🔎My favorite airdrop strategies

weekly valuable insights

BOB is building the Gateway to Bitcoin DeFi. Check out what makes it stand out.

GM friends. Here’s what I’ll cover today:

🔎My favorite airdrop strategies

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎My favorite airdrop strategies

The great thing about airdrop farming is that it’s highly profitable during both market uptrends and downtrends.

And given the recent rough market conditions, I thought it would now be a good time to provide an update on the main airdrops I am farming in the Ethereum ecosystem.

First of all, I think the best tokenless protocols to farm now are from these sectors:

perpetual DEXs

prediction markets

The reason for this is that farming these kinds of dApps typically requires active capital management in order to farm them efficiently.

This keeps whales and farmers that prefer passive liquidity provision away, making their airdrops less diluted.

I’ll cover two arbitrage strategies for farming those with no directional exposure.

Let’s get into it👇

1. Arbitrage funding rates between perps DEXs (Extended, Paradex, Lighter, and Variational)

Funding rate arbitrage is a delta-neutral strategy I covered many times and which I consider to be the most efficient way to farm perps airdrops.

It involves simultaneously taking a long and short position on two exchanges in order to profit from the funding rate difference between them.

Extended, Paradex, and Lighter are perps DEXs that have all announced they plan to airdrop a very big % of their token supply at TGE (20-35%), which makes me pretty bullish on their airdrops, considering that most other dApps airdrop only 5-10%.

Variational also promised a 50% total community token allocation.

In short, here’s how to arbitrage funding rates between them:

Deposit the same amount of funds on all exchanges you want to farm

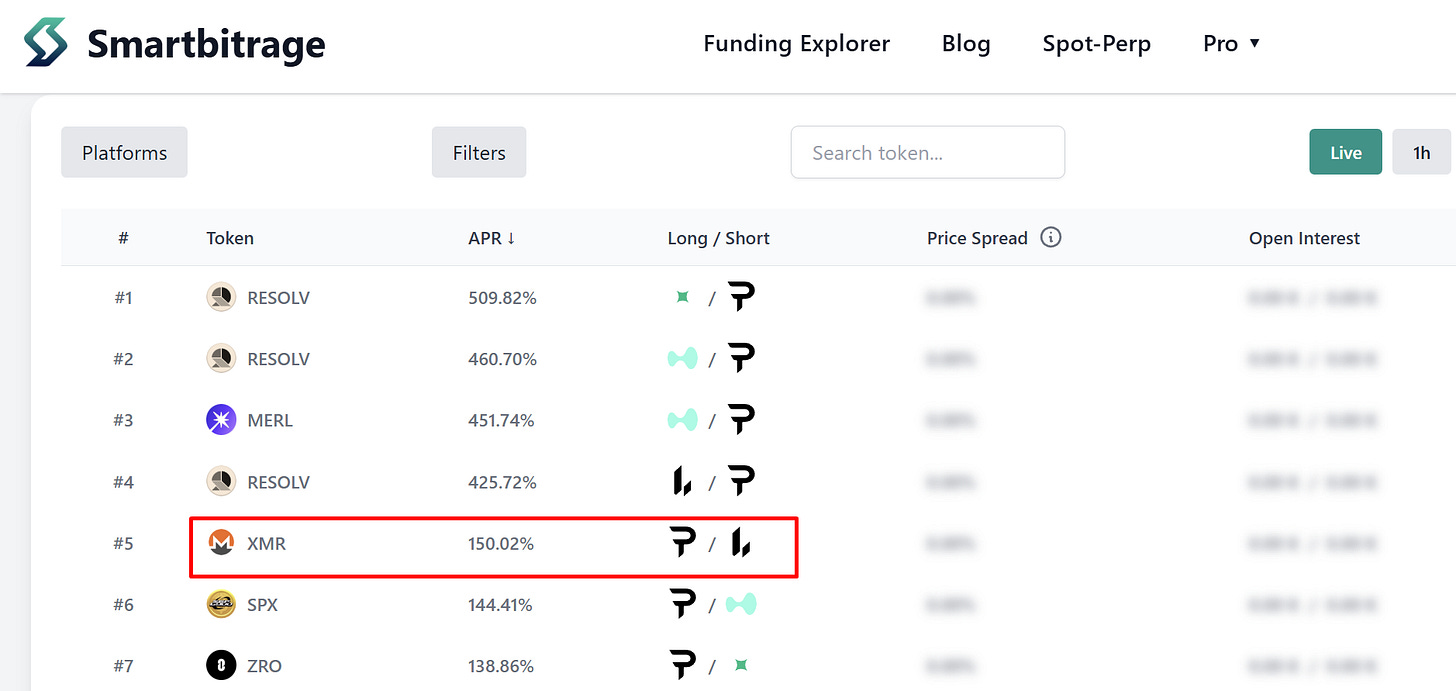

Go to smartbitrage.com and click “Live” to see the best funding rate arbitrage opportunities at this moment

