🔎10 catalysts to watch this week

A compilation of crypto catalysts, airdrop strategies and alpha articles

CoinQuant is a no-code platform that lets you build, analyse, and automate trading strategies. Explore CoinQuant now.

GM friends.

Here’s what I’ll cover today:

10 crypto events to watch this week

A dashboard for perps DEXs

Some great crypto reads

Let’s dive in👇

Crypto catalysts to watch this week

Hyperliquid’s prediction markets - Hyperliquid team just started testing prediction markets on testnet, which indicates that they might launch a prediction market product soon

Ondo Summit - Ondo Summit starts on Feb. 3. Expect some big announcements

Lido V3 Community Call - A Lido community call about the recent Lido V3 mainnet launch is scheduled for Feb. 3. The biggest change that Lido V3 brings is stVaults, which offer node operators much greater flexibility

Flying Tulip’s public ICO - Flying Tulip’s ICO on Coinlist starts on Feb. 2. The $1 billion ICO FDV seems way too high to me in the current market conditions, but the fact that it offers a refund option makes it a risk-free opportunity. The TGE date wasn’t announced yet

Hey Anon’s new product - Daniele Sesta’s project called Hey Anon will release a new prediction market product (Pandora Parlays for Polymarket) on Feb. 2

Venus Flux launch - Venus Flux, a new deployment of the Fluid money market on BNB Chain built by Fluid in partnership with Venus, launches on Feb. 4

OP token buybacks - Optimism will use 50% of its Superchain revenue to buy back OP tokens starting in February

Chiliz Vision 2030 - Chiliz Vision 2030 will be announced on Feb. 3

BERA token unlock - 41% of $BERA circulating supply ($31M at current prices) will be unlocked on Feb. 6

Saylor’s Strategy Q4 2025 earnings call - Saylor’s Strategy earnings call is scheduled for Feb. 5

Together with CoinQuant

CoinQuant, explained.

Trading infrastructure has moved fast over the past few years, but strategy research hasn’t kept pace.

Most traders still test ideas across charts and scripts, with no consistent way to understand how a strategy behaves across time, risk, and different market conditions.

CoinQuant is a no-code trading research platform built around that gap.

The platform

CoinQuant lets traders structure ideas into strategies, backtest them on historical, tick-level data across multiple assets, and review performance using consistent, research-focused metrics, not signals or shortcuts.

It’s designed for traders who want clearer insight into drawdowns, consistency, and risk before putting capital to work. As the platform evolves, new features will roll out alongside planned automation, execution, and institutional-grade integrations starting in Q2 2026.

Participation

Strategy building, backtesting, and performance analysis all happen in one environment, designed around real trading conditions.

Activity is tracked through a points system that reflects meaningful platform usage, such as onboarding, building strategies, and running backtests.

Rewards

CoinQuant is introducing $CQX, a utility token distributed through a long-term, activity-based airdrop program.

There is no presale. Instead of rewarding passive capital, token distribution is tied to real platform usage. Points earned through participation convert to token allocations after the token generation event.

If you’re interested in trading research and participation-based airdrops, CoinQuant is worth exploring.

You can see the $CQX token and distribution mechanics here.

