🔎How to spot good ICOs

weekly valuable insights

Vechain’s biggest staking upgrade since launch has recently gone live. Check out its new staking mechanism here.

GM friends. Here’s what I’ll cover today:

🔎How to spot good ICO opportunities

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎How to spot good ICO opportunities

I made a post two months ago saying that it’s ICO season.

And man, it really is. We’ve seen dozens of projects announcing their public token sales over the past weeks.

ICOs (public token sales) are definitely not free money opportunities, though.

Most participants in these sales have actually lost money. Even MON, one of the most hyped new tokens, is now below its ICO price. So this is something to keep in mind.

But if you still want to participate in these token sales opportunities, I’ll show you my strategy using Polymarket to spot the ICOs with good valuations.

Let’s dive in 👇

First of all, I’ll quickly explain what pre-markets are.

Pre-markets enable investors to speculate on the price of an unreleased token by placing buy or sell orders, creating an order book of early interest.

Obviously, they are not entirely accurate, as it’s hard to estimate how much buying and selling pressure will be at launch.

Yet they are a great way to gauge the sentiment toward an unreleased token.

There are two kinds of pre-markets:

perps pre-markets listed on perps DEXs

prediction pre-markets, which have only recently started gaining popularity

Perps pre-markets have been around for a long time. But the problem with them is that they are available only for a very small number of high-profile unreleased tokens.

On the other hand, Polymarket has changed the game by creating prediction pre-markets for over 80 unreleased tokens, including those from many projects that announced public token sales.

Here’s an actual example of how you could have used the data from these pre-markets.

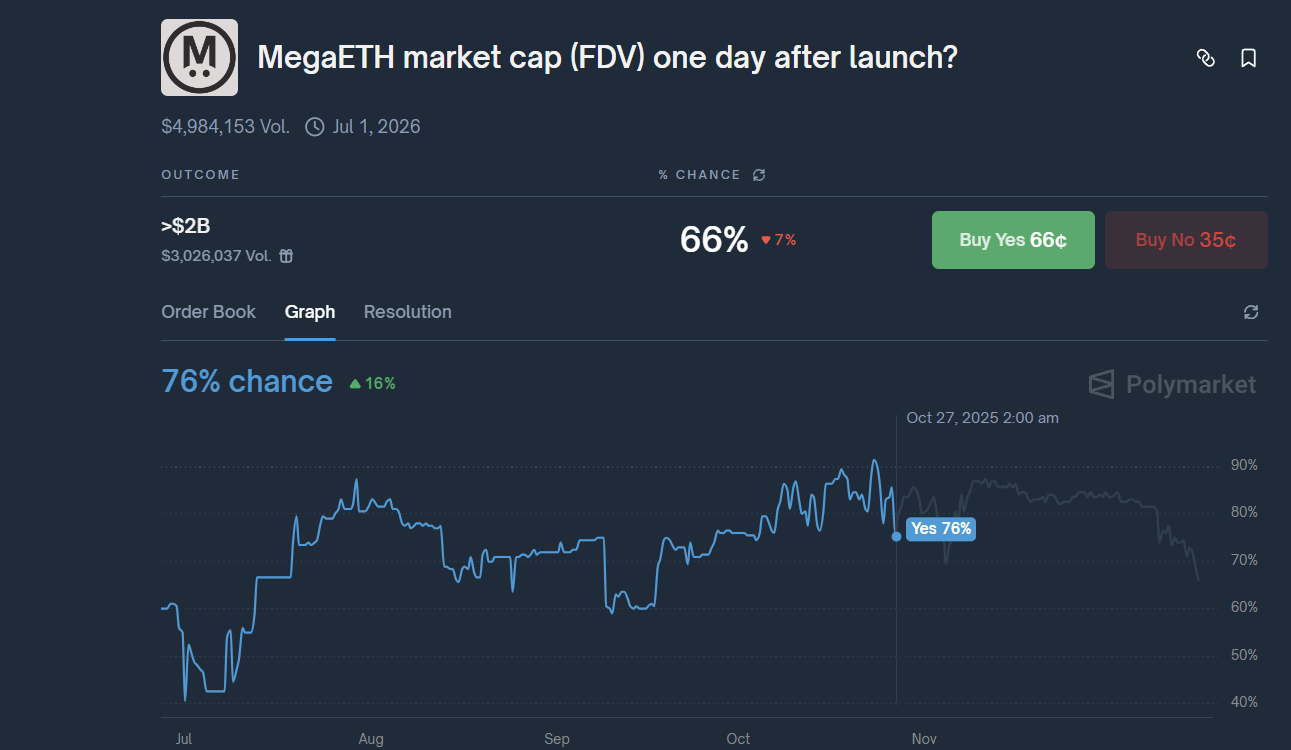

MegaETH, one of the most anticipated Ethereum L2s, conducted its ICO between Oct. 27 and Oct. 30 at a $1 billion FDV with all tokens fully unlocked at TGE.

