🔎Best airdrop farms on Solana

BOB is building the Gateway to Bitcoin DeFi. Check out what makes it stand out.

GM friends.

First of all, I want to start by providing some context on why I decided to write a newsletter focused specifically on Solana airdrops.

I’ve been heavily farming airdrops for the last 2-3 years.

90%+ of the airdrops I’ve gotten were from projects built on Ethereum L1 and L2s.

But what might come as a surprise is that many of the biggest ones I received in terms of airdrop APR were actually from Solana ecosystem projects.

And this is not just a coincidence.

On average, based on both my research and my own experience, liquidity providers (LPs) on Solana dApps have received bigger airdrops than the liquidity providers on Ethereum dApps for the same amount of liquidity provided over the past few years.

This is because the tokens of dApps native to Solana often launch at a much higher FDV than many tokens of Ethereum dApps with the same TVL.

So in this issue, I wanted to share a few of my favorite airdrop strategies on Solana.

In some cases, you can even farm 2 airdrops at once while also earning a nice double-digit yield on top of the airdrop points.

Let’s dive in 👇

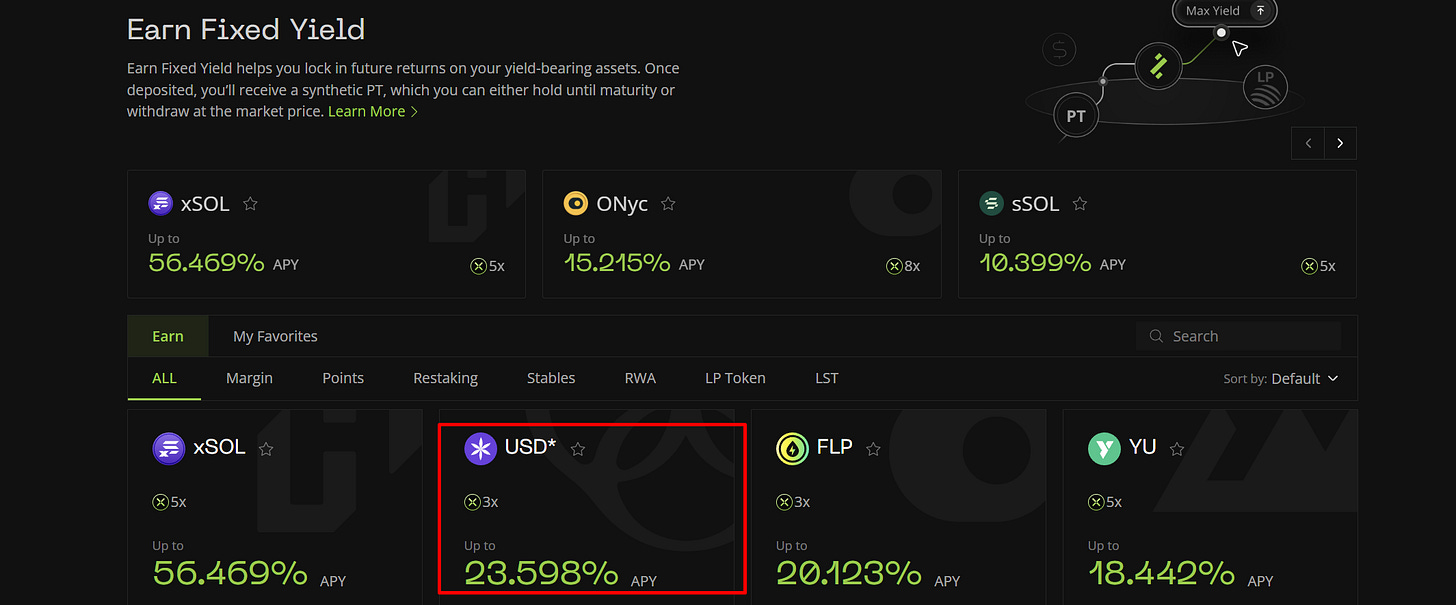

1. Deposit USD* on RateX for a 23.59% fixed APY + RateX points

RateX can also be seen as the Pendle of Solana.

It has $50M in TVL, it’s been live for a year, and it’s currently the 2nd largest yield trading exchange on Solana.

The protocol raised $7M in funding from Gate.io, Crypto.com Capital, GSR, and Echo.

Speaking about USD*, USD* is the yield-bearing stablecoin of Perena.

