🔎Lighter airdrop: What to expect?

weekly valuable insights

Ionex is building the Perps Metadex of Plasma. Start trading and get rewarded!

GM friends. I wish you all a Merry Christmas and a wonderful holiday season!

Here’s what I’ll cover today:

🔎Lighter airdrop: What to expect?

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎Lighter airdrop: What to expect?

The biggest airdrop of 2025 is likely around the corner.

According to Polymarket, Lighter, the largest tokenless perps DEX, will launch its token on Dec. 29.

While its team hasn’t publicly said anything about Lighter TGE date yet (at the time of writing), Polymarket says there’s an 73% chance its airdrop will happen on Dec. 29, which might be due to bets placed by insiders.

On top of this, an airdrop allocation form has recently been added to the Lighter user interface, which will expire on Dec. 26. Vladimir Novakovski, the founder of Lighter, has also previously hinted that the TGE will happen during the holiday season and has recently changed his X profile picture to the image below:

Given all of these factors, I think there’s a decent chance we will see Lighter launch its token, LIT, in the coming days (most likely on Dec. 29).

Why is there so much hype around Lighter?

If you’ve been active on CT over the past few days, chances are your timeline has been filled with posts about Lighter and its TGE.

I think there are quite a few reasons for this:

Lighter was the first perps DEX to introduce zero-fee perps for retail traders and collect fees only from market makers and high-frequency traders, and the zero-fee model attracted a lot of traders

In a similar way to Hyperliquid, Lighter promised a big airdrop (25% of its token supply will be airdropped at TGE) and built a very strong community

Its team raised $68M in funding at a $1.5 billion valuation from tier-1 VCs such as Founders Fund and Robinhood

The project received a lot of support from Ethereum community, as the exchange is built on a custom Ethereum L2 with verifiable order matching and liquidations

This could be the biggest airdrop since Hyperliquid, so the anticipation is massive.

At the time of its writing, its token LIT is trading at a $3.5 billion FDV on pre-market, which is equivalent to a ~$900 million total airdrop allocation (25% of supply).

What valuation to expect on the TGE day?

As I said previously, it’s not fully confirmed that Lighter will launch its token on Dec. 29, although it is likely.

But I thought I’d share a few thoughts about my TGE expectations anyway.

On one hand, I appreciate that the Lighter team said a few months ago that the TGE is coming in 2025, and it seems likely they actually plan to keep that promise, while many other projects constantly delay their token launches.

On the other hand, the market conditions are horrible right now. Even high-profile new tokens like MON (Monad) have performed terribly, with MON now being below its ICO price only 1 month after TGE.

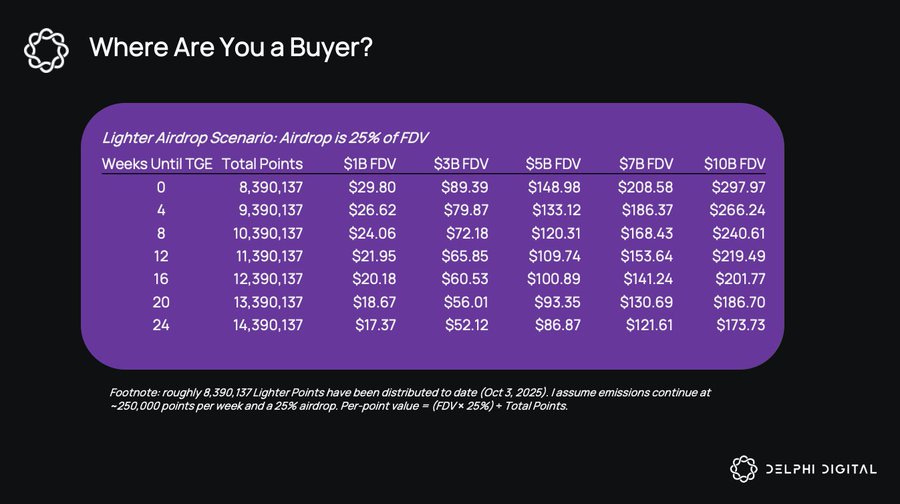

So my guess is that the Lighter token will trade at an FDV mostly somewhere in the $2-3.5 billion range and that there will be a lot of volatility in the first 24h after TGE. Eventually, if its trading volume doesn’t drop a lot post-TGE, then $LIT could go higher a few days after TGE if BTC also performs decently.

