My top airdrop farms for 2026

10 airdrops I am farming

I also published this article on X. If you wish to read it there, you can find it here.

Airdrops are far from dead.

In 2025, the total value of the top five airdrops surpassed $4.5 billion.

And let’s not forget that the largest airdrop in DeFi history (Hyperliquid) happened just a little over a year ago.

Indeed, nowadays it’s very important to be selective with what you farm.

The days when you could get a $10k airdrop for providing $100 in liquidity are gone, but you can still make high amounts of money by farming the right projects.

In this article, I will cover my top airdrop picks for 2026 and the bull thesis for each one. Let’s dive in:

First of all, my strategy this year is to focus on farming primarily two kinds of dApps:

prediction market platforms

perpetual DEXs

The reason for this is simple. Both are time-consuming and require active capital management, which makes them significantly harder to farm.

In comparison, whales can just deposit a few hundred million dollars into a stablecoin protocol, do nothing else, and get most of their airdrop. But deploying high amounts of liquidity to farm an app like Polymarket or Variational is way more challenging.

This is why I think some of the best DeFi airdrops of all time came from perp DEXs like Lighter and Hyperliquid, which required active trading and, as a result, had fewer farmers.

Now let’s talk about the dApps I am farming:

1. Extended

I’ve already covered this one many times, but I’ve done it because I believe it is by far one of the best farming opportunities right now.

To farm this perps DEX, you have to generate volume. The more you trade, the more you earn. A fixed number of points is distributed every week.

The best way to generate trading volume, in my opinion, is by opening delta-neutral positions between multiple perps exchanges. For example:

Open a $10,000 BTC long on Extended

Open a $10,000 BTC short on Paradex

(or another perps DEX you want to farm)

Close them after a few hours

In this way, you can farm multiple perps airdrops with no directional risk.

I’ll cover a few other perps DEXs I am farming alongside Extended later in this post. But for now, let’s focus on Extended.

A few reasons why I am bullish on Extended:

It’s one of the fastest-growing tokenless perps DEXs by all metrics

You can deposit your trading capital into the Extended vault to earn 20-40% APR on your collateral while also using it to trade (the money deposited in the vault can be used as collateral)

Its team confirmed they will airdrop 30% of their token supply at TGE (for context, Hyperliquid airdropped 31%, and Lighter 25%) - I reached out to the team personally, and they confirmed this information to me

The TGE is scheduled for H1 2026

It has significantly deeper liquidity than most other perps DEXs

Its founder was previously the Head of Crypto Operations at Revolut

The primary reason why this is my favorite perps DEX to farm is the high double-digit APR I am getting on my collateral.

If you trade actively, you’ll earn up to 20-40% APR on your money deposited into the Extended vault, while also earning points for your trading activity. This yield is subsidized with trading fees.

This is possible because Extended is the first perps DEX to allow using its market-making vault shares as collateral.

Even if we ignore the airdrop, this high yield alone makes this one of the best opportunities in DeFi in my opinion.

You can use my invite link here for a 10% points boost.

2. Polymarket

Polymarket doesn’t need an introduction.

The prediction market platform has already partnered with some of the world’s largest sports organizations (e.g., UFC), has been constantly featured on CNN and on other mainstream media channels, and has raised $2 billion in funding at a $9B FDV from the parent company of the New York Stock Exchange.

Still, despite all of this, its TVL is only $299M according to DeFiLlama.

Yes, I know that everyone on CT is talking about Polymarket, and it may feel overcrowded, but the fact that it raised money at a $9 BILLION FDV and it has only $299M in TVL makes me think its airdrop is still very underfarmed.

Polymarket CMO confirmed in Oct. 2025 that they plan to launch a token and do an airdrop. I would expect the TGE to happen this year.

If they indeed do an airdrop, Polymarket could easily end up being one of the biggest airdrops ever given the valuation of its latest funding round and that its token would probably have a $10B+ FDV at launch.