A few things you should know about Perena:

Its USD* holders are earning 15% APR from a mix of delta-neutral strategies, lending positions, and tokenized liquid assets

Perena raised funds from Borderless Capital and YZi Labs (formerly known as Binance Labs), which is a green flag in my opinion

Perena has $26M in TVL at this moment

My strategy is the following:

→ Get some USDC on Solana (you can bridge from Ethereum using Jumper)

→ Go to Jupiter and swap USDC for USD*

→ Go to RateX, click on “Earn”, and deposit your USD* there

In this way, you’ll forego your Perena points, but you’ll get 23% APR + 3x RateX points on USDx in exchange for that.

The only thing I don’t like about USD* is that while there’s a dashboard where you can see some details about its backing, there’s no way to verify on your own that it’s fully collateralized. But the team said that they are working to improve the transparency.

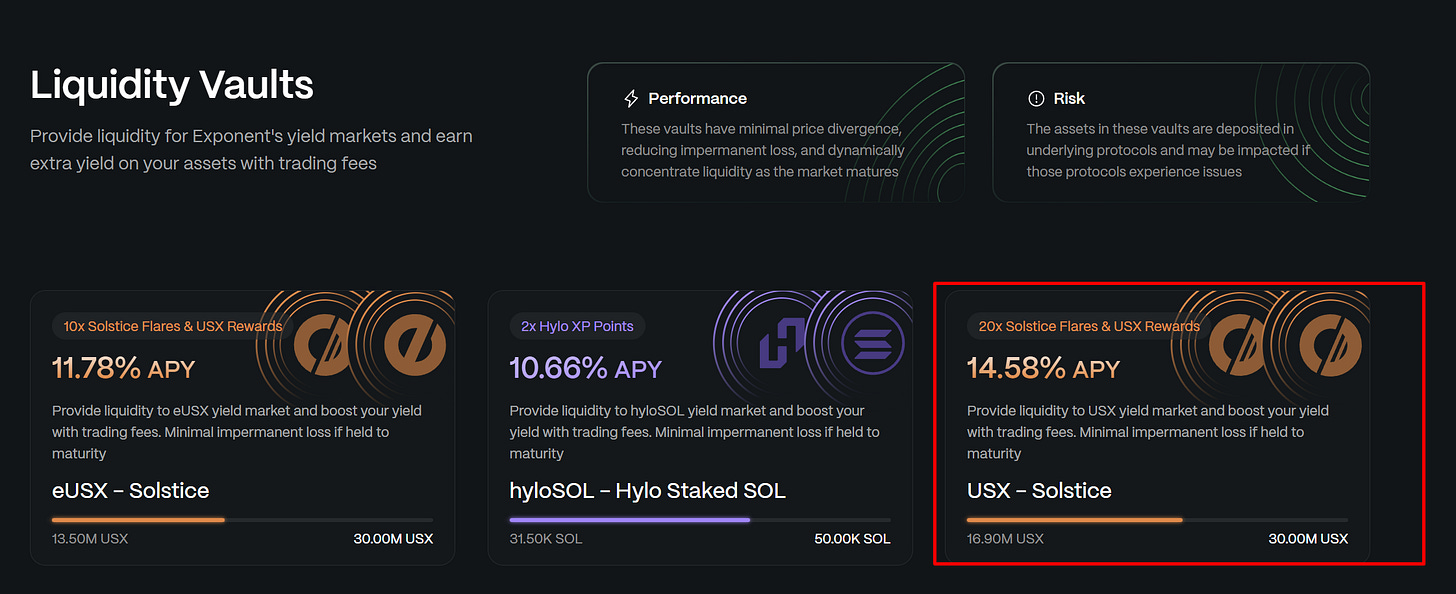

2. Provide USX liquidity on Exponent for 14.58% APY + Solstice Flares points

USX is the stablecoin of Solstice, the fastest-growing stablecoin protocol on Solana.

A few things you should know about it:

Since its launch in late September, its TVL has surged to $316M

Its yield-bearing stablecoin called eUSX is currently earning 4.1% APY from funding rate arbitrage, hedged staking and tokenized T-bills (pretty low tbh, but the strategy I’ll cover here offers a much higher APY)

At least 8% of Solstice’s total token supply will be allocated to the airdrop

Its TGE seems likely to happen in Q1 2026

Just like Ethena, Solstice holds its stablecoin’s backing assets in institutional custody with Copper Technologies & Ceffu, two of the biggest crypto custodians.