Was a $1 billion FDV a good valuation? Absolutely yes.

And even if you didn’t know the project well, you could have reached this conclusion by searching the MegaETH pre-market on Polymarket and seeing that, on Oct 27, the market was pricing in:

a 76% chance that its FDV one day after launch will be >$2B (which is basically a 2x from $1b FDV)

a 36% chance that its FDV one day after launch will be >$4B

a 16% chance that its FDV one day after launch will be >$6B

So there is a strong chance that the MegaETH token would trade at a valuation well above its ICO valuation, and that its ICO was a great opportunity. We will find out if this is true in January when the token launches, but I am highly confident that MegaETH FDV will be above $1B, and that token sale participants will be in profit.

And this is how you can leverage Polymarket’s pre-markets to your advantage.

By looking at them, you can basically tell which ICOs have a good valuation and which don’t, based on the market sentiment around a certain project.

Next, I’ll share with you my thoughts on two of the most hyped upcoming ICO opportunities and explain my thinking process.

But before that, here’s an overview of Vechain’s latest major upgrade:

Together with Vechain

Vechain’s biggest staking upgrade ever is live

Hayabusa upgrade has recently gone live, introducing Stargate 2.0 - the most important evolution of VeChain staking to date.

If you missed launch day, here’s what you need to know.

Hayabusa is the upgrade that brings real decentralization to Vechain by enabling delegators to play a significant role in ensuring the network security.

Every VET holder can now stake and delegate their VET collateral to earn rewards.

If you haven’t taken action yet, here’s how to get involved:

• Open or install VeWorld

• Check if you hold a Node NFT (which you get for staking VET)

• Go to Stargate 2.0 to delegate your Node NFT

• Compare validators and delegate your Node NFT to one of them

That’s all you have to do to start earning VTHO rewards for securing the network.

If you’re a VET holder, you can stake your VET for a Node NFT, which is an NFT-based staking position, on the Stargate 2.0 platform.

Hayabusa strengthens VeChain by making the network more decentralized, more secure, and more community-driven.

Check out VeChain’s new staking model today!

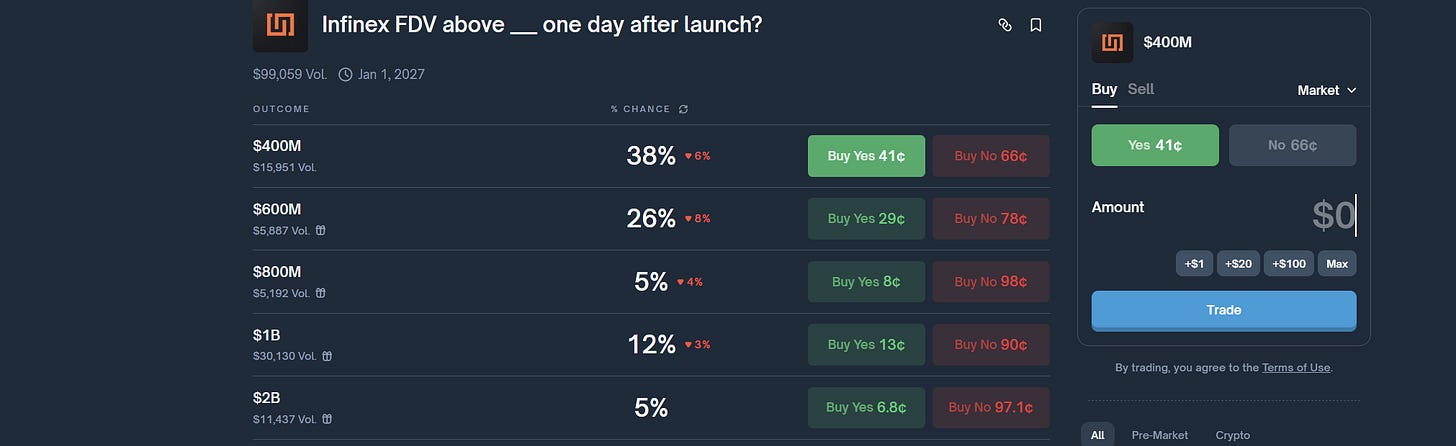

Circling back, an upcoming ICO that has also gotten a lot of attention lately is Infinex.