Click “Platforms” to select the perps DEXs you are using

Then scroll down to find an arbitrage opportunity for a well-known token with an attractive APR

Open a short, respectively a long position, to profit from the funding rate difference according to the instructions shown on the platform

Close the positions when the APR for your delta-neutral positions turns negative for 2-3 consecutive hours

My advice is to avoid doing funding rate arbitrage for assets with a small market cap or for memecoins, as you can get easily liquidated due to their high volatility.

In the image above, you can see that the platform shows that a good opportunity at the time of writing is to long XMR on Paradex and short it on Lighter. If the price spread between Paradex and Lighter is small, it’s an ideal delta-neutral setup.

By doing this, you’ll earn 150% APR at this moment, which seems pretty good to me.

And on top of this huge APR, you’ll also earn points on Paradex and Lighter, which will qualify you for their future airdrops.

Obviously, this 150% APR from funding rates won’t last forever.

You need to constantly monitor your positions across perps DEXs to avoid getting liquidated, and always look for new arbitrage opportunities.

Funding rate arbitrage takes some time, and it might seem a bit complicated at first, but I believe it’s worth it, as perps airdrop points could end up being very valuable.

If you want to dive deeper and learn more about funding rate arbitrage and perps airdrops, check out this in-depth guide I wrote a while ago:

That being said, before I also cover a strategy to farm prediction markets apps like Polymarket, here’s an overview of BOB's new staking campaign:

Together with BOB

The new staking rewards campaign in BTCfi

If you believe Bitcoin DeFi has strong potential, you should check out BOB.

BOB is building the Gateway to Bitcoin DeFi. It’s already one of the largest Bitcoin L2s by DeFi TVL, and it raised $21M in funding from VCs like Coinbase Ventures.

By combining Bitcoin’s security with Ethereum’s smart contracts, it aims to unlock new utility for the world’s biggest digital asset - $BTC.

And just a few days ago, BOB announced an exclusive staking campaign.

Here’s what you need to know:

$BOB is the native token of the BOB hybrid chain, which has a staking mechanism designed to provide economic security

By staking BOB, you can receive a maximum 60% base APR

For a limited time, BOB holders who stake their tokens can qualify for up to 250% additional bonus tokens by timelocking their tokens for 18 months

If you believe in the future of BOB, then you should know that staking $BOB for 18 months is like buying it at ~$28M FDV, thanks to the bonus token rewards.

The bonus tokens campaign is available for the first 60 days after TGE on a first-come, first-served basis.

BOB’s goal is to become the premier destination for Bitcoin liquidity, apps, and institutions.

Learn more about what makes BOB stand out today!

2. Arbitrage prediction markets (Polymarket <> Opinion)

Polymarket is definitely an airdrop still worth farming in my opinion.

Despite already being one of the hottest crypto apps and raising funds at a $9 billion valuation, its TVL is only $276M.

Speaking about Opinion, Opinion is a new prediction market platform on BNB Chain backed by YZi Labs (formerly known as Binance Labs). It has already become the 3rd largest prediction market platform in 5 weeks since launch.

Almost all the prediction markets on Opinion can also be found on Polymarket.

My strategy for farming them is simple:

Find a market available on both Opinion and Polymarket, but with different odds

Buy YES shares, respectively NO shares, on the platform where they are trading at the lower price