It also provides monthly attestations reports on its collateral reserves.

My strategy to farm its airdrop:

→ Go to Jupiter and swap USDC to USX (on Solana)

→ Provide USX as liquidity to the USX pool on Exponent on the “Liquidity” page

Exponent is the largest yield trading protocol on Solana, and it works in a similar way to Pendle and RateX.

With this strategy, I am getting 14.58% APY on USX + 20x Solstice Flares points + potential exposure to Exponent airdrop, as it doesn’t have a token yet.

20x Solstice Flares is the highest Solstice points multiplier you can get at this moment.

Before I share a few other strategies, here’s an overview of BOB, the hybrid chain unlocking real utility for Bitcoin:

Together with BOB

The Gateway to Bitcoin DeFi

A sector that I believe has massive growth potential is Bitcoin DeFi.

For comparison, while over 30% of ETH supply is used in DeFi, only 0.3% of Bitcoin’s $2.2 trillion market cap is currently deployed in true Bitcoin DeFi.

BOB is building the Gateway to Bitcoin DeFi to change this.

In short, BOB is a hybrid chain that combines Bitcoin’s security with Ethereum’s flexibility, designed to unlock real utility for BTC.

Just a few days ago, its team released $BOB, the native token powering it.

Here’s what you should know about BOB:

BOB is the #1 blockchain by Bitcoin DeFi TVL

Its hybrid architecture uniquely combines ZK proofs and BTC staking to create native bridges to both Ethereum and Bitcoin

BOB enables 1-click BTCFi, making it possible to access BTC staking, DeFi strategies, and vaults in just one click, as it abstracts the bridging process

Its team raised a whopping $21M in funding from well-known VCs such as Castle Island Ventures, IOSG Ventures, Coinbase Ventures, and Amber Group

$BOB token sits at the core of the BOB’s Hybrid Chain ecosystem as its utilities include staking for economic security, governance, and priority access to new features.

The end goal of BOB is to create real utility for BTC.

Explore what makes it stand out!

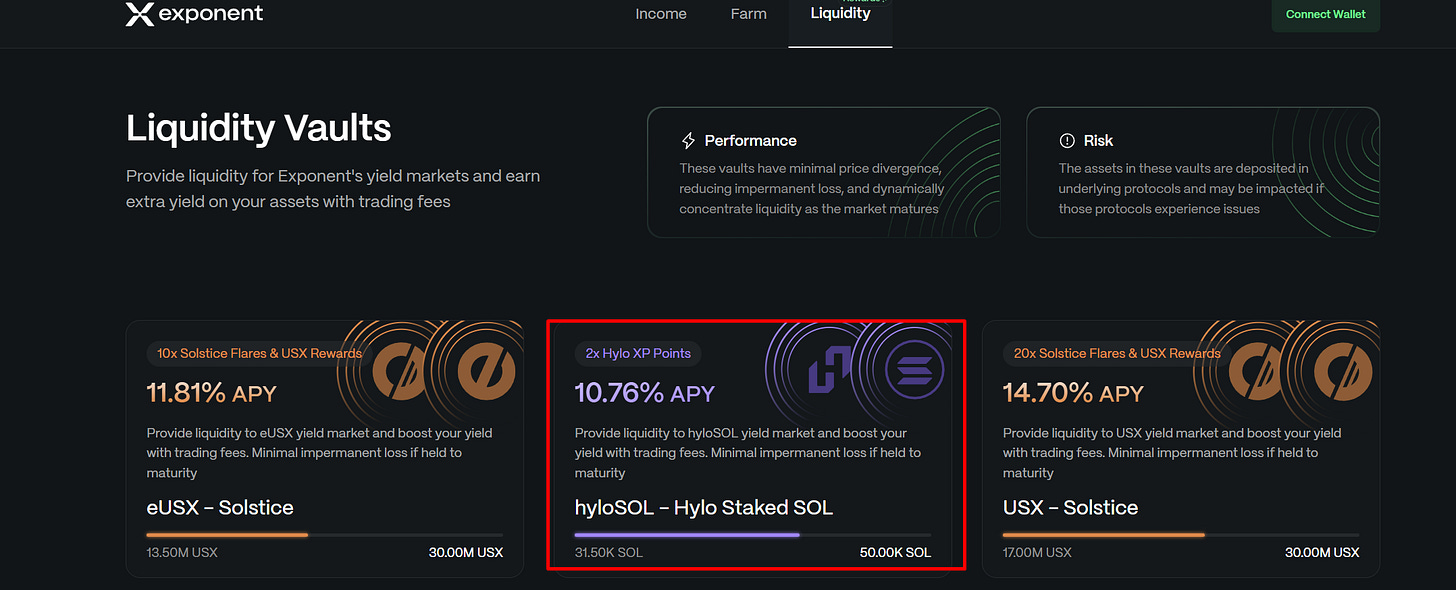

3. Provide hyloSOL+ liquidity on Exponent for 10.2% APY + Hylo points

10% APR is not a lot, but I think this is one of the best (if not the best) yields you can get on SOL right now.