I am personally farming it by doing two things:

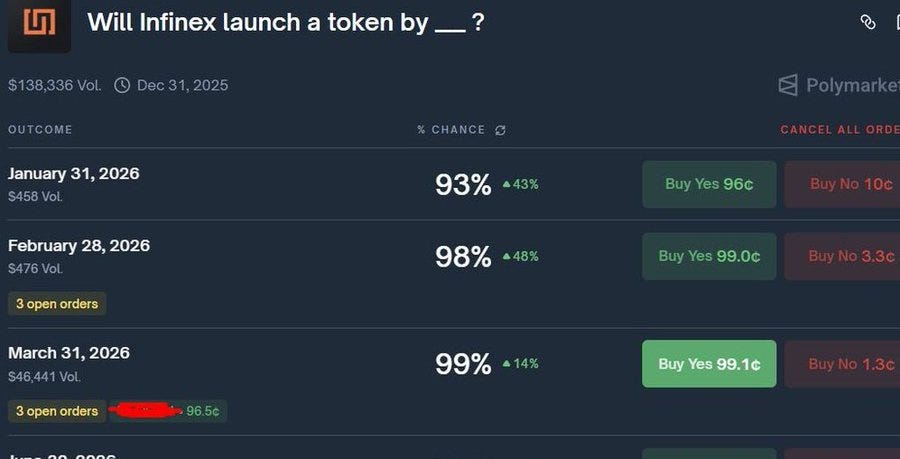

place directional bets on crypto events based on my research - for example, recently the Infinex team has revealed on their website and Discord server that they will do their TGE in January, but despite this, I was still able to buy YES shares on Polymarket, betting that Infinex will launch a token before March 31 2026, at an average price of 96.5c

You can make good money by finding inefficiencies like this in prediction markets.

Arbitrage prediction markets between exchanges (e.g. buy YES shares for a market where you bet that BTC will reach $100k this year at 80c on Polymarket, and buy the same number of NO shares betting that BTC will not reach $100k this year at 15c on Opinion - in this example, I’ll make a profit regardless of the outcome as either the YES or the NO shares will be worth 100c when the market expires)

If there’s interest, I’ll write a full guide on exactly how to find these kinds of opportunities and farm prediction markets.

3. GRVT

GRVT is a perps DEX that I started farming just a few weeks ago.

It’s a top 10 perps DEX by trading volume. However, I’ve seen only a few posts about it on CT so far, so I wouldn’t say it’s a consensus farm.

This can be both bullish and bearish, depending on how you look at it:

On one hand, one could argue that, given that it’s currently not getting much attention on CT, there won’t be many buyers for its token at TGE. On the other hand, if it gains more popularity in the future, farming its points now might pay off big time.

Speaking about why I chose to farm it, there are several reasons:

It raised $33.3M in funding from well-known investors like ZKSync, EigenCloud, Hack VC, and many others

Its team confirmed a 22% token supply airdrop at TGE, and the TGE is likely to take place in late Q1 2026

GRVT is “the first licensed DEX” that actually received regulatory approval, which might make it easier for it to onboard institutions, as they are generally looking for regulated platforms

All users earn a 10% fixed APR on up to $100k of their USDC collateral by placing 10 trades monthly (doesn’t matter the size - you can place ten $50 trades and qualify)

It pays you instead of charging a fee when placing limit orders (the rebates aren’t huge, but hey, I can’t complain about being paid to trade)

You can also earn points by providing liquidity - GRVT has a vault called GLP with a 23% APY and points rewards for depositors. However, to get access to it, you need to trade on the platform first

If you want to farm it, you can get a 30% points boost with an invite link.

As I explained earlier, my strategy to farm perps DEXs like GRVT is to open delta-neutral positions between it and other DEXs to collect funding rates.

4. Paradex

Paradex is a perps DEX that has getting a lot of attention lately and that I’ve also covered a few times in the past.

In short, this is why I’ve been farming it:

A minimum 20% of its token supply will be airdropped at TGE

It has zero fees and no ADL (no ADL decreases the risk of getting liquidated during extreme volatility)

Paradex team announced that they will adopt a performance-based unlock model for their token allocation, which signals that they are committed to the long-term success of the project

It’s incubated by Paradigm and backed by major trading firms like Jump Trading

Paradex is one of the very first DEXs that launched Privacy Perps, and privacy is one of the biggest narratives right now

It’s worth noting, though, that its TGE is rumored to happen (although this is not officially confirmed) in just a few weeks from now.

