🔎DeFi is about to go mainstream

weekly valuable insights

Hinkal is a private crypto wallet fully composable with DeFi. Try it out today!

GM friends. Here’s what I’ll cover today:

🔎The missing piece for DeFi to go mainstream

📊 Crypto chart of the week

🗞️ The latest DeFi news

🔎The missing piece for DeFi to go mainstream

On-chain adoption has drastically increased in the past years.

But let’s face it: 99% of people still find it way too difficult to use on-chain apps, create a wallet, pay gas fees, switch networks, and so on.

In reality, most dApps today are built for a very small set of advanced DeFi users, as they are way too complicated to use for the average person.

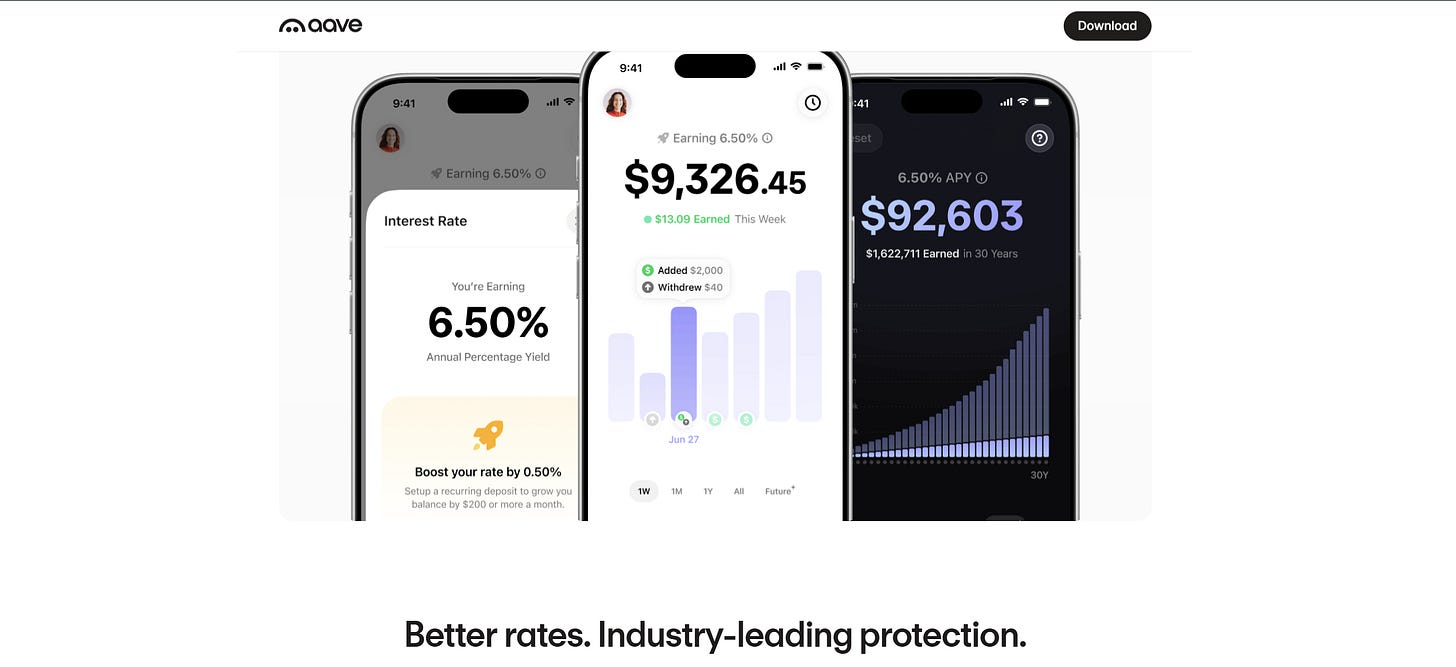

Yet this week, Aave announced a new product that I believe has a shot at bringing normies on-chain.

They introduced the Aave App - a DeFi savings app that actually looks like a mobile app that your mom or your uncle would be able to easily use.

