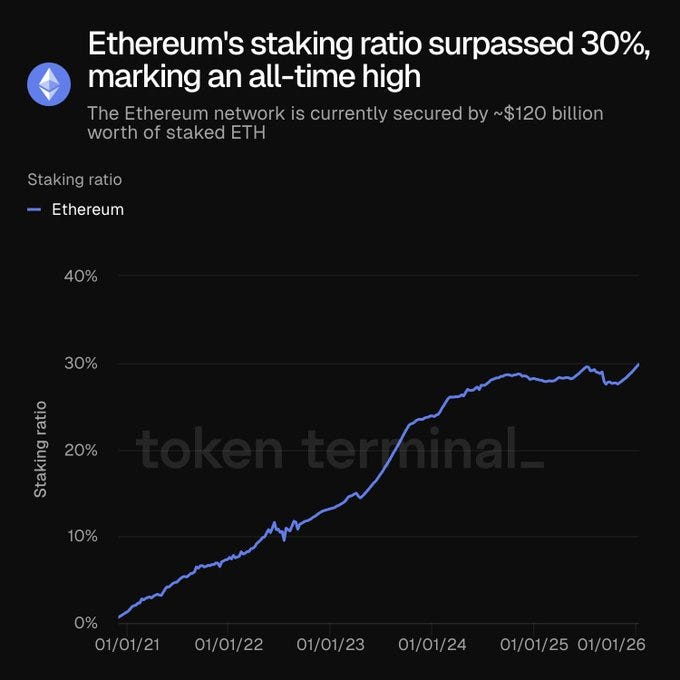

ETH staking ratio surged past 30% for the first time

Crypto meme of the week😂

The latest developments in DeFi

MegaETH launched its public mainnet

Aave went live on Mantle with a new MNT incentive program

Polymarket filed trademark application for POLY ticker

Sui launched suiUSDe, a native stablecoin for Sui backed by Ethena

LayerZero introduced Zero, its own blockchain targeting 2 million TPS

BlackRock bought $UNI and listed its BUIDL fund for trading on Uniswap

Citrea announced the Citrea Mainnet Campaign - a campaign tracking the activity of the early users of its ecosystem dApps

Ondo enabled the use of tokenized stocks as collateral on lending markets

Lighter introduced Funding Rate Rebates for perps traders who stake LIT. Funding rate rebates are also available for traders in the Premium fee tier

USDai announced its ICO on Coinlist and its upcoming TGE in March

Robinhood launched Robinhood Chain public testnet, which is powered by Arbitrum

Coinbase introduced Agentic Wallets - its first-ever wallet infrastructure built for autonomous AI agents

Kamino announced it will support borrowing against off-chain collateral

Kaito AI partnered with Polymarket to roll out attention markets

Royco introduced tranched yield vaults that split yield sources from any DeFi vaults into two pools: Senior and Junior

Backpack allocated 25% of its upcoming token supply for airdrop at TGE

Sushiswap went live on Solana

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.