HyloSOL+ is a SOL liquid staking token (LST) built by Hylo, a tokenless DeFi protocol on Solana backed by Solana Ventures, Robot Ventures, and Colosseum.

Hylo has been one of the fastest-growing Solana dApps this year, and it has $80M TVL.

My strategy:

→ Go to Hylo, click on “LST”, select “Plus+” instead of “Normal”, and deposit SOL there to get hyloSOL+ in return

→ Go to Exponent, click on “Liquidity”, and deposit your hyloSOL+ in the hyloSOL+ pool to provide liquidity

That’s how I am earning 10.2% APY + 5x Hylo points on hyloSOL+.

The TGE timeline for Hylo has not been announced, but my hope is that after its airdrop, my total APY will be over 25-30% including the airdrop rewards.

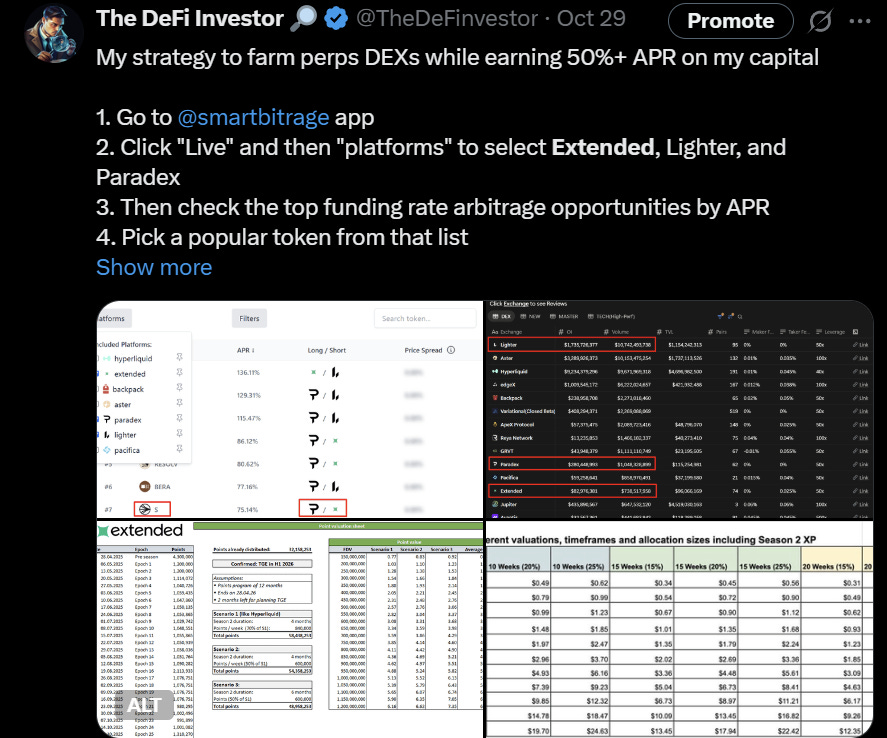

4. Generate trading volume on Pacifica to earn points

Personally, I am currently focusing mostly on farming four perps airdrops: Extended, Paradex, Lighter, and Variational.

The first two (Extended and Paradex) are my highest priority.

But if you want to get exposure to the airdrop of the most popular perpetual DEX in the Solana ecosystem, that one is Pacifica.

Some key info:

Pacifica is built by a team that includes the COO of FTX and the Nftperp founder

The project is fully self-funded (no VCs, Hyperliquid-style)

Pacifica’s points program is live, with 10,000,000 points being distributed weekly

If you’re a trader, the easiest way to farm it is to simply move your trading activity to Pacifica. If you aren’t a trader, or if you want to generate more volume to get more points, you can farm it via funding rate arbitrage with a delta-neutral strategy between Paradex and another perps DEX (e.g. Extended).