In short, the Aave App will offer:

Up to 6.50% APR on stablecoins

Savings protection - up to $1,000,000 in insurance coverage for every user

Multiple deposit methods - Stablecoins, bank transfer, and debit card

Recurring deposits to automate savings

Euro savings on top of USD savings

6.5% APR is not a lot tbh, but most fintech and TradFi companies offer up to 3.5-4%, so it’s still significantly better than other traditional alternatives.

The real game-changer, though, is the insurance protection. In case AAVE is ever exploited (please no), you’ll still get your funds back. (up to $1M)

To my knowledge, this is the first DeFi app offering that.

Besides this, from what I’ve seen in the screenshots they provided, the mobile app will abstract away all the blockchain-related features. (gas fees, blockchain networks)

So it will probably offer a user experience similar to a Revolut savings account.

AAVE App might be able to offer the best of both worlds:

A friendly user experience similar to web2 apps, coupled with full transparency as all funds will be auditable on-chain, and with a higher savings yield.

The app is currently available in early access on iOS. But it’s also coming to Android.

In other news, another major thing happened this week.

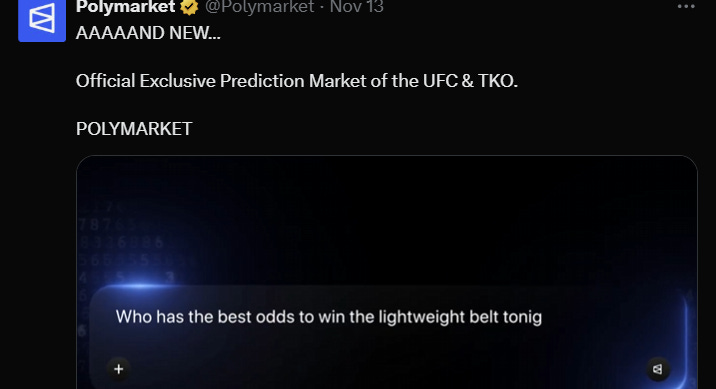

Polymarket became the official exclusive prediction market of the UFC.

What’s crazy is that Polymarket isn’t even available to US users (yet), however, it’s already partnering with some of the biggest organizations and companies in the US.

Partnerships like this will certainly bring more eyeballs to crypto.

Overall, I am pretty excited to see these developments.

DeFi apps and crypto apps in general are starting to make a lot of big steps in the right direction that will eventually help onboard the first billion people on-chain.

Polymarket is probably the first crypto app that began being used at a massive scale by regular people who have nothing to do with crypto.

But in 2026, I expect many other crypto products to go mainstream.

Together with Hinkal

The private wallet DeFi has been missing

Every DeFi user today is operating with a public transaction statement.

Your wallet exposes your entire transaction history and your holdings.

Front-running, alpha leakage, targeted attacks, and personal safety concerns are all caused by the same problem: on-chain visibility.

Hinkal fixed this.

Hinkal is a self-custodial, private DeFi wallet, giving users the ability to hide their holdings and interact with any dApp without revealing their holdings.

Here’s what you need to know:

Hinkal lets you transact from a shielded address and has also been used by Vitalik Buterin

The wallet is fully composable, allowing private interactions with any dApp on supported chains

Multi-chain from day one - You can use it on Ethereum, Arbitrum, Base, Polygon, and Optimism

With Hinkal, your on-chain activity becomes invisible to everyone but you. It lets you trade, lend, stake, and farm — exactly as you normally would — but privately.

Shield your wallet’s assets with Hinkal!