🛠️Crypto tool of the week

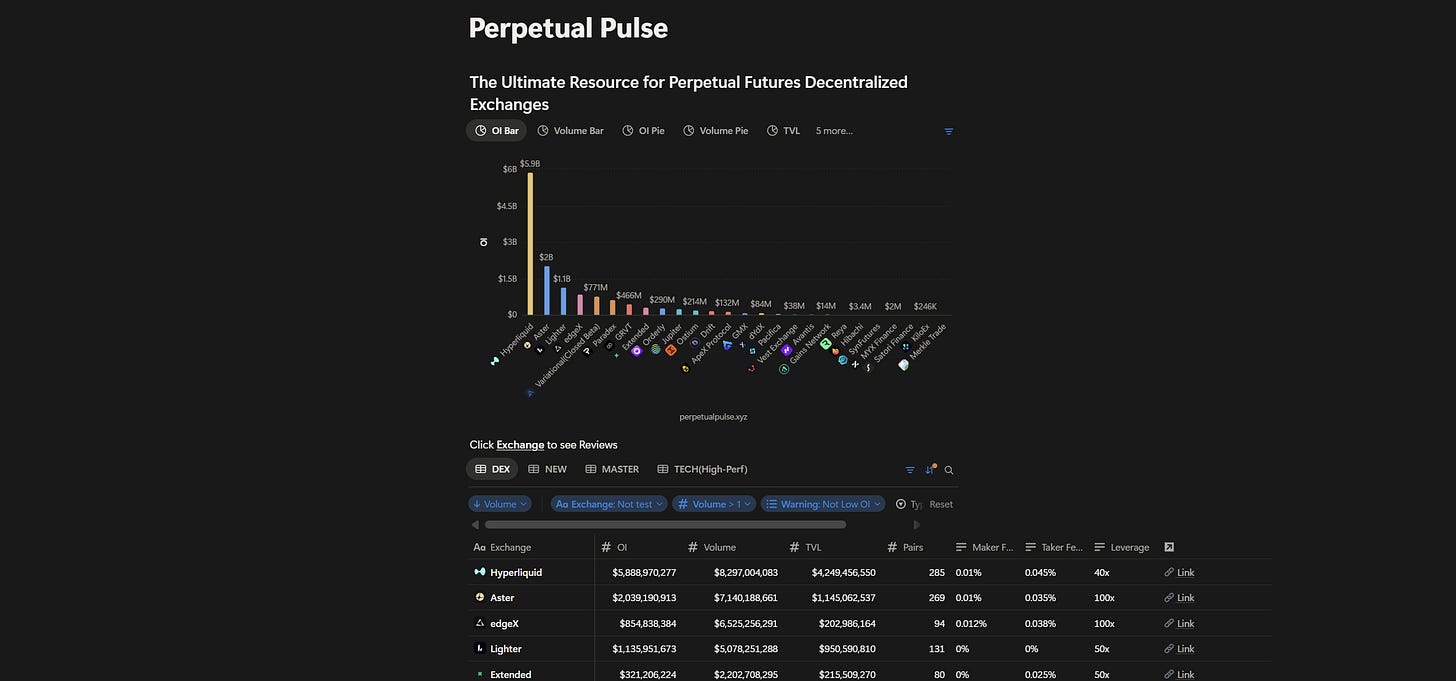

A dashboard for perps DEXs

Dozens of perps DEXs have launched in the last year alone.

If you want to keep an eye on the sector and see which ones are gaining traction, I recommend using Perpetual Pulse.

It’s basically a Notion page created by @hansolar21 where you can see:

The top perps DEXs by OI, volume, TVL, pairs, and fees

How the stats of each DEX changed over time

The pros and cons of each platform

I find it pretty useful to see how the perps DEX landscape is changing.

7 Alpha Articles

A great read if you feel lost

Why BTC and ETH haven’t rallied with other risk assets

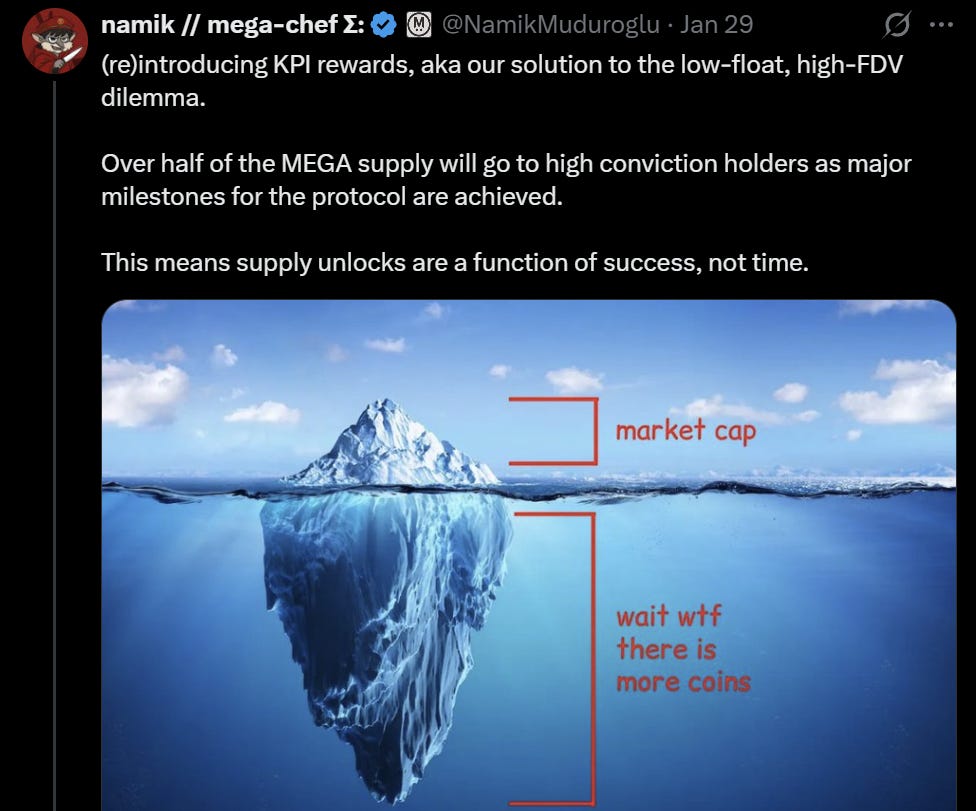

MegaETH’s solution to the low-float, high-FDV dilemma

A thread on Lighter and its future developments

Some valuable advice

How to prompt Claude

This isn’t a crypto-related post, but I think you’ll find it useful if you use AI tools.

The bull case for on-chain lending

If you found this issue valuable, subscribe to receive the next newsletter issue straight into your inbox.

Have a fantastic day!

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.

Thanks for writing this, it clarifys a lot. What if the Flying Tulip refund realy changes things?