You can see how I am arbitraging funding rates below:

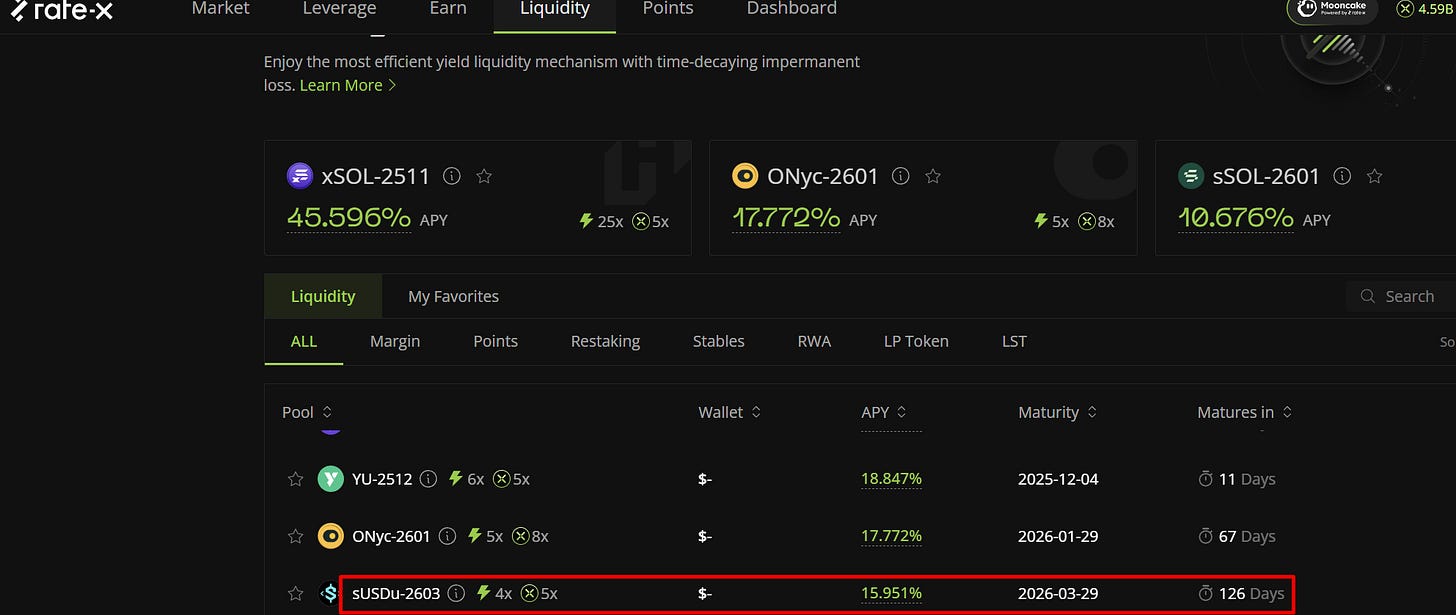

5. Provide sUSDu liquidity on RateX for 15.95% APY + Unitas points + RateX points

sUSDu is the yield-bearing stablecoin of Unitas Labs.

Unitas is a relatively new protocol, and generally, I am a bit reluctant to use new dApps, but one thing I like is that it has recently released a Proof of Solvency dashboard in collaboration with Accountable.

Using it, you can check its reserves and stablecoin collateral ratio in real time.

A few other things you should know about it:

Unitas raised $3M from Stanford Blockchain Builders Fund and Amber Group

Its total USDu stablecoin supply is currently 25.45M

The protocol generates a 14.78% APY (based on 7d performance) for its sUSDu yield-bearing stablecoin holders from a delta-neutral JLP-based strategy

My strategy is this:

→ Go to Unitas and buy USDu using USDC or other assets

→ Then click on “Earn” and stake USDu for sUSDu

→ Go to RateX, click on “Liquidity”, and deposit your sUSDu there to provide liquidity

With this strategy, you’ll get 15.95% APY, Unitas points, and RateX points.

We don’t know anything about Unitas’s TGE plans so far, but the 15.95% APY alone makes this strategy appealing in my opinion.

That’s all for today.

I think yield farming is one of the best things you can do during downtrends like the current one, so I will try to cover more yield opportunities in the next issues.

I hope that you found this issue helpful!

Until next time,

The DeFi Investor

Don’t I need Solana to get these airdrops how do I guarantee an airdrop