Chart of the week

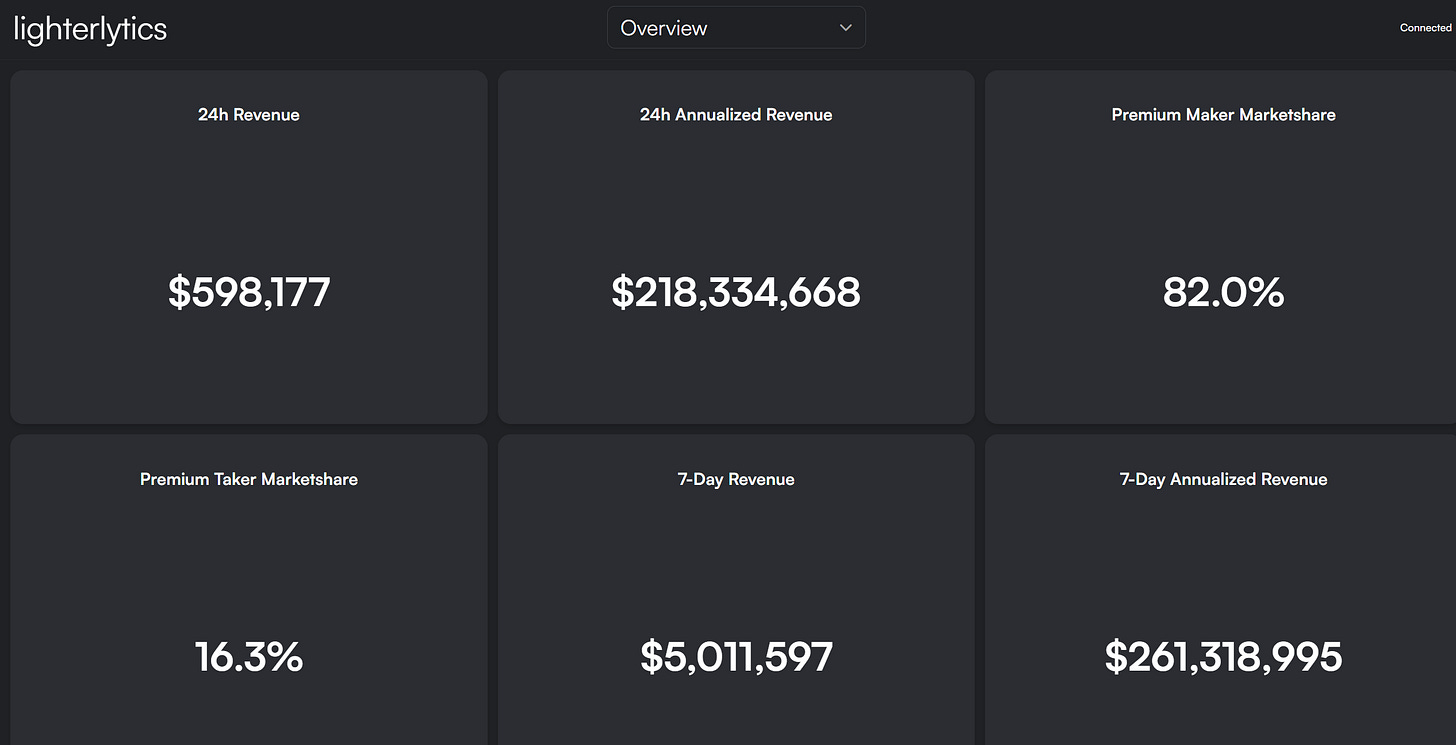

Lighter surpassed $200M in 24h annualized revenue

Crypto Meme😂

The latest developments in DeFi

AAVE introduced the Aave App - a consumer-friendly savings app

Hyperliquid released HIP-3 Growth Mode, reducing trading fees by 90% for new markets

Pendle started being used by Galaxy to deploy institutional capital into on-chain fixed yields

BOB, a hybrid L2 combining Bitcoin’s security with EVM smart contracts, launched its token called BOB

Phantom introduced Phantom Terminal - a new pro-level trading platform

MegaETH announced its upcoming mainnet beta launch in early December

Polymarket became the official exclusive prediction market of the UFC

Arbitrum team teased the launch of private Arbitrum chains

Paradex enabled its users to sell up to 50% of their S2 airdrop XP points

INFINIT added support for new Agentic DeFi Strategies to Katana. The goal is to minimize the friction of complex strategies with the help of AI agents

Revolut selected Polygon as its primary blockchain for stablecoin payments

Hyperbeat announced that its users have to sign the Hyperbeat Foundation terms to be eligible for its upcoming airdrop

Cookie DAO launched the Cookie Launchpad powered by Legion. The first ICO is for Vooi, a perps DEX aggregator

DappRadar announced it is shutting down

Aegis released Season 2 of the Aegis Points Program. Aegis is a BTC-backed stablecoin protocol

EtherFi enabled borrowing & spending money against HYPE using EtherFi Card

Defi App released its Android mobile app

That’s all for this week!

Until next time,

The DeFi Investor

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.