So there’s not much time left to farm it.

You can use my invite link here for a points boost.

5. Opinion

Opinion is the third-largest prediction market platform.

When Hyperliquid started gaining significant traction, CZ and Binance began heavily promoting Aster, a DEX competitor on the BNB Chain.

This drove ASTER token’s valuation to insane levels, making Aster’s first airdrop one of the best airdrops of 2025 in terms of ROI.

Now we’re seeing the same thing happening with Opinion.

Prediction markets are gaining massive traction, and I believe Binance and CZ are now trying to capitalize on this trend too.

Opinion is a prediction market platform built on the BNB Chain and is backed by YZi Labs (formerly known as Binance Labs). Less than 2 weeks after its official launch, it suddenly became the 3rd-largest prediction market platform.

I suspect that its rapid growth is due to insiders heavily farming it. It has a points program, so an airdrop is basically confirmed.

If CZ starts heavily promoting Opinion after its TGE, just like he did with Aster, I believe its airdrop could be worth a lot.

I am farming Opinion primarily by looking for arbitrage opportunities between the prediction markets on Polymarket and Opinion. Almost all markets from Opinion are also available on Polymarket, so it’s quite easy to find mispriced markets that are available on both platforms.

6. Variational

Variational is a perps DEX with a unique RFQ model.

The majority of perps DEXs use a central limit order book (CLOB) model, which simply matches the buy (bid) and sell (ask) orders on the platform.

In contrast, in an RFQ model, traders request a price for their trade, and market makers respond with executable quotes and compete to fill it.

Technical details aside, the great thing about this is that it enables Variational to offer much deeper liquidity than other perps DEXs. When you trade on Variational, the slippage is minimal.

A few other things you should know about it:

Variational has 500+ perps markets and zero fees

Its points program went live less than a month ago

It has a very interesting program called “loss refunds”. When you close a trade where you lost money, there’s a 0.5%-5% chance (depending on your trading activity on the exchange) that the exchange will fully refund your loss

A few days ago, one guy closed a position with a $30,000 unrealized loss and got insanely lucky as his entire loss was refunded!

There’s one more thing I should mention:

Its team didn’t announce anything regarding when the TGE could happen or what % of their token supply will be allocated to the first airdrop.

This makes it hard to estimate its airdrop potential. But we know that 50% of its total token supply will be allocated to the community, which is great.

Variational is invite-only, but you can use this link to get access.

(first-come, first-served, as I have a limited number of invites)

A few other tokenless protocols I am farming:

Pacifica - Pacifica is the leading perps DEX in the Solana ecosystem. Its fees are a bit high, and the TGE timeline is unclear, so farming this one is not a top priority for me, but I am pushing some volume from time to time

RAAC - RAAC, a DeFi project supported by Curve founder, is the issuer of pmUSD, a new gold-backed stablecoin. The protocol has announced a lot of interesting yield programs over the past months, including some USDC bonds offering a 60% fixed APR + points rewards for locking your capital for 60 days, which I participated in

Predict - Predictdotfun is another BNB-native prediction market backed by YZi Labs. I’m farming this one by doing arbitrage between it and Polymarket (e.g. buy YES shares for a prediction market at 90c and NO shares for the same market but on the other platform at 8c)

Neutrl - Neutrl is a synthetic dollar protocol that generates a double-digit yield via OTC arbitrage. Its sNUSD pool on Pendle offering 13% APY + 25x Neutrl points to liquidity providers is quite interesting

And that’s it.

Those are the main airdrops I am farming at this moment.

If there are any other opportunities you think I should take a look at, let me know in the comments.

I put a lot of effort into this article, so I hope you found this helpful!

People still doing airdrops. I did not know it

Great article :)

I'm only farming tread.fi and HIP3 bit still enjoyed the lecture