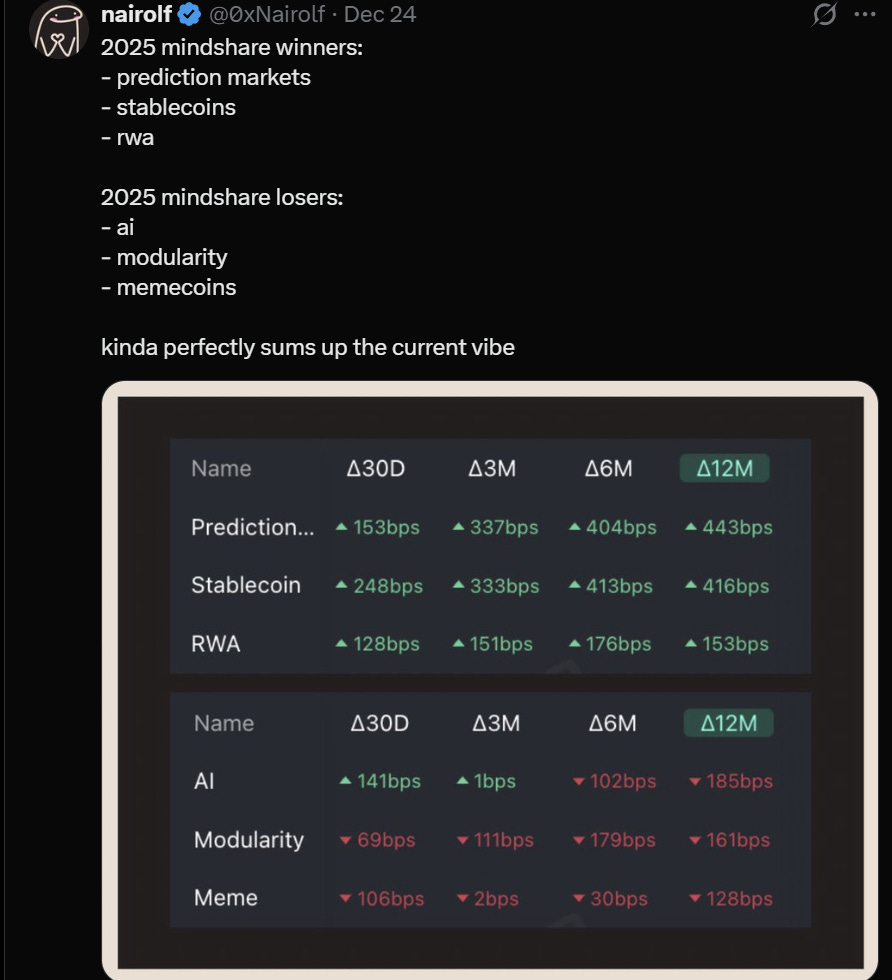

Speaking about Lighter points, here’s what airdrop you could expect based on how many points you have (this valuation table is from Oct. 3):

Most people on CT seem to have higher expectations than I for the Lighter TGE valuation, but I think that there will be a lot of selling pressure in the first 24h from airdrop farmers, and the market conditions are unfortunately not great either.

Still, even at a $2-3.5 billion FDV, the airdrop should be massive for early traders. In case the FDV ends up being higher, even better.

Tokenless Perps DEXs remain some of the best airdrop opportunities to farm.

If you’ve farmed Lighter, congrats and enjoy your airdrop, you deserve it🫡

Together with Ionex

Trade and get rewarded

Ionex just launched Chromes - a new rewards layer that turns your DeFi perps trading activity into more points, bigger multipliers, and a larger airdrop allocation.

These are time-limited community badges that are part of the Ionex Points campaign.

In case you’re not familiar with the protocol, Ionex is building Plasma’s Trading Hub - an all-in-one platform with unified spot and perps and deep liquidity.

What makes its new Chromes stand out is that they offer real utility: collecting them will help you unlock an up to 1.25× Ionex Points Multiplier!

Here are a few examples of Chromes you can earn today:

Ionex Initiate - by collecting 1k+ Ionex points (you can easily do that by trading perps or providing liquidity on Ionex)

Euler - by supplying $100 worth of USDT0 on Euler Finance (on Plasma)

Aave - by supplying $100 worth of WXPL on Aave v3 (on Plasma)

Gearbox - by supplying $100 worth of USDT0 on Gearbox (on Plasma)

Ionex Operator - by collecting 50k Ionex points

The more Chromes you earn, the bigger your Ionex points multiplier.

The Chromes Campaign is designed to make DeFi on Plasma more rewarding and incentivize active DeFi participants.

On top of this, Ionex also offers highly competitive spreads and deep liquidity.

Check out Ionex’s Chromes Campaign today!

Chart of the week

Prediction market, stablecoin, and RWA narratives have surged in mindshare in 2025

Crypto Meme😂

The latest developments in DeFi

Uniswap’s fee switch proposal has passed

Robinhood deployed 1900+ tokenized stocks on Arbitrum so far

Base app went live for everyone in 140+ countries

Michael Selig, a pro-crypto guy, became the new CFTC Chair

Infinex scheduled its Infinex Token Sale for Jan. 3 at $99.99M FDV. The registration for it starts today, and there will be a 1-year token lock

Hyperliquid Foundation recognized the HYPE in the Assistance Fund as burned

Resolv added support for delta-neutral HYPE and SOL strategies to earn higher yield

GMX went live on Ethereum L1, enabling trading and providing liquidity on mainnet

Solana Foundation introduced Kora, a mechanism that enables fee-free transactions and paying fees in any token on Solana

Superform introduced its new SuperVaults, enabling to earn up to 8% APY on USDC, ETH, and WBTC

Euler Finance lending stack went live on HyperEVM

Polygon announced the release of Shift4’s stablecoin settlement platform on Polygon, bringing 24/7 stablecoin payments to global commerce

FX100 introduced 100x non-liquidatable leverage perps

Altura launched its USDT0 stablecoin vault on HyperEVM with 20% base APY. It generates from funding strategies, delta-neutral strategies, staking, restaking, and liquidity provision

Katana launched Katana App v1 - a brand new home screen for DeFi on Katana

Jupiter was integrated into Coinbase for Solana DEX swaps

Tria, a self-custodial neobank, released Season 1 of Tria Points

RateX released its RTX token and airdrop claiming portal

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.