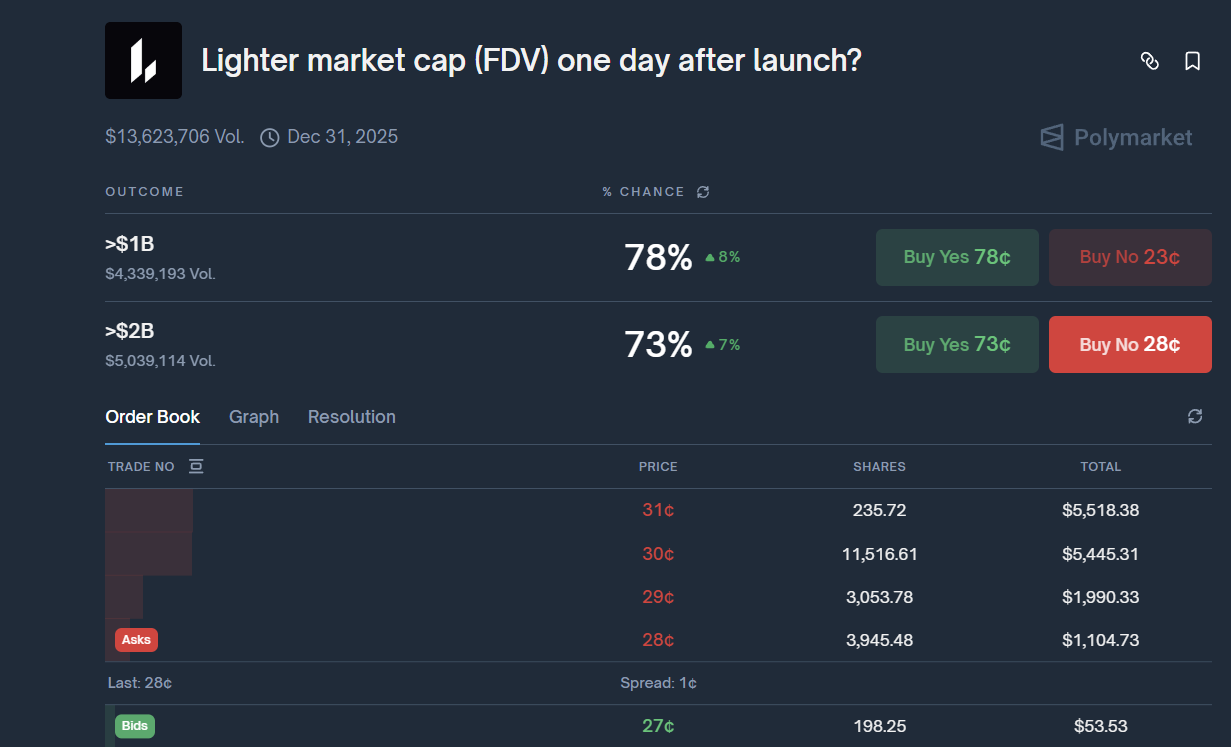

For example, at the time of writing, you can buy YES shares on Opinion betting that Lighter FDV one day after launch will be over $2 billion at 70.5 cents. (70.5% YES probability)

And at the same time, you can buy NO shares on Polymarket betting that Lighter FDV one day after launch will be below $2 billion at 28 cents. (72% YES probability)

70.5 + 28 = 98.5

In total, 1 NO share + 1 YES share will be worth $1 when Lighter launches a token or when the market expires on Jan. 1, 2026, regardless of the outcome.

So if you buy the same number of YES and NO shares on Opinion and Polymarket, you’ll get $1 per share for every 98.5 cents invested, no matter what happens with Lighter TGE and how its token performs.

That’s a 1.52% return in one month (as the markets expire on Jan. 1, 2026), which is equivalent to a 17-18% risk-free APR!

It’s a pretty good return considering that you also generate prediction volume and farm Polymarket and Opinion airdrops in this way.

Opinion has a points program live, so an airdrop is pretty much confirmed.

Those are the two strategies I wanted to cover today.

I’ve tried to explain them as simply as possible, although funding rate arbitrage in particular can be challenging to execute efficiently at the beginning.

Yet if you manage to master them, you’ll be able to make money in all market conditions and farm some of the highest-potential upcoming airdrops.

Chart of the week

EtherFi Cash keeps hitting new ATHs in weekly revenue

A reason for this might be EtherFi Cash’s new promotion, which gives new users 10% back on their spending until Dec. 10.

Crypto Meme😂

The latest developments in DeFi

Ethereum’s Fusaka upgrade went live

Lighter’s spot trading is confirmed to launch later this week

Aave DAO is voting on shutting down its zkSync, Metis, and Soneium deployments

INFINIT’s early access waitlist for its Prompt-to-DeFi capability will be closing soon

Polymarket released its U.S. App

Almanak launched Strategy Builder V1, enabling users to turn trading ideas into fully code-based onchain strategies with the help of AI

Ostium, a perps DEX native to Arbitrum L2, raised $20M in funding

Uniswap teamed up with Revolut to make it easier to buy crypto

Fluid teased the development of Fluid DEX V3 - a new perps DEX

Hinkal released confidential payments on Arbitrum

Jupiter released Refinance for Jupiter Lend, enabling users to move their borrowing positions from other protocols to Jupiter in a few clicks

YieldBasis is discussing a proposal to share its revenue with YB token stakers

Kinetiq, the largest liquid staking protocol on Hyperliquid, launched its token $KNTQ

Drift Protocol released Drift v3 - a new iteration of its perp DEX

Ethena’s USDe became a quote asset on Hyperliquid

Based introduced livestreaming for Polymarket prediction markets

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.