This one starts in January. We don’t yet know when the sale begins, but the TGE will take place on Jan. 15.

In case you’re not familiar with Infinex, it’s a crypto superapp that aims to abstract away the complexities of crypto and make DeFi easy to use for ordinary people.

It’s built by the Synthetix founder. I’ve personally tried it, and I have to say it’s a really good product. You can use it to do cross-chain swaps, trade perps, and more.

But now let’s focus on its ICO sale. Each participant will have two options:

Buy INX (Infinex’s token) at a $300M FDV (but with a 1-year lock)

Buy INX at $1 billion FDV (fully claimable at the TGE)

The sale is expected to happen in January on the Sonar launchpad.

$300M FDV seems attractive, especially given that Infinex has a Patron NFT collection trading at a valuation that implies a $430M FDV.

However, the 1-year lock seems way too long for me in the current market conditions.

Speaking about buying INX token at a $1 billion FDV, this valuation seems way too high for me, given the performance of most recent token launches.

But as I explained earlier, the best way to gauge the early interest around an upcoming TGE is to look at pre-markets. At the time of writing, based on the bets placed by Polymarket’s pre-market users, there is:

a 38% chance that Infinex FDV will be above $400M

a 26% chance that Infinex FDV will be above $600M

a 12% chance that Infinex FDV will be above $1 billion

As I said, you shouldn’t consider these pre-market markets to be entirely accurate regarding the FDV of a certain token at launch, as they are based on speculation and there are lots of variables you can’t anticipate.

But the fact that there’s only a 12% chance that Infinex FDV will be $1B+ makes me think that participating in INX ICO is not a good idea from a risk/reward perspective.

The 2nd ICO I wanna cover is for Solstice, which starts on Dec. 22 on the Legion launchpad.

Solstice is the largest stablecoin protocol on Solana, with $326M in TVL.

It’s often called “the Ethena of Solana” because it generates yield for its yield-bearing asset holders in a similar way to Ethena, via a set of delta-neutral strategies.

Unfortunately, we don’t know the token sale FDV and its vesting terms yet (at the time of writing), as the Solstice team hasn’t announced them so far, but I thought it would still be interesting to cover it nevertheless.

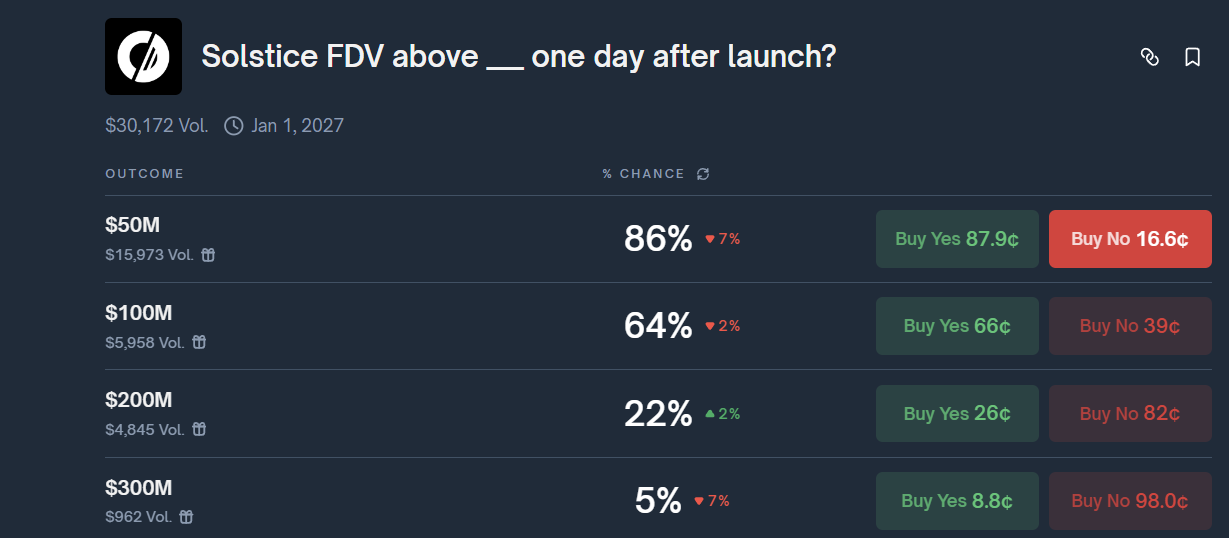

There’s a prediction pre-market for Solstice on Polymarket as well.

