🔎10 catalysts to watch this week

A compilation of crypto catalysts, airdrop strategies and alpha articles

Saga is offering some of the best stablecoin yields in DeFi. Discover them here.

GM friends.

Here’s what I’ll cover today:

10 crypto events to watch this week

A new crypto security tool

Some great crypto reads

Let’s dive in👇

Crypto catalysts to watch this week

Optimism’s buyback program - Optimism DAO is voting on a proposal to use 50% of Superchain sequencer revenue for $OP buybacks

Polygon’s Open Money Stack announcement - Polygon will introduce its vision for the “Open Money Stack” during an X space on Jan. 13

Solana’s Privacy Hackathon - Solana Privacy Hackathon starts on Jan. 12

Trump’s tariffs - US Supreme Court may issue rulings on Trump’s tariffs on Jan. 14, which is likely to have a major impact on all markets. However, the date is not officially confirmed yet

Aster’s airdrop checker - Aster will launch the airdrop checker for its Stage 4 airdrop on Jan. 14. Claiming will open on Jan. 28

Crypto market structure bill - The US Senate will vote on the pro-crypto market structure bill this week, on Jan. 15. This bill will provide a much-needed regulatory framework for crypto projects in the US

BNB Chain’s Fermi hard fork - BNB Chain’s Fermi hard fork, which will reduce block times from 0.75s to 0.45s for fast tx confirmations, will go live on Jan. 14

MultiversX’s Supernova upgrade - Voting to activate MultiversX’s Supernova upgrade, a major network upgrade that will make MultiversX 10x faster by dropping block times to 600 milliseconds, ends on Jan. 18

Jumper’s major announcement - Jumper is set to make a major announcement on Jan. 13

Token launches - Football.Fun will release its token FUN on Jan. 15, while Fogo will also release its token on Jan. 15

Together with Saga

Access industry-leading stablecoin yields

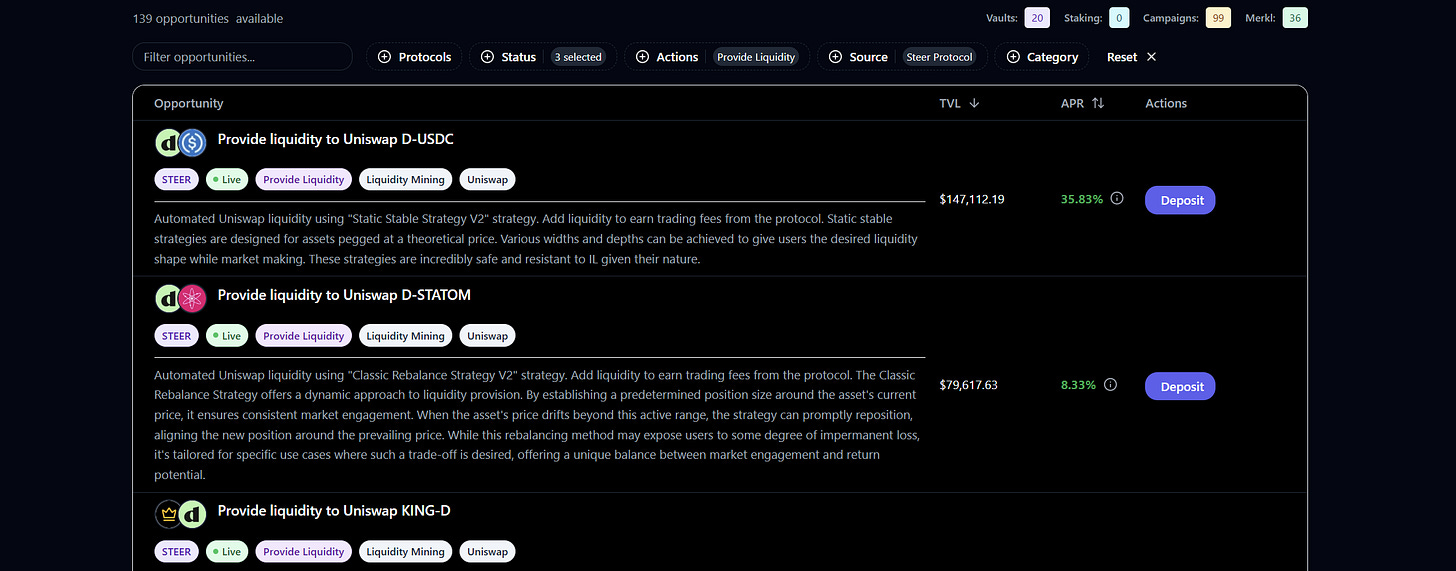

Saga is quickly becoming a go-to chain for yield farmers.

If you’re not familiar with it, Saga is a multichain ecosystem that prioritizes capital efficiency to offer some of the best yields in DeFi.

If you’re looking for a place to put your capital to work, then you should know that you can get up to 62% APR on stablecoins by using the dApps built on Saga.

Here’s how to get started:

Go to app.squidrouter.com to bridge your USDC to Saga

Head to sagayield.com to see all the yield opportunities available

My favorite two options are the Uniswap $D-$USDC stablecoin liquidity pool with 13% APR and the Uniswap $MUST-$D stablecoin LP pool with 62% APR.

Both $D and $MUST are stablecoins issued by stablecoin protocols on Saga.

