🔎Real Yield narrative is back

weekly valuable insights

Ionex is building Plasma’s Trading Hub. Check it out today!

GM friends. Here’s what I’ll cover today:

🔎Real Yield narrative is back

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎Real Yield narrative is back

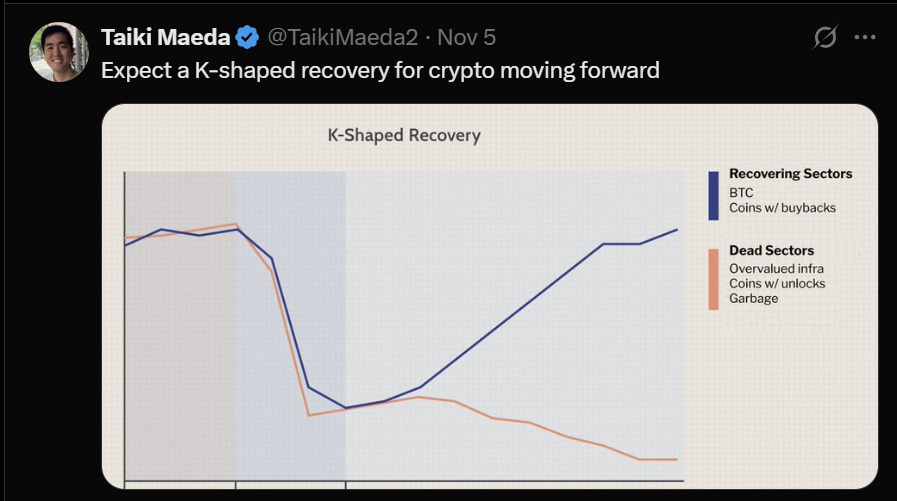

We’re officially in token buyback season.

Most UNI token holders have been asking for one single thing for years.

And this week, Uniswap Labs finally listened to them. Hayden Adams, the CEO of the Uniswap Labs, introduced a fee switch proposal.

The proposal includes:

Turning on protocol fees and using them to buy and burn UNI tokens

Burning 100M UNI tokens from Uniswap treasury (which are worth $800M at the current prices!)

Introducing “aggregator hooks”, which are essentially a new source of revenue

It is extremely likely to pass, as this is what UNI token holders have been asking for for years. But this post is not only about Uniswap.

Besides it, there are many other top protocols that also started a buyback program in 2025 such as Jupiter, AAVE, Fluid, Chainlink, and Lido.

What is Real Yield and why does it matter?

In 2022, the hottest crypto narrative at some point was Real Yield.

“Real Yield” protocols were essentially the ones that were generating high revenue, had attractive tokenomics, and a sustainable economic model.

We’re now seeing real yield protocols starting to be trending again in 2025, and more and more projects are working on increasing their token utility.

And I think it’s an extremely positive development.

Since basically the inception of crypto, the vast majority of tokens have been launched primarily as a way for teams to raise money and provide exit liquidity for insiders.

There’s nothing wrong with using them as a fundraising tool.

But the issue is that in most cases, token holders who invested early didn’t meaningfully benefit from the success of the projects. So even if the project thrived, the token slowly went to 0. There are so many such examples.

Hyperliquid showed that things can be done differently.

By allocating 99% of its fees for buybacks, it gained a very strong community, and the price of its token going up proved to be the best marketing strategy.

Happily, we’re now seeing lots of other projects following its example and launching mechanisms that grow the demand for their tokens.

What’s the best move right now?

There are three ways to capitalize on this trend in my view:

If you’re bullish on the market → Look to invest in tokens with a low market cap/revenue ratio, a team that constantly ships, and great tokenomics

If you’re neutral/bearish:

Try out pair trading

For instance, short an asset with no utility + high inflation that you’re bearish on while longing another asset with a high buying pressure from buybacks + major catalysts at the same time.

As long as the asset you long outperforms the one you short, you will make a profit regardless of the general market direction.

If you don’t have experience trading with leverage though, I definitely do not recommend trying this with large amounts of money.

Trading is a mental game that takes a lot of time to learn and master. Yet if you know what you’re doing, pair trading can be a great strategy in all market conditions.

Farm the airdrops of high-revenue projects

Perpetual DEXs are probably the best example.

Hyperliquid airdrop was so big because its token valuation was also significant, as people wanted to invest in a highly profitable business.

I am not sure if another project will ever be able to do a bigger airdrop than HYPE, but airdrop farming can still be profitable.

It’s refreshing to see though that many projects are starting to focus on what really matters: creating a profitable, sustainable business that creates real value and driving value to token holders.

The future of DeFi certainly looks bright.

Together with Ionex

The MetaPerp of Plasma

If you’re looking for a perps DEX to trade on, check this out.

Ionex is pioneering a new kind of perpetual DEX - the MetaPerp, which combines CeFi-level execution, DeFi self-custody, and aggregated liquidity.

Recently, it also launched its Ionex Points (Ions) campaign, with up to 20% of the total $INX token supply being allocated to it.

The more you participate, the bigger your airdrop allocation.

Here’s what makes Ionex stand out:

First all-in-one exchange on Plasma - With Ionex, you can swap, provide liquidity, and trade with leverage in one single place

Earn twice - Your trading activity earns you airdrop points, while the protocol revenue funds buybacks that boost your allocation’s value

RFQ Trading - Ionex uses an RFQ system instead of the usual AMM design, which allows it to offer highly competitive spreads and deep aggregated liquidity

On top of that, Ionex supports Cross-Margin, a system that treats all your positions as part of one portfolio and increases capital efficiency.

The protocol is building a platform where you can trade on-chain while enjoying a CEX-like user experience.

Trade on-chain perps without giving up performance with Ionex!

Chart of the week

Crypto Meme😂

The latest developments in DeFi

Uniswap founder proposed activating the fee switch

DefiLlama introduced LlamaAI - an AI-powered conversational interface to DefiLlama’s data

Mantle announced the launch of QCDT, the first ever tokenized money market fund in Dubai, on Mantle. QCDT was created by DMZ Finance

Lighter raised $68M at a $1.5B valuation

Arbitrum launched Epoch 6 of its DeFi Renaissance Incentive Program. This one is focused mainly on providing high ETH yields using $ARB incentives

Lido published a LDO buyback mechanism proposal

Monad announced its ICO on Coinbase at $2.5b FDV

Neutrl, a crypto-native yield protocol, went live

dYdX is discussing a proposal to allocate 75% of its revenue to buybacks

Circle is exploring launching its own native token on its blockchain

Injective launched its EVM mainnet

China accused US government of stealing $13 billion in a Bitcoin theft

Extended added support for Builder Codes, enabling other dApps to build on top of it

Polymarket announced its odds will be integrated into Google

Trump said Americans will get a $2000 dividend payment

Huma Finance announced plans to launch HUMA token buybacks in December

Sonic announced plans to increase the S token burns

Aerodrome team introduced Aero - an upcoming new exchange that unifies liquidity and connects any network

Superform V2, a stablecoin neobank, went live on Arbitrum

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.

Nice one