You can see the odds below (at the time of writing):

My thoughts are the following:

If the Solstice ICO FDV is $50M or less and the token investment allocation is fully or mostly unlocked on day 1 of the TGE, this ICO will be a great opportunity.

As you can see, Polymarket is pricing in an 86% chance that the Solstice FDV one day after TGE will exceed $50M and a 64% chance that it will exceed $100M.

So I believe there’s a very high chance of making money if it is sold at $50M FDV.

On the other hand, if the token sale FDV is ~$100M, there is still a good chance buyers will be in profit, but the risk/reward is no longer very good, in my opinion.

I am saying this because Polymarket is pricing in only a 22% probability that Solstice FDV will be over $200M one day after launch, so the upside is relatively limited.

That’s what I wanted to cover today. This article has been longer than usual, but I hope you’ve found the information provided here valuable.

Good luck and see you in the orderbooks🫡

Chart of the week

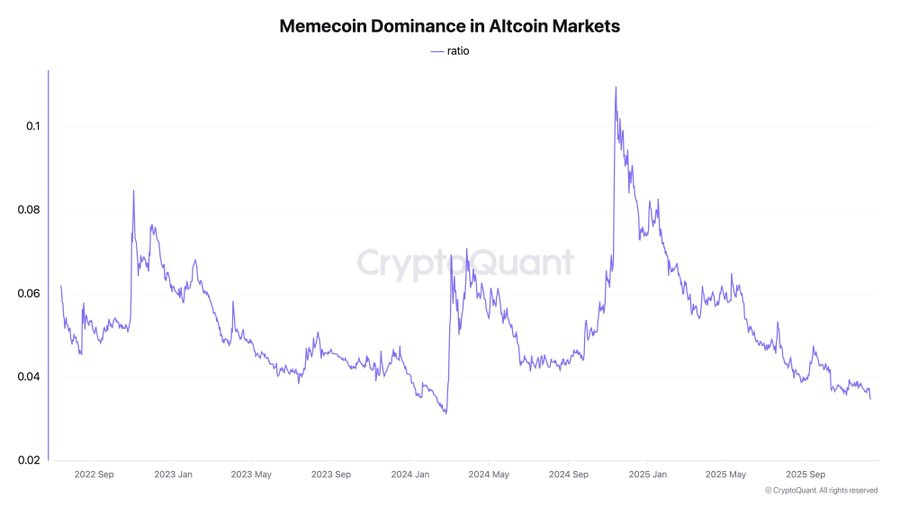

Memecoin dominance in altcoin markets is on a sharp decline

Crypto Meme😂

The latest developments in DeFi

JPMorgan launched its first-ever tokenized money market fund on Ethereum

Hyperliquid introduced Portfolio Margin to enable users to use HYPE and BTC as collateral for perps trading

INFINIT released Prompt-to-DeFi, a new product that enables anyone to create executable DeFi strategies with zero code required and all non-custodial

SpiceNet devnet is live, giving DeFi users and builders universal access to cross-chain trading, liquidity, and yield through a single brokerage layer

SEC closed its 4-year investigation into AAVE

BOB announced the native Bitcoin vaults stack, enabling the use of Bitcoin as DeFi collateral without giving up custody

BNB Chain announced plans to roll out a new stablecoin

Kamino announced its roadmap, which includes enabling users to borrow against off-chain collateral and launching an RWA DEX

Metamask added support for native Bitcoin

RateX, the yield trading DEX on Solana, released its airdrop checker

Hyperliquid Foundation proposed to burn the HYPE tokens in its Assistance Fund (13% of its circulating supply)

Vooi, the perps DEX aggregator, integrated Lighter and launched its token VOOI

Ondo Finance announced plans to expand to Solana

Jupiter acquired RainFi, a P2P lending protocol on Solana

Phantom Wallet announced in-wallet prediction markets powered by Kalshi

RedotPay, a popular crypto card, raised $107M in funding

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.