🔎10 crypto events to watch this week

A compilation of crypto catalysts, airdrop strategies and alpha articles

Saga makes it easy for DeFi users to earn yield on bluechip assets. Discover the best yields on Saga here.

GM friends.

Here’s what I’ll cover today:

10 crypto events to watch this week

A lesser-known crypto data aggregator

Some great crypto reads

Let’s dive in👇

Crypto catalysts to watch this week

Solana’s Breakpoint Conference - Solana’s biggest Breakpoint Conference so far starts on Dec. 11. Some major announcements are expected to be made

Bittensor’s Halving - Bittensor’s TAO Halving will happen on Dec. 12

Avalanche ETFs deadline - The next deadline for the approval of Avalanche ETFs in the US is Dec. 12

Stable mainnet - Stable, a stablecoin-focused L1 backed by Bitfinex and Hack VC, scheduled the launch of its mainnet and token for today, on Dec. 8

FOMC interest-rate decision - FOMC interest-rate decision will be revealed on Dec. 10

Extended’s tokenized vault shares launch - Extended will enable using vault shares as collateral to trade perps next week

Lighter’s memecoin launch - Lighter is expected to airdrop a memecoin to its points holders soon, now that spot trading is live. A memecoin called LIGER was confirmed to launch after spot trading goes live by the Lighter team

Hey Anon’s new prediction market platform - Hey Anon, a DEFAI project led by Daniele Sesta, announced plans to release permissionless prediction markets this month

Kalshi’s biggest announcement yet - Kalshi, a popular prediction market app, will make its biggest announcement since launch between Dec. 11 and Dec. 13 at the Solana Breakpoint conference

Almanak TGE - Almanak, a DeFi Agent Platform, will launch its token on Dec. 11

Together with Saga

Multichain DeFi has arrived

Imagine earning yield on any bluechip asset you have on a single blockchain.

On Saga, you can now earn, borrow, or lend using bluechip assets from any ecosystem (from BTC and ETH to ATOM) without leaving their native exposure.

This is possible thanks to Saga’s Liquidity Integration Layer, which connects liquidity across major blockchains, making every asset more productive.

Here are a few of the most interesting dApps in the Saga ecosystem:

Colt - Colt’s $D is the native stablecoin of Saga that earns by automatically deploying capital into the best performing yield-bearing stablecoin protocols on Ethereum (e.g. Noble, YieldFi)

Mustang - Mustang is a borrowing protocol whose stablecoin $MUST can be minted by depositing collateral such as wETH, stATOM, yUSD, and tBTC

Steer Protocol & Beefy Finance - Using those, you can access automated yield strategies to put your assets to work in just a few clicks

Both Mustang and Colt also have a points program.

Saga is creating a new kind of DeFi chain - a place where you can access high-yield opportunities for both stablecoins and top assets from all major ecosystems.

Whether you hold BTC, ETH, ATOM, or stablecoins, with Saga, you can make your assets work harder.

Check out Saga’s yield opportunities today!

🛠️Crypto tool of the week

An interesting free crypto data aggregator I’ve discovered recently is DropStab.

Some of its dashboards are already available on other platforms like DeFiLlama, but DropStab also has a few exclusive features you can’t find elsewhere.

Using DropStab, you can do things such as:

See a list of tokens with a buyback program

Check what the best-performing crypto VCs are

Find tokenless projects for potential airdrops

… and many other things

7 Alpha Articles

A few valuable pieces of advice

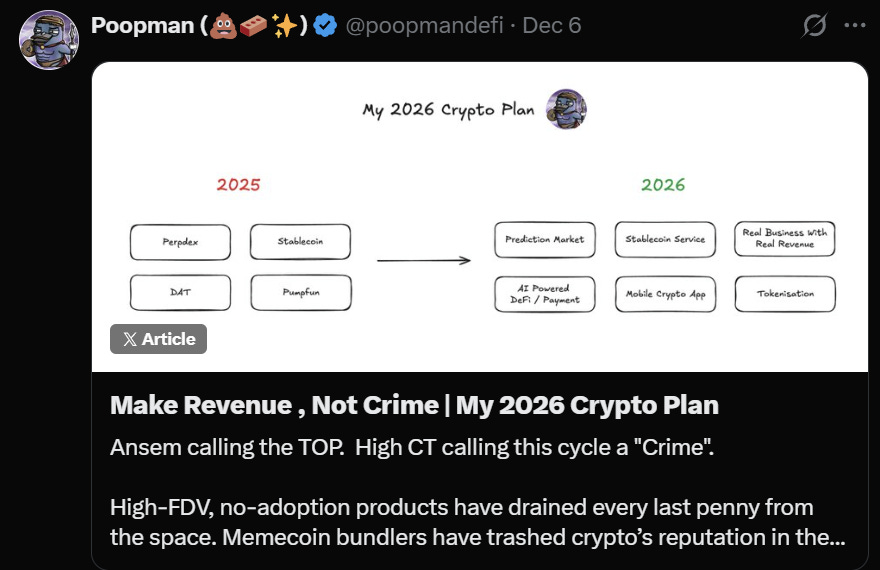

Poopman’s 2026 crypto plan

Is airdrop farming still worth it?

Can L1s compete against BTC as cryptomoney?

Why Miles Deutscher is bullish on BTC

What happened to restaking?

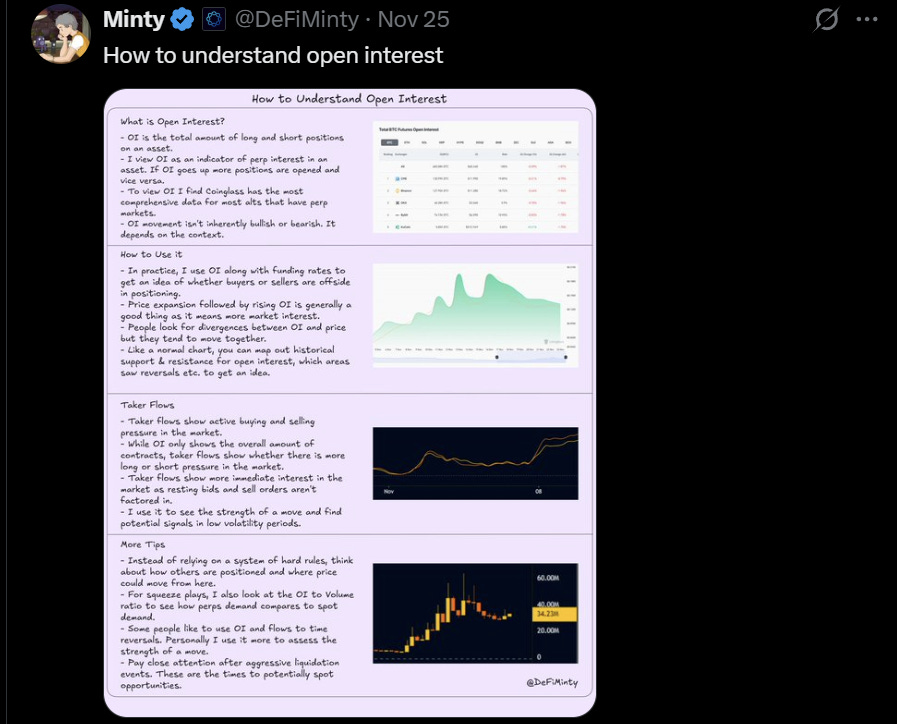

How to understand open interest

If you found this issue valuable, subscribe to receive the next newsletter issue straight into your inbox.

Have a fantastic day!

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.

This week is a live-fire drill for the entire digital asset stack. ETF flows, Dencun aftershocks, Solana throughput upgrades, and stablecoin migration aren’t isolated events, they’re structural signals. The real story is how liquidity, regulation, and scalability collide. Anyone tracking security, on-chain activity, or asymmetric opportunities should be paying attention, this is where the next narrative inflection forms.

0xObsidianEnoch: Architecting the Future of Decentralized Trust.