→ If you choose the Uniswap $D-$USDC stablecoin liquidity pool

Go to coltstable.com to mint $D using USDC and then deposit your capital in the LP pool here

→ If you choose the Uniswap MUST-$D stablecoin liquidity pool

Go to coltstable.com to mint D with some of your USDC, then visit oku.trade to buy MUST, and in the end deposit your capital in the LP pool here

In just a few steps you can unlock some of the best yields in DeFi.

Start earning a double-digit APR on stablecoins with Saga today!

🛠️Crypto tool of the week

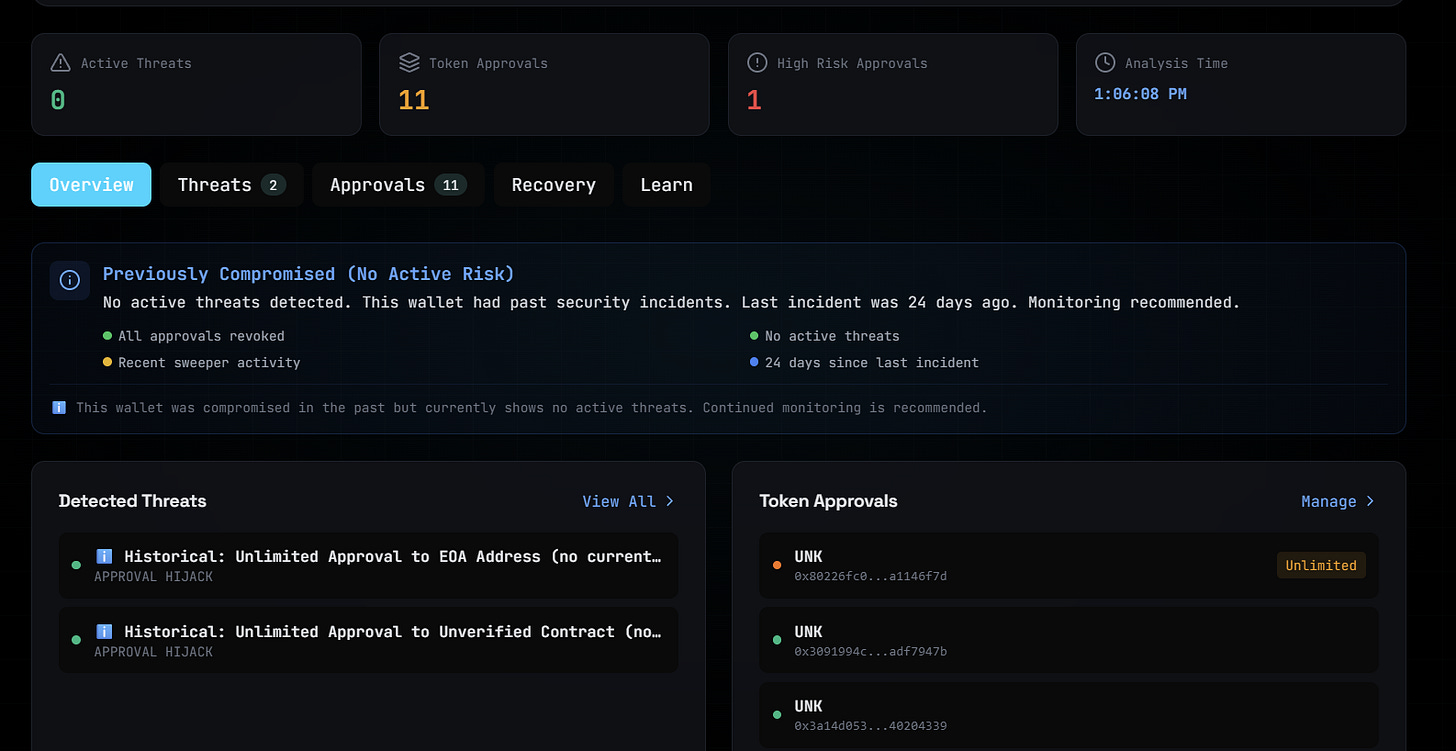

A new crypto security tool

@MercyDeGreat, a great guy I’ve been following on CT for quite some time, has recently released a new crypto security tool called Securnex.

The way it works is pretty straightforward:

Go to Securnex

Select a blockchain

Paste your wallet address there

Then the platform will tell you if it detects any active threats (e.g. if your wallet is potentially compromised), and what token approvals you should revoke.

So basically, all it does is scan your wallet and tell you if it’s safe or not.

The tool is still pretty new, so it might sometimes detect false threats, but it’s free to use, and I think it’s great we’re starting to see more crypto security platforms.

6 Alpha Articles

5 tips to become a better airdrop farmer

How to find good DeFi yields

crypto, combat sports, ego, and self-defeat

IZU’s altcoin research playbook

Why fixed-rate lending never took off in crypto

Some great life advice

If you found this issue valuable, subscribe to receive the next newsletter issue straight into your inbox.

Have a fantastic day!

Want to sponsor this newsletter?

Please send me a DM on Twitter (X). I have a sponsorship deck that I can send you.

Strong breakdown. Having a clear catalyst map helps separate signal from noise. The edge isn’t reacting to every event, it’s knowing in advance which ones matter, what’s already priced in, and where asymmetric risk still exists. Patience and discipline win weeks like this.